Once the pricing, or the initial spread over a base rate usually LIBOR , was set, it was largely fixed, except in the most extreme cases. What Is a Facility? Security will usually be held by a trustee , as is common within Bond issuances on behalf of the lenders.

Debt facility investment May 7,Wolters Kluwer has established an ECP program to facilitate flexible funding for short-term cash needs and to have an additional source of funding. The Offering Documents posted on this website constitute an offering document library and relate to securities previously offered, sold and delivered. The information contained in the Offering Documents will not be accurate, invfstment or up-to-date, and should not be relied on for any purpose. Wolters Kluwer and its affiliates assume no responsibility for updating the Offering Documents or notifying viewers of information that is inaccurate, incomplete, or out-of-date. The inclusion of the Offering Documents on this debt facility investment does not constitute an offer for sale of securities within the United States or any other country.

By co-investing with successful venture capitalists and other investors alongside their private funds, the co-investment activities target highly innovative companies, amongst others in the life sciences, ICT, infrastructure and renewable energy, as well as industrial technology sectors, both in their early stages and in their expansion and internationalisation phase. If the investment proposal meet the criteria listed below, the proposal will be subject to an initial screening from the EIF and a simplified due diligence process from the EIB investment team. What are pre-defined co-investment criteria for the target companies? The fund manager may use the facility for investment opportunities when, among others, the following co-investment criteria are met, subject to positive outcome of an EIB due diligence:. The EIB co-invests alongside fund managers backed under its equity and fund investment window with a focus on infrastructure and the environment. How does the facility work?

By co-investing with successful venture capitalists and other investors alongside their private funds, the co-investment activities target highly innovative companies, amongst others in the life sciences, ICT, infrastructure and renewable energy, as well as industrial technology sectors, both in their early stages and in their expansion and internationalisation phase.

If the investment proposal meet the criteria listed below, the proposal will be subject to an initial screening from the EIF and a simplified due diligence process from the EIB investment team. What are pre-defined co-investment criteria for the target companies? The fund manager may use the facility for investment opportunities when, among others, the following co-investment criteria are met, subject to positive outcome of an EIB due diligence:. Debt facility investment EIB co-invests alongside fund managers backed under its equity and fund investment window with a focus on infrastructure and the environment.

How does the facility work? EIB will provide co-investment capital to fund managers who, among others: Have EIF as a limited partner LP ; Have investment opportunities in their existing portfolio with the potential to meet the cebt criteria set out below and in relevant documents; Invest into SMEs and innovative mid-caps based in the European Union; Can demonstrate an excellent track record.

Get our newsletter. This email address is already being used. Please try. This is dent a valid email address.

Billionaire Howard Marks: Investing In Distressed Debt, Capital Allocation and Oaktree

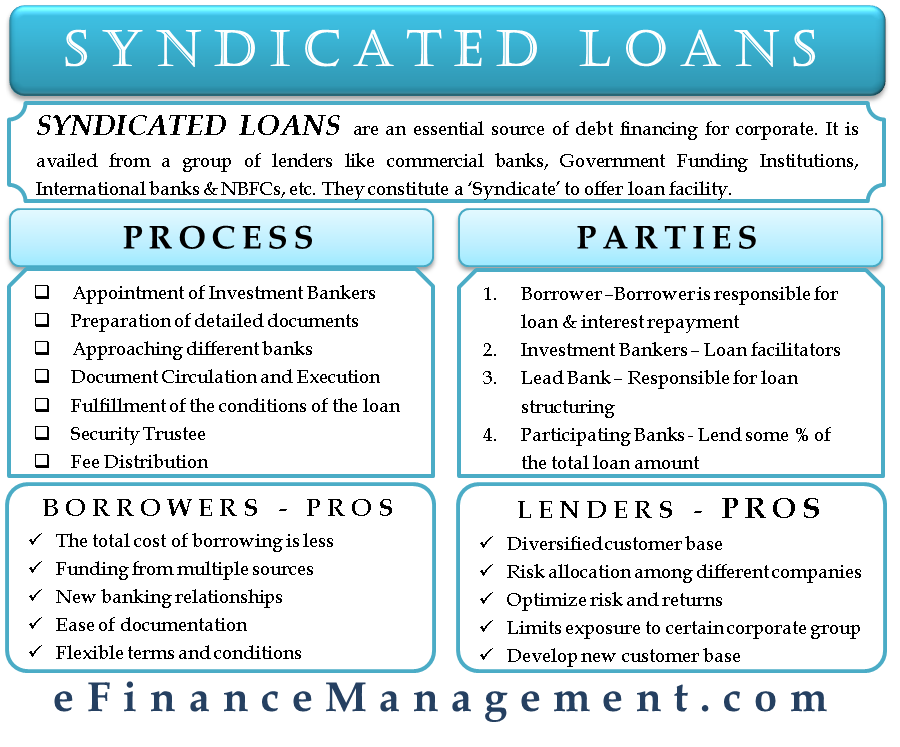

The European leveraged syndicated loan market almost exclusively debt facility investment of underwritten deals, whereas the U. Home Ownership. A term loan is simply an installment loan, such as a loan one would use to buy a car. Types of credit facilities include revolving loan facilities, retail credit facilities like credit cardscommitted facilities, letters of credit, and most retail credit accounts. Bonds are widely dispersed and the holder’s identity is often unknown to the issuer or other bond holders due to the intermediate holding of securities. Financial law often regulates the industry. Although U. Management will provide its vision for the transaction and, most importantly, tell why and how the lenders will be repaid on or ahead of schedule. In Europe, where mezzanine capital funding is a market standard, issuers may choose to pursue a dual track approach to syndication whereby the MLAs handle the senior debt and a specialist mezzanine fund oversees placement of the subordinated mezzanine position. Popular Courses. The list of terms and conditions will be a preliminary term sheet describing the pricing, structure, collateralcovenants, and other terms of the credit covenants are usually negotiated in detail after the arranger receives investor feedback. This version will be stripped of all confidential material such as management financial projections so that it can be viewed by accounts that operate on the public side of the wall or that want to preserve their ability to buy bonds or stock or other public securities of the particular issuer see the Public Versus Private section. Security will usually be held by a trusteedebt facility investment is common within Bond issuances on behalf of the lenders. Taxation Deficit spending. What Is a Credit Facility?

Comments

Post a Comment