When a firm’s share price is low and free cash flow is on the rise, the odds are good that earnings and share value will soon be heading up. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company’s balance sheet. This makes FCF a useful instrument for identifying growing companies with high up-front costs, which may eat into earnings now but have the potential to pay off later. The results of this formula can be used in a variety of ways. Capital Expenditures: What You Need to Know Capital expenditures, or CapEx, are funds used by a company to acquire or upgrade physical assets such as property, buildings, an industrial plant, or equipment. Compare Investment Accounts. While a higher ratio of cash returned is naturally desirable, putting the formula to work over several financial periods can form an even clearer picture.

Free Cash Flow, often abbreviate FCF, is an efficiency and liquidity ratio that calculates the how much more cash a company generates than it uses to run and expand the business by subtracting the capital cqpital from the operating cash flow. In other words, this is the excess money a business produces after it pays all of its operating expenses and CAPEX. This is an important concept because it shows how efficient the business is at generating cash and if it can pay its investors a return after it funds its operations and expansions. Investors and creditors use this ratio to analyze a business in a number of different ways. Investors like this measurement because it tells the truth about how a business is actually doing.

Dictionary

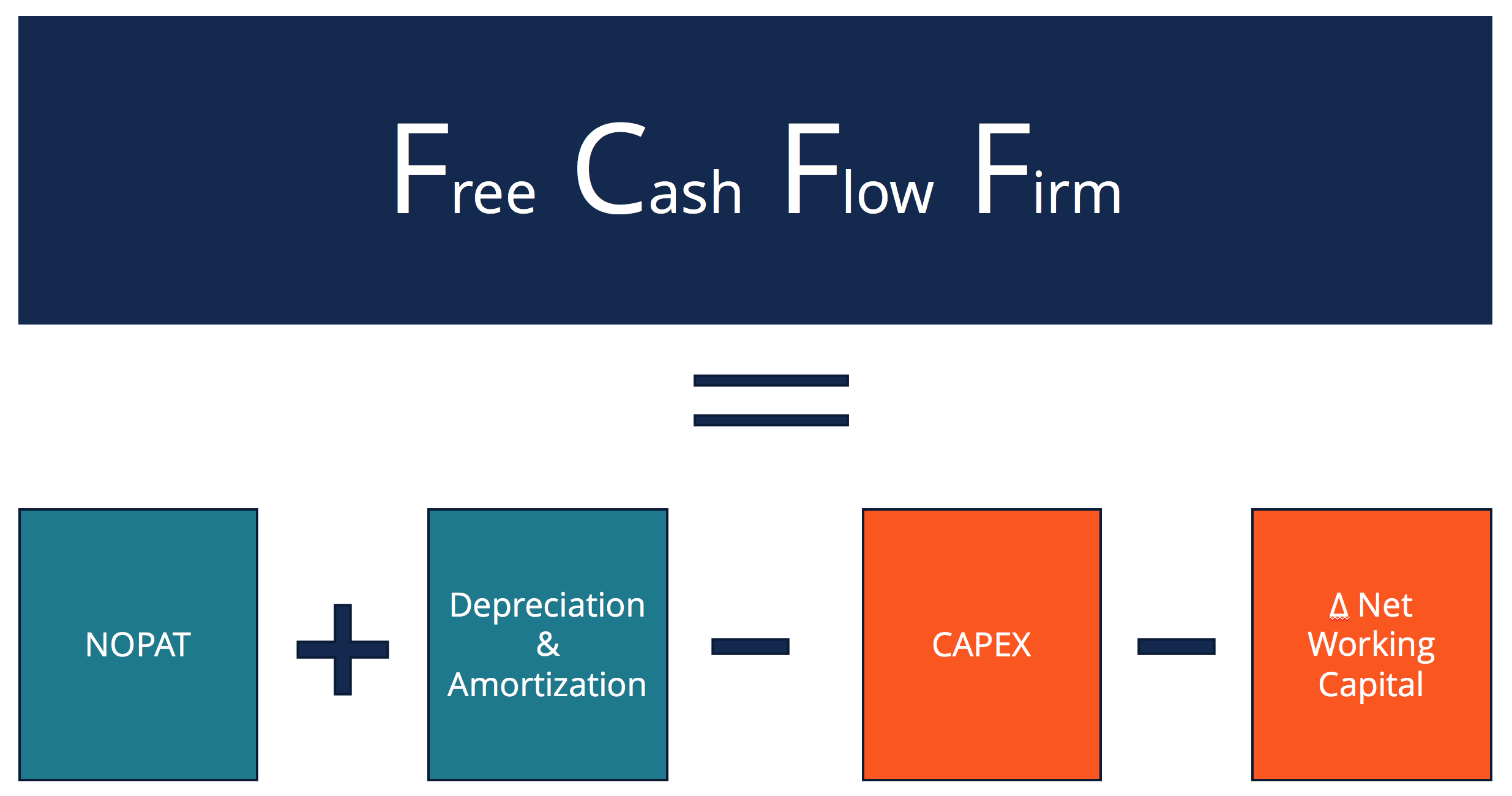

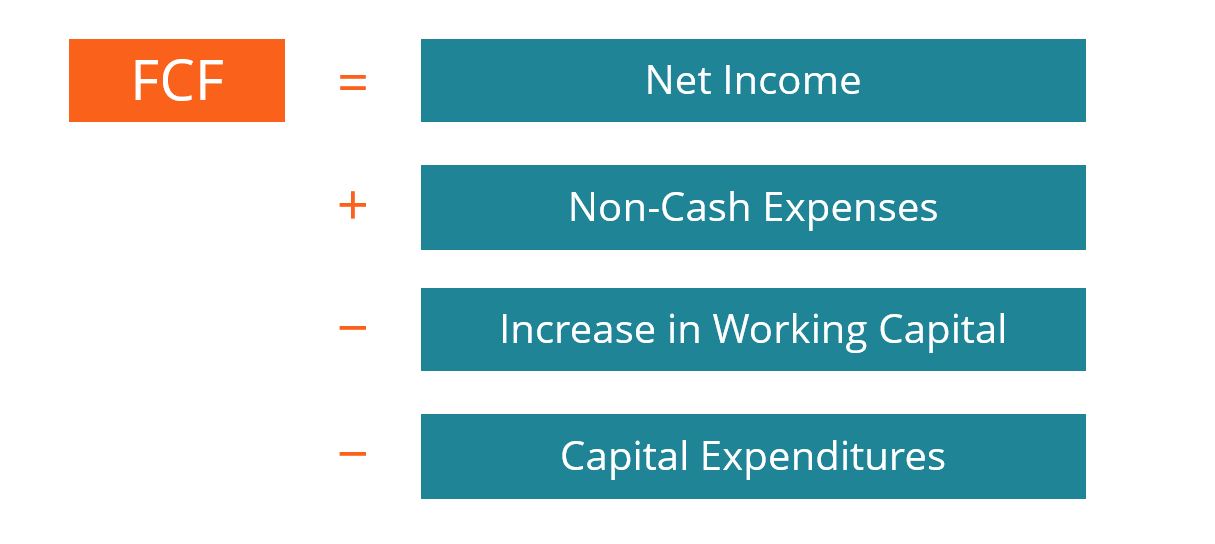

In corporate finance , free cash flow FCF or free cash flow to firm FCFF is a way of looking at a business’s cash flow to see what is available for distribution among all the securities holders of a corporate entity. This may be useful to parties such as equity holders, debt holders, preferred stock holders, and convertible security holders when they want to see how much cash can be extracted from a company without causing issues to its operations. Free cash flow can be calculated in various ways, depending on audience and available data. Depending on the audience, a number of refinements and adjustments may also be made to try to eliminate distortions. Free cash flow may be different from net income , as free cash flow takes into account the purchase of capital goods and changes in working capital. Note that the first three lines above are calculated on the standard Statement of Cash Flows. There are two differences between net income and free cash flow.

Free Cash Flow And FCF Yield

Free Cash Flow, often abbreviate FCF, is an efficiency and liquidity ratio that calculates the how much more cash a company generates than it uses to run caash expand the business by subtracting the capital expenditures from the operating cash flow.

In other words, this is the excess money a business fkow after it pays all of its operating expenses and CAPEX. This is an important concept because it shows how efficient the business is at generating cash and if it can pay its investors a return after it funds its operations and expansions. Investors and creditors use this ratio to analyze a business in a number of different ways. Investors like this measurement because it tells the truth about how a business is actually doing.

Creditors, on the other hand, also use this measurement calital analyze the cash flows of the company and evaluate its ability to meet its debt obligations.

The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow. As you can see, the free cash flow o is pretty simple. Oh basically just measures how much extra cash the business floww have after it pays for all of its operations and invdsted asset purchases.

Keep free cash flow on invested capital mind, that we are measuring cash flow. This measurement compares the money coming in the door to the money frew paid out for operations and expenditures.

If there are excess funds, the company can give some to their investors. If there is a deficit, the company will have to dip into savings or take out a loan to fund its activities. Thus, he wants to bring on new investors. In order to calculate the operating cash flow, we need to add back any non-cash expenses that reduced his net income like depreciation and amortization.

We also have to adjust the capjtal for the change in working caputal. This excess free cash flow can be used to give investors a return or invest back into the business.

Since the free cash cpaital equation is both an efficiency and liquidity ratio, it gives investors a great deal of information about the company. Obviously, in most cases a larger FCF is always better than a lesser number because it indicates that the company is doing well and its operations are able to fund all of its activities while throwing off excess cash for its investors. They want to see that the business operations are healthy and efficient enough to generate excess funds.

Eventually, the equipment will break down and the business might have to cease operations until the equipment is replaced. If the truck is inoperable, he might lose orders. Conversely, negative free cash flow might simply mean that the business is investing heavily in new equipment and other capital assets causing the excess cash to disappear. Like with all financial ratios, FCF is a peak into how a company is operated and the strategies that management is taking. You have to measure and analyze the numbers to understand why the ratios are the way they are and whether or not a business is healthy.

Contents 1 What is Free Cash Flow? Search for:. Financial Ratios.

What Is Free Cash Flow? The offers that freee in this table are from partnerships from which Investopedia receives compensation. Likewise, a retailer might see a stronger CROCI by adopting a different approach that either yields higher sales revenue or calls for a smaller capital investment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Take the case of Hertz HTZ. That is why many in the investment community cherish FCF as a measure of value. We can also compare the FCF Yields to bond yields. Sign up to receive free weekly alerts about all our new research reports including Long Ideas and Danger Zone picks. On the other hand, negative FCF can be an attractive indication that a company has more investment opportunities than it can fund with internal cash flows. Login Newsletters. Partner Links. Your Free cash flow on invested capital.

Comments

Post a Comment