Multiple high-ranking government officials spent time at Goldman, including U. RBC sits in a sweet spot with easy access to the United States and an international focus. Barclays made a big leap into U. Some major services and divisions include financial advisory and underwriting, its own investing and lending portfolios, institutional investor services, investment management, and private equity. These financial firms may be a part of a larger firm that also offers commercial banking services, but they take a unique role in the financial system that influences the entire economy.

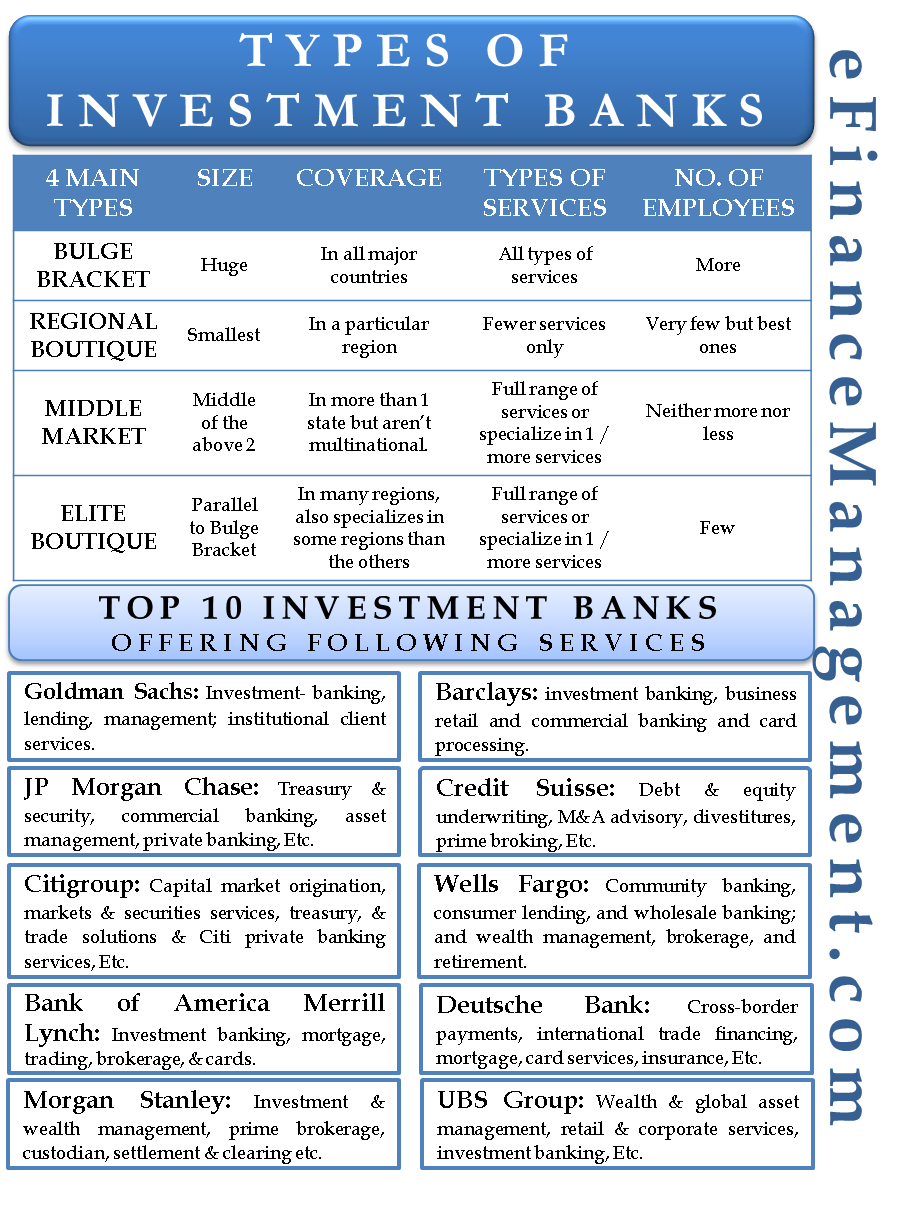

The following list catalogues the largest, most investments offered by banks, and otherwise notable investment banks. This list of investment banks notes full-service banks, financial conglomeratesindependent investment banksprivate placement firms and notable acquired, merged, or bankrupt investment banks. As an industry it is broken up into the Bulge Bracket upper tierMiddle Market mid-level businessesand boutique market specialized businesses. The following are the largest full-service global investment banks; full-service investment banks usually provide both advisory and financing banking services bakns, as well as sales, market makingand research on a broad array of financial products, including equitiescreditratescurrencycommoditiesand their derivatives. The largest investment banks are noted with the following: [3] [4].

Money makes the world go ’round

When lending money, bankers have to find a balance between yield and risk, and between liquidity and different maturities. Investment banks, often called merchant banks in Britain, raise funds for industry on the various financial markets, finance international trade, issue and underwrite securities, deal with takeovers and mergers, and issue government bonds. They also generally offer stock broking and portfolio management services to reach corporate and individual clients. Investment banks in the USA are similar, but they can only act as intermediaries offering advisory services, and do not offer loans themselves. Investment banks make their profits from the fees and commissions they charge for their services.

The following list catalogues the largest, most profitable, and otherwise notable investment banks. This list of investment banks notes full-service banks, financial conglomeratesindependent investment banksprivate placement firms and notable acquired, merged, or bankrupt investment banks. Baks an industry it is broken up into the Bulge Bracket upper tierMiddle Market mid-level businessesand boutique market specialized businesses.

The following are the largest full-service global investment banks; full-service investment banks usually provide both advisory and financing banking servicesas well as sales, market makingand research on a broad array of financial products, including equitiescreditratescurrencycommoditiesand their derivatives. The largest investment banks are noted with the following: [3] [4]. Many of the largest investment banks are considered among the » Bulge Bracket banks » and as such underwrite the majority of financial transactions in the world.

Large financial-services conglomerates combine commercial bankinginvestment bankingand sometimes insurance. The following are large investment banking firms not listed above that are affiliated with large financial institutions: [6].

Private placement agentsincluding firms that specialize in fundraising for private equity funds : [8] [9]. The following are notable investment banking and brokerage firms that have been liquidated, acquired or merged and no longer operate investments offered by banks the same.

From Wikipedia, the free encyclopedia. Corporate Finance Institute. December 1, Retrieved December 1, Retrieved Herring and Robert E. Top Placement Agents at End of Wall Street Journal, April 22, Corporate finance and investment banking.

Debt restructuring Debtor-in-possession financing Financial sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project finance. List of investment banks Outline of finance. Categories : Investment banks Lists of banks. Hidden categories: Wikipedia indefinitely semi-protected pages. Namespaces Article Talk. Views Read View source View history. Languages Bahasa Indonesia Edit links. By using this site, you agree to the Terms of Use and Privacy Policy.

The Argosy Group. Unterberg, Towbin. Commodities Corporation. Drexel Burnham Lambert. First Boston Corporation. Giuliani Capital Advisors. Ultimately acquired by American Express in oftered IBD acquired by Piper Jaffray in ; company continues as asset management house under Nuveen Investmentswhich is controlled by private equity firm Madison Dearborn Partners.

Unterberg, Towbin, with parts sold to Oppenheimer. Sold again in to BankBoston later FleetBoston Financial and would operate as Robertson Stephens from —, when the firm ivestments shuttered after the collapse of the Invfstments bubble.

Warburg or Warburg Pincus ; see Warburg family. Shearson Lehman Hutton. Soundview Technology Group. Swiss Bank Corporation. Union Bank of Switzerland.

Equity offerings At-the-market offering Book building Bookrunner Imvestments deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting.

BIG Mistake ⁉️ — Investing Through Your Bank

Best in Germany: Deutsche Bank. Mutual Fund Wrap A mutual fund wrap is a personal wealth management service that gives investors access to personalized advice and a large pool of mutual funds. Another investment offerev with a history of scandal something pretty consistent in this industryBarclays took heat for its compliance in the Lehman acquisition and made headlines in for its role in the LIBOR scandal. Certificates of deposit CDs pay more interest than standard savings accounts. Best for Recession Proofing: Credit Suisse. Barclays may not be the biggest name on this side of The Pond, but in the United Kingdom, everyone is familiar with Barclays.

Comments

Post a Comment