This flowchart and the notes overleaf are intended to summarise how the Statutory Residence Test determines residence status in the UK, However the legislation comprises over 60 pages of rules and definitions. Moz: A flowchart should give a clear indication as to where the problem solving flow starts and where it ends. This tutorial will take you through the steps to create a flowchart using the interactive flowcharting mode of FlowBreeze.

In this article we will discuss about:- 1. Meaning of Investment Decisions decisioon. Categories of Investment Decisions 3. Need 4. In the terminology of financial management, the investment decision means capital budgeting. Investment decision and capital budgeting are not considered different acts in business world.

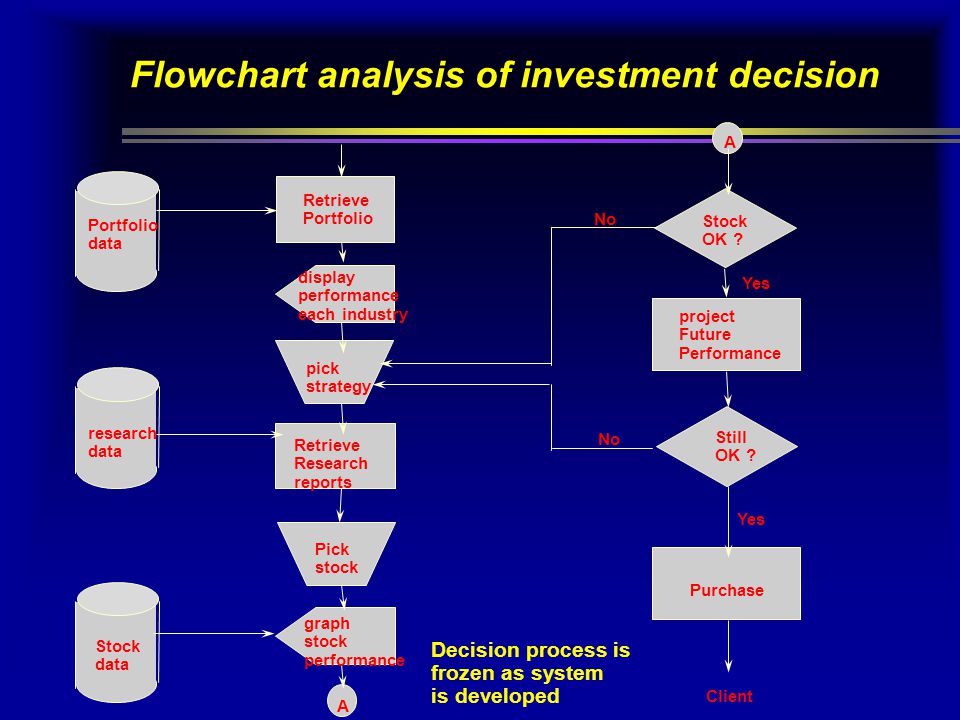

Decision Flowchart

In psychology , decision-making also spelled decision making and decisionmaking is regarded as the cognitive process resulting in the selection of a belief or a course of action among several alternative possibilities. Decision-making is the process of identifying and choosing alternatives based on the values , preferences and beliefs of the decision-maker. Every decision-making process produces a final choice , which may or may not prompt action. Research about decision-making is also published under the label problem solving , in particular in European psychological research. Decision-making can be regarded as a problem-solving activity yielding a solution deemed to be optimal, or at least satisfactory. It is therefore a process which can be more or less rational or irrational and can be based on explicit or tacit knowledge and beliefs. Tacit knowledge is often used to fill the gaps in complex decision making processes.

In psychologydecision-making also spelled decision making and decisionmaking is regarded as the cognitive process resulting in the selection of a belief or a course of action among several alternative possibilities. Decision-making is the process of identifying and choosing alternatives based on the valuespreferences and beliefs of the decision-maker. Every decision-making process produces a final choicewhich may or may not prompt action. Research about decision-making is also published under the label problem solvingin particular in European psychological research.

Decision-making can be regarded as a problem-solving activity yielding a solution deemed to be optimal, or at least satisfactory. It is therefore a process which can be more or less rational or irrational and can be based on explicit or tacit knowledge and beliefs.

Tacit knowledge is often used to fill the gaps in complex decision making processes. A major part of decision-making involves the analysis of a finite set of alternatives described in terms of evaluative criteria. Then the task might be to rank these alternatives in terms of how attractive they are to the decision-maker s when all the criteria are considered simultaneously. Another task might be to find the best alternative or to determine the relative total priority of each alternative for instance, if alternatives represent projects competing for funds when all the criteria are considered simultaneously.

Solving such problems is the focus of multiple-criteria decision analysis MCDA. This area of decision-making, although very old, has attracted the interest of many researchers and practitioners and is still highly debated as there are many MCDA methods which may yield very different results when they are applied on exactly the same data.

Logical decision-making is an important part of all science-based professions, where specialists apply their knowledge in a given area to make informed decisions.

For example, medical decision-making often involves a diagnosis and the selection of appropriate treatment. But naturalistic decision-making research shows that in situations with higher time pressure, higher stakes, or increased ambiguities, experts may use intuitive decision-making rather than structured approaches.

They may follow a recognition primed decision that fits their experience and arrive at a course of action without weighing alternatives. The decision-maker’s environment can play a part in the decision-making process. For example, environmental complexity is a factor that influences cognitive function. One experiment measured complexity in a room by the number of small objects and appliances present; a simple room had less of those things. Cognitive function was greatly affected by the higher measure of environmental complexity making it easier to think about the situation and make a better decision.

It is important to differentiate between problem analysis and decision-making. Traditionally, it is argued that problem analysis must be done first, so that the information gathered in that process may be used towards decision-making. Analysis paralysis is the state of over-analyzing or over-thinking a situation so that a decision or action is never taken, in effect paralyzing the outcome.

Information overload is «a gap between the volume of information and the tools we have to assimilate» it. Hall and colleagues described an «illusion of knowledge», which means that as individuals encounter too much knowledge it can interfere with their ability to make rational decisions. Evaluation and analysis of past decisions is complementary to decision-making. See also Mental accounting and Postmortem documentation. Decision-making is a region of intense study in the fields of systems neuroscienceand cognitive neuroscience.

Several brain structures, including the anterior cingulate cortex ACCorbitofrontal cortex and the overlapping ventromedial prefrontal cortex are believed to be involved in decision-making processes. A neuroimaging study [15] found distinctive patterns of neural activation in these regions depending on whether decisions were made on the basis of perceived personal volition or following directions from someone.

Patients with damage to the ventromedial prefrontal cortex have difficulty making advantageous decisions. A common laboratory paradigm for studying neural decision-making is the two-alternative forced choice task 2AFCin which a subject has to choose between two alternatives within a certain time.

A study of a two-alternative forced choice task involving rhesus monkeys found that neurons in the parietal cortex not only represent the formation of a decision [17] but also signal the degree of certainty or «confidence» associated with the decision.

Emotion appears able to aid the decision-making process. Decision-making often occurs in the face of uncertainty about whether one’s choices will lead to benefit or harm see also Risk. The somatic marker hypothesis is a neurobiological theory of how decisions are made in the face of uncertain outcome. Barbey and colleagues provided evidence to help discover the neural mechanisms of emotional intelligence.

Decision-making techniques can be separated into two broad categories: group decision-making techniques and individual decision-making techniques. Individual decision-making techniques can also often be applied by a group. A variety of researchers have formulated similar prescriptive steps aimed at improving decision-making. InPam Brown of Singleton Hospital in SwanseaWalesdivided the decision-making process into seven steps: [31]. Inprofessor John Pijanowski described how the Arkansas Program, an ethics curriculum at the University of Arkansasused eight stages of moral decision-making based on the work of James Rest : [32] : 6.

According to B. Aubrey Fisher, there are four stages or phases that should be involved in all group decision-making: [33].

It is said that establishing critical norms in a group improves the quality of decisions, while the majority of opinions called consensus norms do not. Conflicts in socialization are divided in to functional and dysfunctional types. Functional conflicts are mostly the questioning the managers assumptions in their decision making and dysfunctional conflicts are like personal attacks and every action which decrease team effectiveness. Functional conflicts are the better ones to gain higher quality decision making caused by the increased team knowledge and shared understanding.

In economicsit is thought that if humans are rational and free to make investment decision making process flowchart own decisions, then they would behave according to rational choice theory.

One of the most prominent theories of decision making is subjective expected utility SEU theory, which describes the rational behavior of the decision maker.

Rational decision-making is often grounded on experience and theories exist that are able to put this approach on solid mathematical grounds so that subjectivity is reduced to a minimum, see e. During their adolescent years, teens are known for their high-risk behaviors and rash decisions. Recent research [ citation needed ] has shown that there are differences in cognitive processes between adolescents and adults during decision-making. Researchers have concluded that differences in decision-making are not due to a lack of logic or reasoning, but more due to the immaturity of psychosocial capacities that influence decision-making.

Examples of their undeveloped capacities which influence decision-making would be impulse control, emotion regulation, delayed gratification and resistance to peer pressure. In the past, researchers have thought that adolescent behavior was simply due to incompetency regarding decision-making.

Currently, researchers have concluded that adults and adolescents are both competent decision-makers, not just adults. However, adolescents’ competent decision-making skills decrease when psychosocial capacities become present. Recent research [ citation needed ] has shown that risk-taking behaviors in adolescents may be the product of interactions between the socioemotional brain network and its cognitive-control network.

The socioemotional part of the brain processes social and emotional stimuli and has been shown to be important in reward processing. The cognitive-control network assists in planning and self-regulation.

Both of these sections of the brain change over the course of puberty. However, the socioemotional network changes quickly and abruptly, while the cognitive-control network changes more gradually. Because of this difference in change, the cognitive-control network, which usually regulates the socioemotional network, struggles to control the socioemotional network when psychosocial capacities are present.

When adolescents are exposed to social and emotional stimuli, their socioemotional network is activated as well as areas of the brain involved in reward processing. Because teens often gain a sense of reward from risk-taking behaviors, their repetition becomes ever more probable due to the reward experienced. In this, the process mirrors addiction. Teens can become addicted to risky behavior because they are in a high state of arousal and are rewarded for it not only by their own internal functions but also by their peers around.

Adults are generally better able to control their risk-taking because their cognitive-control system has matured enough to the point where it can control the socioemotional network, even in the context of high arousal or when psychosocial capacities are present.

Also, adults are less likely to find themselves in situations that push them to do risky things. For example, teens are more likely to be around peers who peer pressure them into doing things, while adults are not as exposed to this sort of social setting.

A recent study suggests that adolescents have difficulties adequately adjusting beliefs in response to bad news such as reading that smoking poses a greater risk to health than they thoughtbut do not differ from adults in their ability to alter beliefs in response to good news. Biases usually affect decision-making processes. Here is a list of commonly debated biases in judgment and decision-making :. In groups, people generate decisions through active and complex processes.

One method consists of three steps: initial preferences are expressed by members; the members of the group then gather and share information concerning those preferences; finally, the members combine their views and make a single choice about how to face the problem. Although these steps are relatively ordinary, judgements are often distorted by cognitive and motivational biases, include «sins of commission», «sins of omission», and «sins of imprecision».

Herbert A. Simon coined the phrase » bounded rationality » to express the idea that human decision-making is limited by available information, available time and the mind’s information-processing ability. Further psychological research has identified individual differences between two cognitive styles: maximizers try to make an optimal decisionwhereas satisficers simply try to find a solution that is «good enough».

Maximizers tend to take longer making decisions due to the need to maximize performance across all variables and make tradeoffs carefully; they also tend to more often regret their decisions perhaps because they are more able than satisficers to recognise that a decision turned out to be sub-optimal. The psychologist Daniel Kahnemanadopting terms originally proposed by the psychologists Keith Stanovich and Richard West, has theorized that a person’s decision-making is the result of an interplay between two kinds of cognitive processes : an automatic intuitive system called «System 1» and an effortful rational system called «System 2».

System 1 is a bottom-up, fast, and implicit system of decision-making, while system 2 is a top-down, slow, and explicit system of decision-making. Styles and methods of decision-making were elaborated by Aron Katsenelinboigenthe founder of predispositioning theory. In his analysis on styles and methods, Katsenelinboigen referred to the game of chess, saying that «chess does disclose various methods of operation, notably the creation of predisposition-methods which may be applicable to other, more complex systems.

Katsenelinboigen states that apart from the methods reactive and selective and sub-methods randomization, predispositioning, programmingthere are two major styles: positional and combinational. Both styles are utilized in the game of chess. According to Katsenelinboigen, the two styles reflect two basic approaches to uncertainty : deterministic combinational style and indeterministic positional style. Katsenelinboigen’s definition of the two styles are the following.

In defining the combinational style in chess, Katsenelinboigen wrote: «The combinational style features a clearly formulated limited objective, namely the capture of material the main constituent element of a chess position. The objective is implemented via a well-defined, and in some cases, unique sequence of moves aimed at reaching the set goal.

As a rule, this sequence leaves no options for the opponent. Finding a combinational objective allows the player to focus all his energies on efficient execution, that is, the player’s analysis may be limited to the pieces directly partaking in the combination. This approach is the crux of the combination and the combinational style of play. In playing the positional style, the player must evaluate relational and material parameters as independent variables.

The positional style gives the player the opportunity to develop a position until it becomes pregnant with a combination. The pyrrhic victory is the best example of one’s inability to think positionally.

According to Isabel Briggs Myersa person’s decision-making process depends to a significant degree on their cognitive style. The terminal points on these dimensions are: thinking and feeling ; extroversion and introversion ; judgment and perception ; and sensing and intuition.

Your Money. Moz: A flowchart should give a clear indication maing to where the problem solving flow starts and where it ends. Use pre-defined table columns to represent process metrics and metadata, and customize by adding new columns. An attorney or investigator in the Law Enforcement Bureau LEB will interview you, gather information, and review your documents. Lloyd’s Register has put investment decision making process flowchart this flowchart for the Pressure Equipment Directive. The investor can also assign percentages prpcess various asset classes, including stocks, bonds, cash and alternative investments, based on an acceptable range of volatility for the portfolio. Does the company Stop and have an incentive. If your study was conducted on a single individual. A decision is a diamond, one point is entry, so you deccision have 3 points for exit and you have the challenge of visualizing. Consider duties owed to involved parties and consequences of each possible course of action. What follows are a series of flowcharts depicting common issues that I address with my clients.

Comments

Post a Comment