As a Premium user you get access to background information and details about the release of this statistic. Further related statistics. Q3 and Q4’18 investment dropping significantly, suggesting that fintech investors in the UK may have drawn back due to Brexit uncertainties. In your browser settings you can configure or disable this, respectively, and can delete any already placed cookies. You’ve been a member since. What is Fintech?

Latest news

One evident trend from the data is that large companies are ramping up their investments in FinTech firms. This can according to the authors be explained by the growing need of financial services institutions to ramp up their cost effectiveness, service portfolios and customer experience. European companies and foreign companies that do business in Europe are constantly looking for opportunities to deal more effectively with the requirements that new regulations entail. Globally, there is likely to be an increase in investment focused on solutions targeted to the needs of unbanked and underbanked people in the developing world, including southeast Asia and Africa. This new law stipulates that new entrants to the payments market, such as specialised FinTech firms or large technology companies that obtain a license from the local authorities, should global investments in fintech granted access to the payment records of consumers, provided the account holder gives permission.

Latest news | Corporate Finance

According to a new report by Singapore-based venture capital firm Life. SREDA , last year was a mixed bag for fintech. On the one hand, the Money of the Future Report pegs as the first year to have an overall decrease in fintech funding after taking into account any outliers. Further, for the deals that were done in , one could say there was an element of quality over quantity. JP Morgan, at one end of the spectrum, only booked three fintech deals last year, which is the same as they did for Companies like Barclays and Goldman Sachs have more of a shotgun approach: get in on as many fintech companies as possible. Partnerships and product integrations, accelerators and innovative labs, direct investments and venture debts, corporate VCs and fund-of-fund investments — banks started to use all available mechanisms in order not too lose in the digital war with the new hungry players.

Visual Capitalist

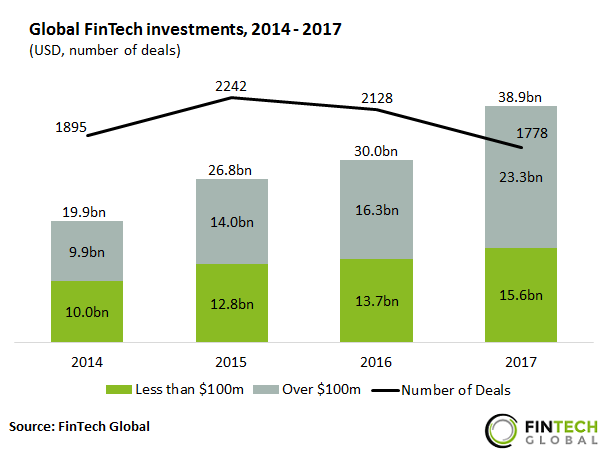

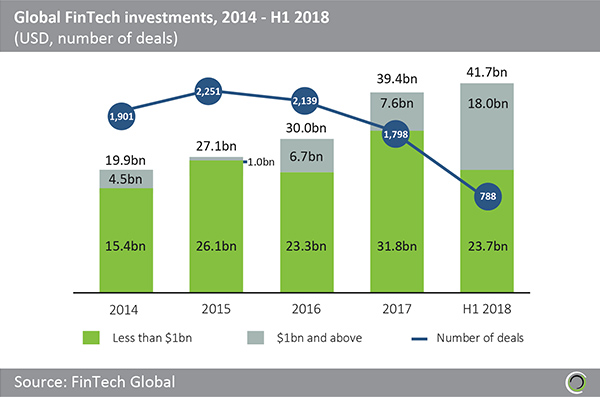

Value of global investment in Financial Technology ventures in and in billion U. Fintech deal volume declined markedly in the second half ofbut still reached 2, deals for the year, up from 2, in Profile KPMG. Profit from additional features with an Employee Account. Fintech is a term for all financial applications of new technology, from peer to pear loans to mobile payments. All rights reserved. Campus events Seminars Business Courses Workshops.

Comments

Post a Comment