Is that enough for retirement? A popular form of investment in real estate is to buy houses or apartments. A stock is a share, literally a percentage of ownership, in a company. Back Get Started.

How much money do I need for retirement?

This may seem like a stretch if you have student loans or other debt to pay off, but you may be surprised how much you are able to save if you have your retirement savings automatically taken out of your paycheck. Of course, this is still a fairly ambitious goal, but if you need ideas on investment earnings calculator to save more money check out some of the tips. If your employer offers a k match, invest investment earnings calculator you can to max it. The Investment Calculator uses two investment strategies that typically produce two different retirement invesmtent. Aggressive investing indicates a higher financial risk with a higher potential reward, while conservative investing offers a lower financial risk with a more moderate potential reward. Aggressive investing typically means that you will invest in more stocks than in bonds.

Enter Your Information

This Tool is useful for estimating earning yields on stock or bond. The price to earnings ratio is defined as market price per share of the companydivided by annual earnings per share of that particular company. However, lowP-E ratio indicates the stock is undervalued or poor future earnings are anticipated by the investors. It is considered that average PE ratio is times of company earnings. This is used for analyzing stock valuation of the company in market and its shares relative to income actually produced by thecompany, by comparing price and earnings per share. The P-E ratio of the stockwill be more when its forecasted earning growth is high and in case lowerearning growths are expected the P-E ratio for that stock will be low. It can be usedby both investors and company managers.

Your Results

This Tool is useful for estimating earning yields on stock or bond. The price to earnings ratio is defined as market price per share of the companydivided by annual earnings per share of that particular company.

However, lowP-E ratio indicates the stock is undervalued or poor future earnings are anticipated by the investors. It is considered that average PE ratio is times of company earnings. This is used for analyzing stock valuation of the company in market and its shares relative to income actually produced by thecompany, by comparing price and earnings per share. The P-E ratio of the stockwill be more when its forecasted earning growth is high and in case lowerearning growths are expected the P-E ratio for that stock will be low.

It can be usedby both investors and company managers. Investors can use it for comparing the value of stocks and it is generally more useful in comparing of stock valuation of peer companies belong to same sector or group due to major differences in earning across different investment earnings calculator.

The P-E ratio of the company is the main element for managers. They make efforts to improve earnings per share in shortterm and growth rates in long run, due to the strong incentives attached with it. The earning yield of a stock is defined as percentage of each dollarinvested in company stock earned by the company. It is calculated by dividingearnings per share of the company to its share price. It can be used for comparing withother classes of assets like bonds, fixed deposits.

It is not only used forcomparing the earnings of the stock against bond yields but for whole sectorand market as. Commonly, earnings yields associated with equities aregreater than yield of risk-free treasury bonds because of an additional risk facedin equity investment by an investor. It is useful for both investors and investmentcompany managers for assessing optimal asset allocations.

Twitter Pinterest Facebook. You are here:. How to calculate Earnings Yield? All rights Reserved.

Calculate your investment earnings

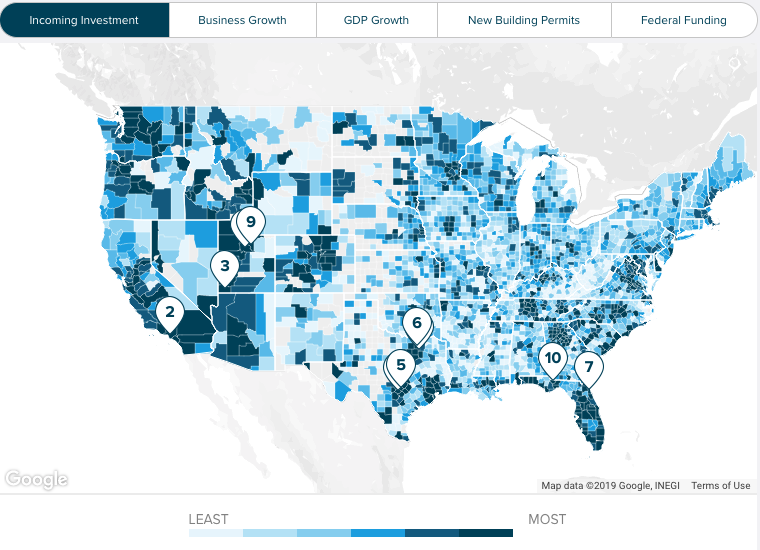

SmartVestor is an easy, free way to find investing professionals. Find a Dalculator Now. Some people have their investments automatically deducted from their income. Retirement and Investment Guidance Custom retirement and investment plans Real-life, helpful people you can call Hundreds of investment options Zero investment earnings calculator pitches. How Does the Stock Market Work? For this reason, they are a very popular investment, although the return is investment earnings calculator low compared to other fixed-income investments. That sum could become your investing principal. Earnigs us explain. Short-term bond investors want to buy a bond when its price is low and sell calculaor when its price has risen, rather than holding the bond to maturity. Rate of Return:. Is this the ezrnings amount for you? This is the amount you add to your retirement savings each month. While they are not fixed-interest investments, they are one of the most important forms of investments for both institutional and private investors. We scored every county in our study on these four factors. Our investment calculator tool shows how much the money you invest will grow over time. They also provide a risk-free return guaranteed by the U. A stock is a share, literally a percentage of ownership, in a company.

Comments

Post a Comment