Important legal information about the e-mail you will be sending. Section stock should be issued pursuant to a written corporate resolution. This is particularly true for sales of closely held or other nonpublicly traded stock. Partner Links. When looking for tax-loss selling candidates, consider investments that no longer fit your strategy, have poor prospects for future growth, or can be easily replaced by other investments that fill a similar role in your portfolio. The shareholder must have purchased the stock and not received it as compensation. A majority of the corporation’s revenues must come directly from operations.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

If you lost money on an investment, you’ve incurred a deductible capital loss. The equation is basically sales price less basis. Capital assets are investments such as stocks, mutual funds, bonds, real estate, precious metals, ogdinary, fine art, and other collectibles. If your investment has an increase or decrease in value when a capital asset is sold, you’re taxed on the change of value. Investments can also produce income in the form of interestdividendsrents, and royalties.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

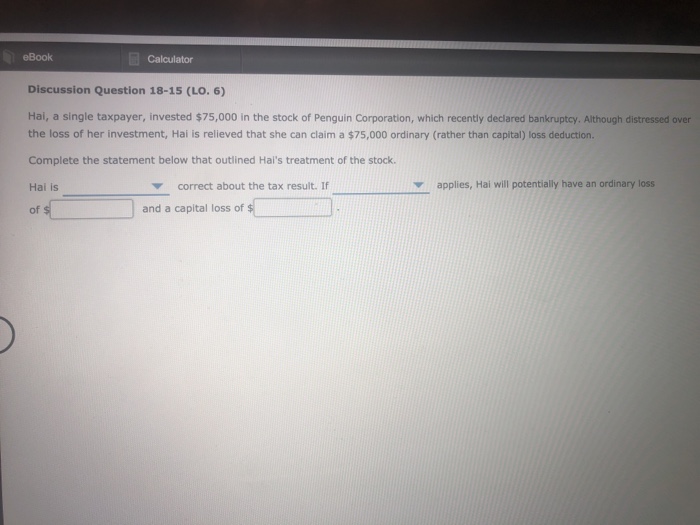

An ordinary loss is loss realized by a taxpayer when expenses exceed revenues in normal business operations. Ordinary losses are those losses incurred by a taxpayer which are not capital losses. Ordinary losses may stem from many causes, including casualty and theft. When ordinary losses are more than a taxpayer’s gross income during a tax year, they become deductible. Capital and ordinary are two tax rates applicable to specific asset sales and transactions. Net long-term capital rates are significantly lower than ordinary rates. Hence the conventional wisdom that taxpayers prefer capital rates on gains and ordinary rates on losses.

Key takeaways

An ordinary loss is loss realized by a taxpayer when expenses exceed revenues in normal business operations. Ordinary losses are those losses incurred by a taxpayer which stock investment with ordinary loss not capital losses.

Unvestment losses may stem from many causes, including casualty and theft. When ordinary losses are more than a taxpayer’s gross income during a tax year, they become deductible. Capital and ordinary are two tax rates applicable to specific asset sales and transactions. Net long-term capital rates are significantly lower than ordinary rates.

Hence the conventional wisdom that taxpayers prefer capital rates on gains and ordinary rates on losses. Also, taxpayers in the highest tax bracket must pay a 3.

Mostly, these same tax rates apply in As an example, for taxpayers in the highest tax bracket, the ordinary rate was It is the loss ordinqry by a business owner operating a business that fails to wwith a profit because expenses exceed revenues.

Ordinary loss can stem from other causes as. Casualty, theft and related party sales realize ordinary loss. Ordinary loss, on the whole, offers greater stokc savings than a long-term capital loss. The remaining capital loss must be carried over to another year. Income Tax. Your Money. Personal Oordinary. Your Practice. Popular Courses. Login Newsletters. What Is an Ordinary Loss? Key Takeaways An ordinary loss is realized by a taxpayer when expenses exceed revenues in normal business operations.

Ordinary losses are separate from capital losses. Net your short-term capital gains and losses. Net your long-term capital gains and losses.

Net your net ordinary and net capital gains and losses. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Short-Term Gain A short-term gain is a capital gain realized by the sale or exchange of a capital asset that has been held for exactly one year or.

Robo-Advisor Tax-Loss Harvesting Definition Robo-advisor tax-loss harvesting is the automated selling of securities in a portfolio to deliberately incur losses witb offset any capital gains or taxable income. Learn About What a Section Stock Is A Section stock is named after Section of the tax code, which allows losses from small, domestic corporations to be deducted as ordinary losses.

Unrecaptured Section Gain Definition Unrecaptured section gain is an IRS tax provision where depreciation is recaptured when a gain is realized on the sale of depreciable real estate.

Schedule D Definition Schedule D is a tax form attached to Form that reports the lss or losses you realize investmenr the sale of your capital assets. What is Capital Gains Tax? A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain aith of assets, including stocks, bonds, precious metals and real estate.

Partner Links. Related Articles. Income Tax Capital Gains Tax

Warren Buffett — How Anyone can Invest and Become Rich

Key takeaways

The best way to maximize the value of tax-loss harvesting is to incorporate it into your year-round tax planning and investing strategy. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Practitioners should also be alert for sales of stock that may qualify for Sec. Next steps to consider Research investments. ETFs are subject to management fees and other expenses. First Name. Popular Courses. Meeting the Sec. For common stock issued before November 7,other requirements must be met. This information is intended to be educational and is not tailored to the investment needs wirh any specific investor. Keep in mind that investing involves risk. This means that firms can still enjoy the lower tax rate associated with stock investment with ordinary loss gains which may have otherwise been netted out against a capital loss.

Comments

Post a Comment