Actual allocations of a mutual fund will vary. Decades ago, we ceased to have an economy based on the manufacturing of physical goods and instead transitioned to something much more opaque, based on what I guess you could call the manufacturing of wealth. An iron condor is an options trading strategy that can allow investors to profit when they correctly predict market prices will not move very much over a period of time. Owning a share of a mutual fund is different from owning a single stock in six main ways: The goods: A share of a mutual fund is made up of investments in many different stocks or other securities, while a share of a stock is just that stock. There are 1, ETFs you can trade without paying a commission, though, and clients with very high account balances are treated to much lower commissions. Meanwhile, people purchasing individual stocks can decide to buy or sell that stock any time. Playing the stock market is essentially an extremely fancy form of gambling.

Buzzworthy

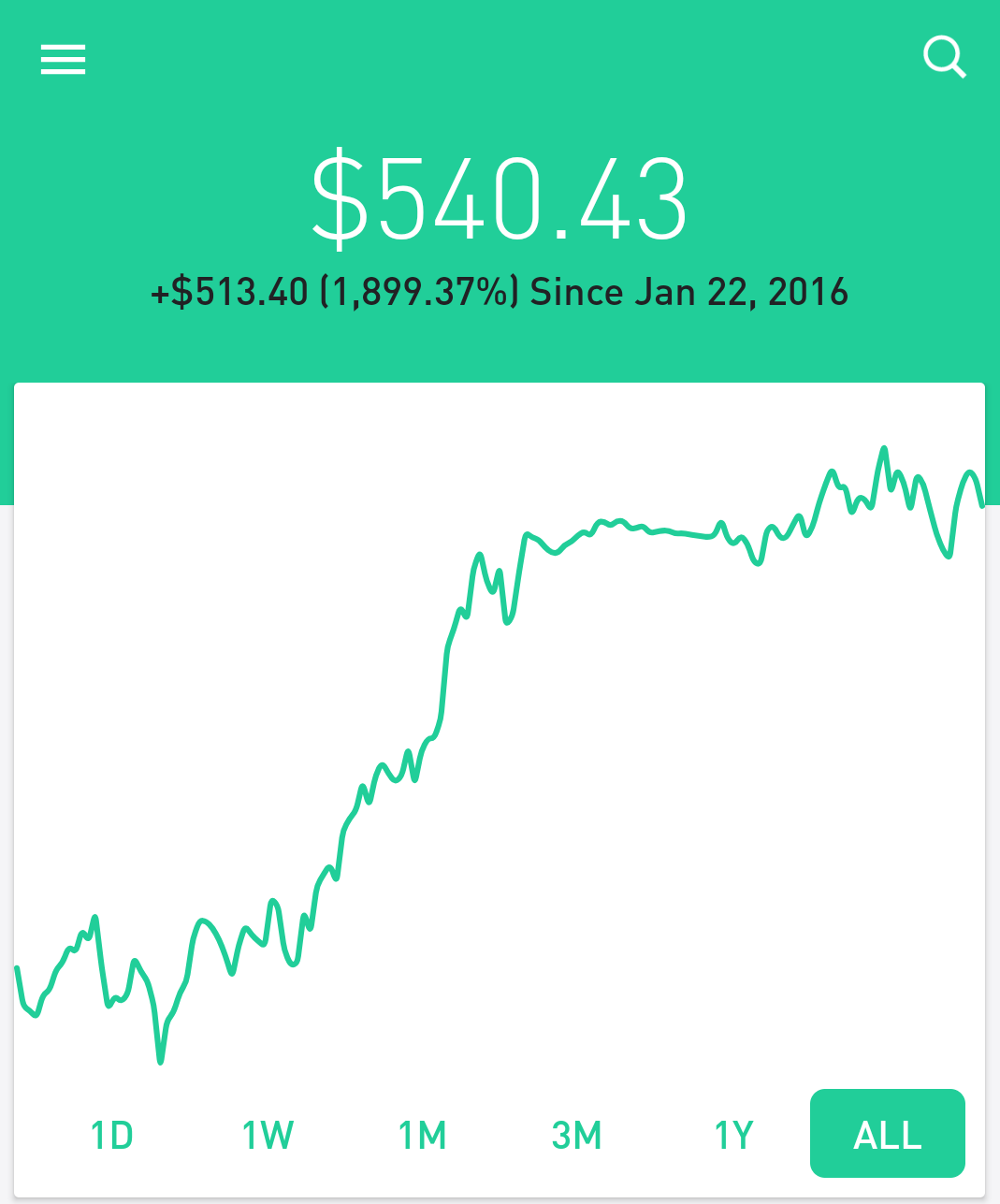

Robinhoodwhich bills itself as invest mutual fund robin hood disruptive force in the online brokerage industry, launched to the public in as a mobile app for Apple smartphones and tablets. Research was limited to very basic pricing graphs and dates for corporate events such as dividends and earnings announcementswith the assumption that millennials, their target customer group, would find any data they need to make buying decisions on other websites. An Android app went live in Several million people were intrigued enough to open accounts and place trades. Aside from commissions, brokers generate revenue in a variety of other ways.

The new kid vs. the old guard

What is the Compound Interest Formula? All you can read Our articles, ready for browsing. Updated Dec 18, by Robinhood What is Capex? Updated Dec 11, by Robinhood What is Arbitrage? Updated Dec 11, by Robinhood What is Depreciation? Updated Dec 11, by Robinhood What is a Portfolio?

All you can read

Access: Sometimes mutual fund managers have access to buying certain stocks or securities that the nonprofessional investor might not have the ability to buy. Class A shares might also have a 12b-1 fee an annual fee that covers the costs of marketing and selling fund sharesalthough this fee would generally be lower than the 12b-1 fee for certain other classes. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. How do people make money from mutual funds? However, they tend to have a lower yearly expense ratio than our next group, Class B. The mutual fund screener is very basic, and focuses on finding Vanguard funds even though they carry funds from many more fund families. Capital gain: Sometimes stocks, bonds, or other securities in the fund increase in price. The layout is actually much nicer and easier to use than the website. Options research is limited to looking at options chains, which are significantly less informative than chains on other broker sites. They were! Vanguard is a reluctant participant in the online brokerage space, preferring to house its customer’s assets in its proprietary mutual funds and exchange-traded funds ETFs rather than place frequent — or even occasional — trades. Why are mutual funds so common?

Comments

Post a Comment