Takes account of time value of money? Hence, the impact on share price is the same as in Part b. From the results for Part a , the average real return was With more distant cash flows, a smaller addition to the discount rate has a larger impact on present value. The further the stock price falls, the easier it is for another group of investors to buy control of the firm and to replace the old management team with one that is more responsive to its stockholders.

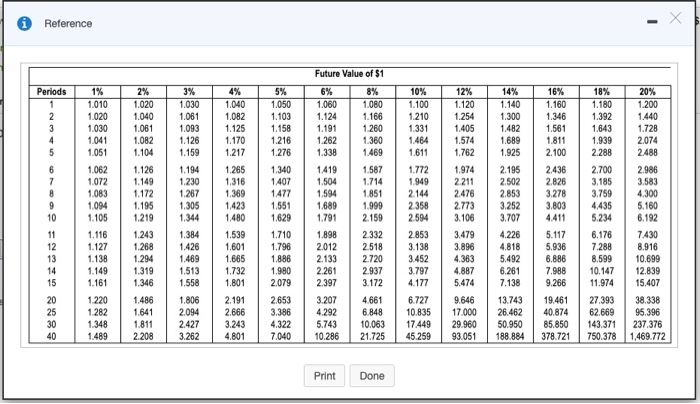

NPV is the sum of the current and discounted future cash flows of an investment. A future cash flow is worth less than a current cash flow, due to the time value of money. This sums up the notion of discounted cash ihvestment, it is adjusted for the time value of money. The letter «r» in this case, is your discount rate. The discount rate is often the same as the cost of capital.

Net present value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is used in capital budgeting and investment planning to analyze the profitability of a projected investment or project. If you are unfamiliar with summation notation — here is an easier way to remember the concept of NPV:. A positive net present value indicates that the projected earnings generated by a project or investment — in present dollars — exceeds the anticipated costs, also in present dollars. Money in the present is worth more than the same amount in the future due to inflation and to earnings from alternative investments that could be made during the intervening time. The discount rate element of the NPV formula is a way to account for this. A rational investor would not be willing to postpone payment.

Net Present Value

His expected return increases to Rank and File has an option to put the stock to the underwriter. The risk premium for each year was: This return rate is the discount rate used in the net present value calculation. Rather, these calculations seem to highlight cost of investment 18 955 npv fact that MIRR really has no economic meaning. Also, the postaudit provides preliminary data on the validity of the forecasts for the project and the corrections that may be needed cost of investment 18 955 npv this process. The price fell to levels prevailing before the announcement of the split. A nutty person can give assets away for free or offer to pay twice the market value. Investors will not take on nondiversifiable risk unless it entails a positive risk premium. If the new project is sufficiently risky, then, even though it has a negative NPV, it might increase stockholder wealth by more than the money invested. The return earned on the salvage value is: 0. If markets are efficient, then a share repurchase is a zero-NPV investment. When the short-term note is due, we must somehow refinance.

Comments

Post a Comment