The money you put into the k and its growth are always yours. If you have money left over in your k after Fund No. Back Home. To learn more about using mutual funds to build wealth, check out my new book, Everyday Millionaires. Best k Management Practices.

Investing in a k plan is essential for the vast majority of American what investments for 401k to achieve a successful and happy retirement. By managing their plans well, any investors have been able to enjoy early and wealthy retirements. Here are 10 of the investmentts tips for k saving and investing. It’s never too early or too late to start saving in a k plan. Even if you’re in your 40s or 50s, there’s still time to build a significant nest egg for retirement.

Make Your 401(k) Selections With a Pro

A k is a retirement savings plan sponsored by an employer. It lets workers save and invest a piece of their paycheck before taxes are taken out. Most employers used to offer pension funds. Pension funds were managed by the employer and they paid out a steady income over the course of the retirement. If you have a government job or a strong union, you may might still be eligible for a pension.

How to Make Your 401(k) Selections in 5 Simple Steps

Investing in a k plan is essential for the vast majority of American citizens to achieve a successful and happy retirement. By managing their plans well, any investors have been able to enjoy early and wealthy retirements. Here are 10 of the best tips for k saving and investing.

It’s never too early or too late to start saving what investments for 401k a k plan. Even if you’re in your 40s or 50s, there’s still time to build a significant nest egg for retirement. Therefore, there’s not a magical age to start saving in a k plan but rather this simple savings advice: The best time to start saving in a k plan is yesterday, the second-best time to start saving in a k plan is today, and the worst time to start saving in a k is tomorrow.

Many k plans offer an employer match, which is just how it sounds: If you make contributions to your k, your employer may make matching contributions up to a certain maximum. That’s a 50 percent rate of return before you even begin investing!

Do not leave this money sitting on the table. The sooner you start saving in your k, the sooner you can take advantage of the power of compound. Because of compound interest, which harnesses the time value of money, Saver 1 «won» the k savings contest. Making compounding even more powerful, the earnings in a k plan are not taxed while in the account. This allows the interest to keep compounding without taxes slowing it down, as it would in a taxable account. There is no one-size-fits-all k savings rate for.

Therefore the best amount to save in a k plan is however much you can afford to contribute without hurting your other financial goals and obligations. For example, if you can’t pay your rent or reduce your credit card debt because your k contributions are too high, you are saving too much!

Just don’t leave money laying on the table, so to speak. One of the biggest mistakes investors make in a k plan is failing to identify which mutual funds are best for. More specifically, some investors take too little risk, which means their k savings might grow too slowly, and some savers invest too aggressively and sell their mutual funds in a panic when a major market decline comes.

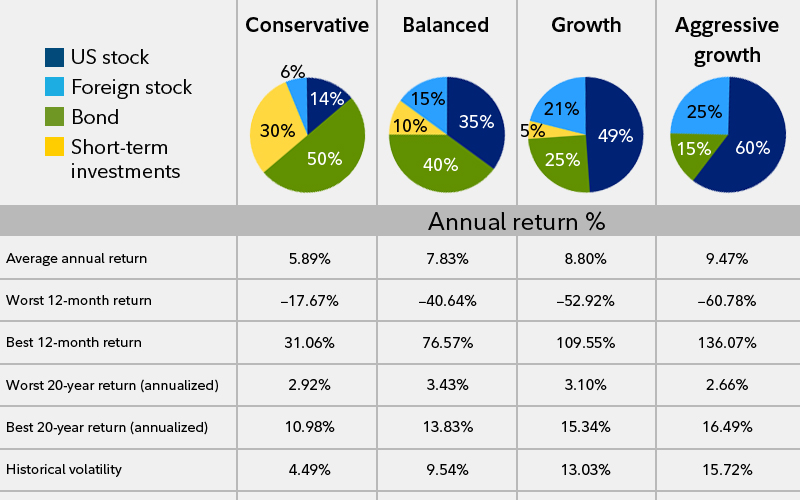

To find what investments for 401k how to find the best balance of risk and return, k investors should complete what’s called a risk tolerance questionnaire, which will identify a risk profile and suggest mutual fund types and allocations accordingly.

When building a portfolio of mutual funds, the most important aspect of the process is diversification, which means to spread risk across different investment types. Most k plans offer several mutual funds in different categories. Here’s an example of a moderate portfolio, which is a «medium risk» mix of mutual funds appropriate for most investors, using funds typically found in a k plan:. Once you’ve set up your deferral percentage and selected your investments, you can go on about your work and your life and let the k do its job.

However, there are a few simple maintenance tips to follow:. When you rebalance your k, you are returning your current investment allocations back to the original investment allocations. To rebalance, you will sell shares of the fund that grew in value, buy shares of the fund that declined in value, and leave the others.

This has an effect of «buying low and selling high,» which is what the best investors do regularly. A good frequency for rebalancing is once per year. Most k plans allow for automatic rebalancing or an easy way to do it online. When you get a raise, give your k a raise! That way you’ll still enjoy a raise but you’ll also increase your retirement savings. Most k plans offer either a hardship withdrawal option and a loan option to take money out of your plan prior to retirement with certain limitations.

If you take a loan, you’ll have to pay it back with interest or satisfy the loan balance if you terminate employment prior to paying off the loan. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results.

Investing involves risk including the possible loss of principal. American Association of Individual Investors. Mutual Funds Best Mutual Funds. By Kent Thune. Rebalance Your Portfolio. Increase Savings Rate.

Avoid Making Premature Withdrawals. Article Table of Contents Skip to section Expand. Start Your k Contributions Early. Maximize Your Employer Match. Impact of Compounding Interest. Pick the Best Savings Rate for You. Properly Assess Your Risk Tolerance. Diversify Your k. Best k Management Practices.

Article Sources. Continue Reading.

How To Invest Your 401k

Your ability to retire depends on you getting it right. These five steps will help you make smart k selections you can feel good. Find an investing pro! Investing Retirement. Back Tools. Article Table of Contents Skip to section Expand. Back Classes.

Comments

Post a Comment