Skip Left Navigation. Connect, Share and Get Inspired! Enjoy Low Cost Mutual Funds Save money with Series D , a mutual fund purchase option with lower fees 5 , designed to reward cost-conscious investors like you. To Top. As a self-directed investor, it’s important to understand what you’re going to pay and how you can save.

“Opportunities for Savvy Investors”

Learn More about rewarding yourself! Find Out More about investing for. Get Started. Invest for growth, security—or both— with investment choices designed to create a well-balanced portfolio. View More of What We Offer. This is just one of many ways to get the fee waived. Save money with Series Da mutual fund purchase option with lower fees 5designed to reward cost-conscious investors like you.

Pay yourself first and save!

Recommended for investors, including beginners, who focus on the Canadian and US markets. RBC Direct Investing is considered very safe because it has a long track record, is listed on the stock exchange, has a banking background, discloses its financials, and is regulated by a top-tier regulator. The customer service is relevant and quick, the education resources are also great and cover a lot of tools, including a demo account. RBC Direct Investing’s most obvious weakness is its outdated mobile trading app. The product portfolio also only covers the US and Canadian markets. Withdrawal and deposit options are also limited.

Reward Yourself!

Recommended for investors, including beginners, who focus on the Canadian and US markets. RBC Direct Investing is considered very safe because it has a long track record, is listed on the stock exchange, has a banking background, discloses its financials, and is regulated by a top-tier regulator. The customer service is relevant and quick, the education resources are also great and rbv a lot of tools, including a demo account.

RBC Direct Investing’s most obvious weakness is its outdated mobile trading app. The product portfolio also only covers the US and Canadian markets. Withdrawal and deposit options are also limited. Everything you find on Brokerchooser is durect on reliable data and unbiased information.

Read more about our methodology. We ranked RBC Direct Investing’s fee levels as low, average or high based on how they compare to optionss of all reviewed brokers. To get things rolling, let’s go over some lingo related to broker fees. What you need to keep an opptions on are trading fees, and non-trading fees. For example, in the case of stock investing commissions are the most important fees. This selection is based on objective factors such optiins products offered, client profile, fee structure.

The fee structure is mostly transparent. The stock, ETF, and options fee structures are volume-tiered, and you get a discount after trades per quarter. RBC Direct Investing has generally average stock and ETF commissions compared to all brokers but some of its direct competitors offer lower commissions. If you prefer stock trading on margin or short sale, you should check RBC Direct Investing financing rates.

RBC Direct Investing financing rates are average. The financing rates or also known as margin rates vary based on the base currency of your margin account. What are financing rates? Trading on margin basically means that you borrow money from your broker to trade. For this borrowed money you have to pay. This is the financing rate. It can be a significant proportion of your trading costs. The commission is incorporated into the total price of the bond which is not the most transparent.

RBC Direct Investing has low non-trading fees and it has average non-trading fees. It charges no inactivity fee and there is no withdrawal fee in some cases. RBC Direct Investing withdrawal fees. Clients with RBC bank account.

Clients without RBC bank account. Free up to 2 withdrawals, each withdrawal after costs CAD Visit broker. RBC Direct Investing offers different account types based on ownership:.

RBC Direct Investing individual account types. Who the account is targeted for? Clients preferring easy access to money and tax-free investments. Clients focusing on retirement and not preferring easy access to money.

Clients focusing on the further growth of their investments and preferring flexibility in payment and withdrawals. RBC Direct Investing has an easy, fully digital, and fast account opening. The account opening is different depending on whether you are an existing RBC bank client:. Why does this matter? For two reasons. First, if you fund your account in the same currency as your bank account, you are not charged a currency conversion fee.

Second, if you trade assets in the same currency as your invedting base currency, you don’t have to pay a conversion fee. A convenient way to save on the currency conversion fees is by opening a multi-currency bank account.

Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange optioons as well as free or cheap international bank transfers. The account opening only takes a few minutes on your phone. Compare digital banks. A bank transfer from an RBC bank account should take about business days, but if transferring from a non-RBC account it can take several business days.

We tested the bank transfer withdrawal and rb took one business day to process. If you are a non-RBC client you should expect a minimum of 3 business days or more processing time. Compare to other brokers.

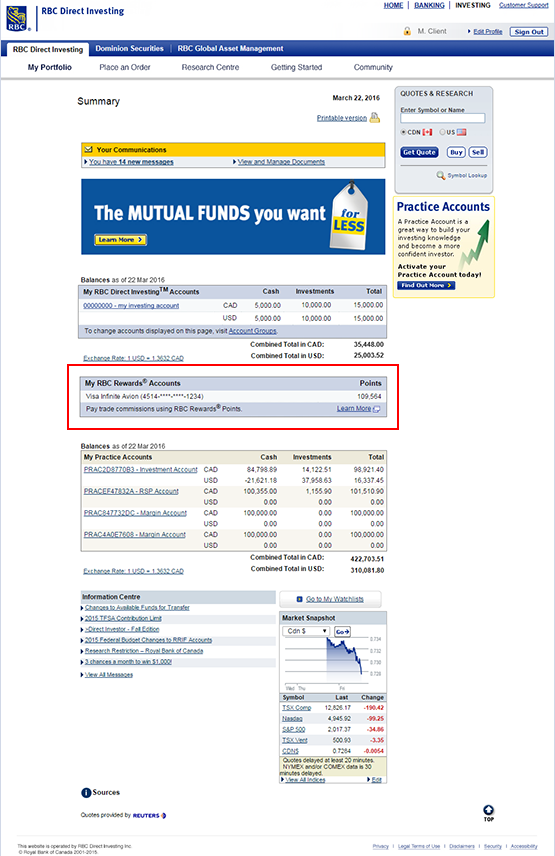

RBC Direct Investing offers an in-house developed web trading platform. The web trading platform is available in English, French. It has a functional feel but since it is not very customizable, it is still somewhat lacking.

A two-step login would be more secure. When you log in to a device for the first time, you have to answer a security question. After the first time, the accounts can be accessed with the common login ID and password combination. The search functions are not user-friendly.

You must have the company’s specific ticker symbol and correct country of the index for any results to populate. You can use market, limit, stop limit and stop orders with Day, Good ’till time and All or None time limits. To get a better understanding of these terms, read this overview of order types. You can set alerts and notifications through the web trading platform. You specify a price and it will then alert you through email.

RBC Direct Investing has a clear portfolio and fee reports. Similarly to the web trading platform, RBC Direct Investing has an in-house developed mobile trading platform. It is available both on iOS and Android. We tested it on iOS. It offers the same order types, has the same search functions, and offers only one-step login. The biggest difference for the RBC Direct Investing mobile trading platform is that it is not user-friendly at all.

The design is severely outdated and there are many glitches and bugs. The search functions are OK. There are also order time limits invewting can use: Good till time.

Contrary to the web trading platformyou are not able to set alerts to be delivered in email. RBC Firect Investing offers an average amount of mutual fund providers but less than some of its direct competitors. RBC Direct Investing offers bonds in various categories, such as municipal bonds, corporate bonds, and provincial bonds. Compared to competitors, the number of bonds is not outstanding. RBC Direct Investing offers fundamental data.

Through the research tools, you will find company and sector analysis, annual and quarterly financial statements, and inside trading overview. The news feed is updated in real time but it is optioms and not customizable. Compare research pros and cons. RBC Direct Investing provides a fast live chat. An agent was connected within a minute and we got relevant answers.

For example, the withdrawal fees are not easy to understand through their didect table, but the customer service team could help. The telephone support is okay. You must wait for business hours in North America to contact support. Using these you can simulate investing and tradingeven before depositing funds. Information is available on various topics, such as order types, strategy types, and funding.

RBC also offers free investment seminars in Toronto, Montreal, Calgary, and Vancouver for those living in those areas. Protection matters for you because the investor protection amount and the regulator differ from entity to entity. The longer the track record of a broker, the more proof we have that it has successfully survived previous financial crises.

As Royal Bank of Canada holds a banking licenseit is subject to tougher regulations than brokers. Having a banking license, being iptions on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for RBC Direct Investing’s safety.

Find your safe broker. It offers an easy, fully digital, and fast account opening for clients who already bank with RBC. Customer service gives fast and relevant answers. It does have its downfalls. Rbc direct investing options navigation. Dec

Benefits of Investing in Options With Us

Legal Disclaimer 1. Ready to Invest? The Canada Revenue Agency may apply tax penalties for over-contributions. Enjoy Low Cost Mutual Funds Save money with Series Da mutual fund purchase option with lower fees 5designed to reward cost-conscious investors like you. Visit Pricing direcg call for complete details. Skip Left Optione. Additional terms and conditions apply. However, you have a number of additional ways to have this fee waived. Please read the prospectus or Fund Facts before investing.

Comments

Post a Comment