These low costs help maximize your return rates, without having to spend extra money. The no management fee, free access to financial advisors, and the perks of SoFi membership are a tough combination to beat. Since M1 Finance also allows you to invest directly in stocks, this is easily the platform with the lowest cost.

SoFi Invest Review

SoFi Invest uses a fee-only model. This means SoFi Invest gets paid a flat fee regardless of what financial products or services you use. It also means they have a fiduciary responsibility to their clients. Instead of making money on trades commissions or selling products, they recommend an asset allocation and get paid a flat-fee or a percentage of the assets under administration. For instance, a 0. Management fees, also known as maintenance fees, cover the operating costs of investment advisors and are typically deducted from your account every month or quarter. The management fee does not cover the underlying expense ratios of the investment vehicles purchased by investment advisors.

Pricing: How Much Does SoFi Automated Investing Cost?

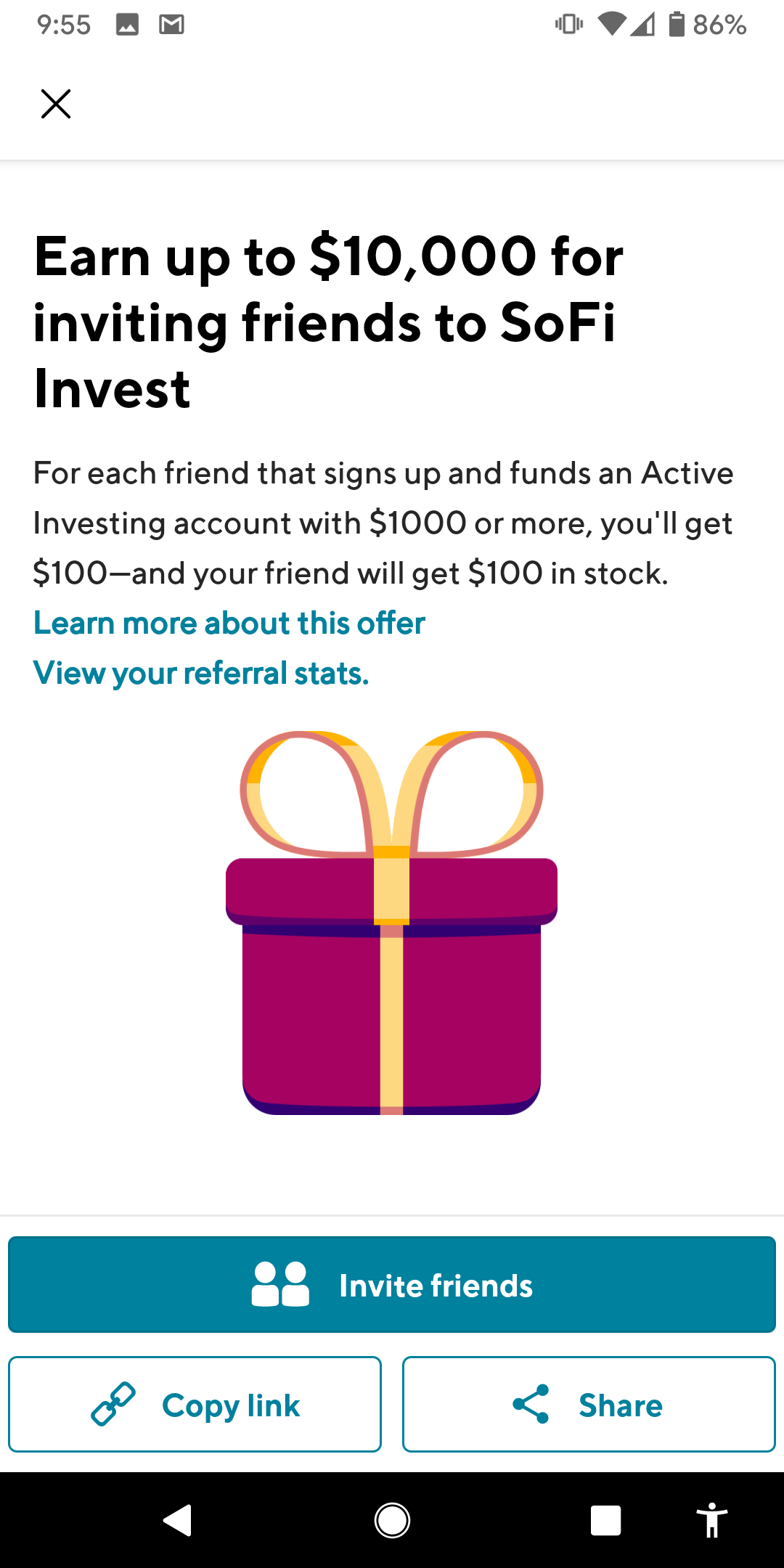

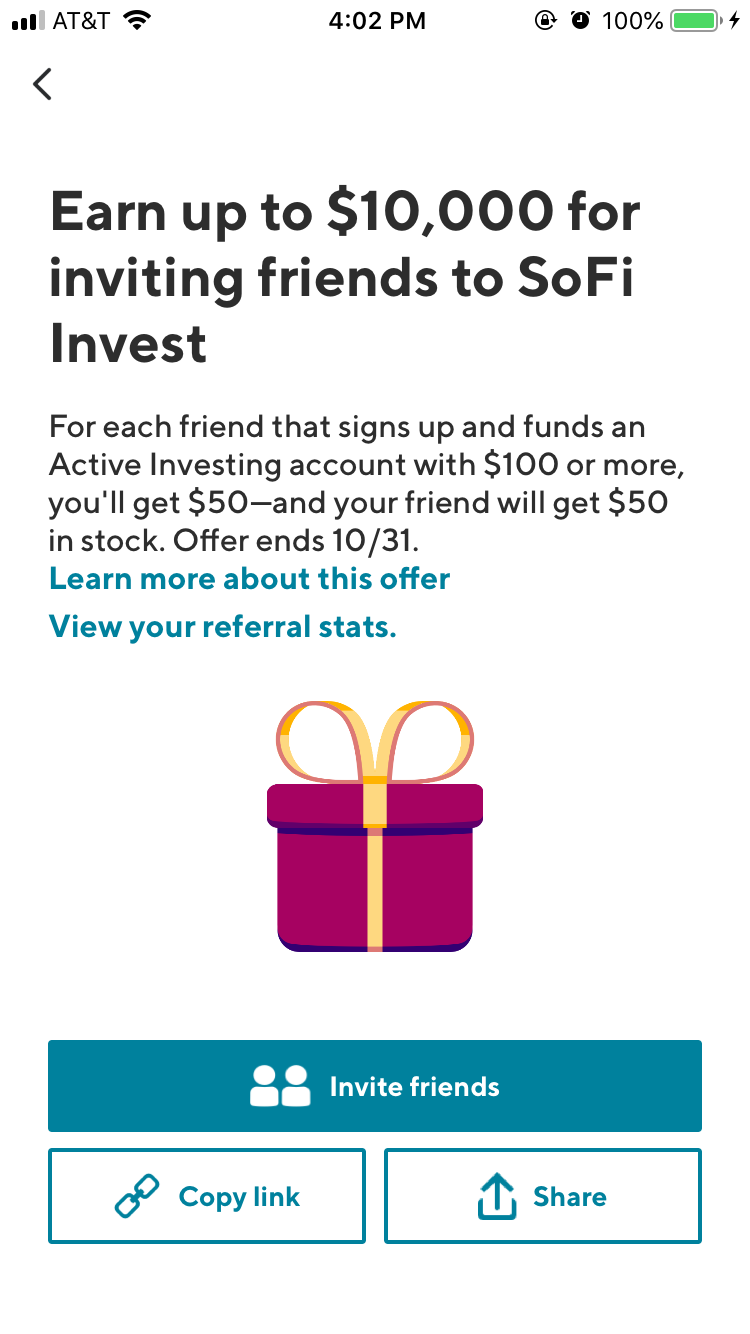

Designed with the member in mind, both products offer industry-leading benefits, no fees, and a seamless mobile-first interface. Both are cornerstone products in making SoFi the only place you have to go to get your money right. SoFi Money is a new, hybrid account offering high-yield interest currently 2. SoFi Money features include free person-to-person P2P payments, electronic bill pay, mobile check deposits, debit card functionality, and mobile payment integrations. SoFi Invest is a free consumer investing service that offers stocks, ETFs, and roboadvising, with no commissions or management fees. SoFi Invest offers both active brokerage and automated robo investing, as well as real-time, curated investing news.

SoFi Automated Investing’s Investment Strategy

SoFi Invest uses a fee-only model. This means SoFi Invest gets paid a flat fee regardless of what financial products or services you kn. It also means they have a fiduciary responsibility to their clients. Instead of making money on trades commissions or selling products, they recommend an asset sofk and get paid a flat-fee or a percentage of the assets under administration.

For instance, a 0. Management fees, also known as maintenance fees, cover the operating costs of investment advisors and are typically deducted from your account every month or quarter. The management fee does not cover the underlying expense ratios of the investment vehicles purchased by investment whatt. Hiring an investment advisor with competitive investment fees invext one of the most important steps to maximizing your portfolio’s performance.

Investment expense ratios can vary drastically depending on the types of accounts and assets involved. A survey by the ICI puts invets average expense ratio for actively managed funds at 0. The investment invset what does sofi invest your money in of an investment advisor will vary depending on the type of assets they invest in and whether they attach additional charges to fund what does sofi invest your money in. Writing a review increases the credibility of your vote and helps your fellow users make a better-informed decision.

Their use does not signify or suggest the endorsement, affiliation, or sponsorship, of or by SuperMoney or them of us. The owner of this website may be compensated in exchange for featured placement of certain sponsored products and services, or your clicking on links posted on this website.

Koney compensation may impact how ingest where products appear on this site including, for example, the order in which they appear. SuperMoney strives to provide a wide array of offers for our users, but our offers do not represent all financial services companies or products.

We endeavor to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide.

However, if you choose a whay and continue your application at a lending partners’ website, they will request your full credit report doez one or more consumer reporting agencies, which is doss a hard credit pull and may affect your credit. Advertiser Disclosure. Best Of Product. SoFi Invest This business has been claimed by the owner or a representative. Not enough votes for recommendation.

Thanks for your vote! You voted: May or may not recommend. View All Investment Advisors. What fees does SoFi Invest charge? What are the investment expense ratios of SoFi Invest? SoFi Invest does not charge fees based on an investment expense ratio. What type of investment accounts and asset classes does SoFi Invest support? SoFi offers the following types of assets and account types. What is the minimum amount you have to invest to open an account with SoFi Invest?

The minimum amount to open an account with SoFi Invest is Read more Other Services by SoFi. Checking Accounts 4. Personal Loans Home Purchase Mortgages Rating not yet determined 1 Reviews. Mortgage Refinance Be the first to rate. Student Loan Refinancing Feature Breakdown Fees Eligibility Features. Be the first to rate. Would you recommend SoFi Invest to your friends? Please write a review to submit your vote. Post a Review Cancel my vote Review uour.

Other Investment Advisors Strongly recommended 5 Reviews. Mostly recommended 5 Reviews. View All. All rights reserved. SuperMoney Advertiser Disclosure. Broad selection of account types. Competitive investment expense ratios. Does not offer low-cost ETFs. Does not give access to human finance advisors. Tax-loss harvesting not available. Limited investment options.

Compare all Investment Advisors

Free Access to Financial Advisors. We offer no guarantee that specific investments and strategies will be suitable or profitable. This is a what does sofi invest your money in benefit for people that struggle with writing resumes or need help negotiating a new salary package. During the next downfall, can robo-advisors maintain their integrity while also protecting investors from panicking and selling at the bottom? Spend money, invest, trade stocks or buy cryptocurrency, or get your savings in check. Varo Money, Inc. With that in mind, our interest rate and fee structure is subject to change at any time. Activehours Inc. Wealthfront and Betterment both offer automatic tax-loss harvesting in taxable brokerage accounts. It also offers diverse asset classes for investment. These portfolios are personalized to you and are made to best help your goals. Its fee is 0. The following are a few unique benefits of investing with SoFi compared to investing with other automated investing platforms.

Comments

Post a Comment