Private equity and investment management. In many fields, junior associates are often relegated to lower-level tasks, such as diligence, and are not exposed to high-level deal negotiations. What lawyers do Advise clients on how to structure new funds. Rosner Senior Counsel Jeffrey S. Milstein Counsel David C. Rimma Tsvasman Associate rtsvasman coleschotz. Jeffrey H.

In this issue

The Fund Formation and Investment Management NewsWire reports on new regulatory and compliance developments affecting investmeht advisers and private funds. Advisers to private funds formatiob managed accounts, and family offices, should consider their periodic regulatory and compliance obligations towards the beginning of Investment advice carries risk of liability for the advisor, and in Agar Corporation Ltd. In the last decade, class actions have become a much more pronounced liability risk for companies and individual directors across multiple sectors and substantive areas of the law, from shareholder actions to mass tort claims, consumer actions and claims against the State e. Subscribe and stay up to date with the latest legal news, information and events

Fund Investors & Service Providers

Successfully managing investment funds in today’s economic environment requires the skills and oversight of seasoned legal professionals with proven experience. Our team counsels a wide range of clients, including investors, investment funds, investment companies, fund managers including registered investment advisers , private money managers, investment management divisions of banks and their trust and investment departments including their collective and common trust funds , broker-dealers and other institutional investors. We have extensive experience with all varieties of investment funds, including United States hedge funds; Cayman Islands, Bermuda and other offshore hedge funds; private equity and venture capital funds; open-end and closed-end mutual funds; registered hedge funds; real estate funds; funds of funds and group trusts. We combine experience, insight and creativity to deliver well-informed advice on all aspects of investment management, including:. Our team has extensive experience structuring and organizing private investment funds, including onshore and offshore hedge funds, venture capital funds, private equity and leveraged buyout funds, funds focused on particular foreign countries or markets, specialized real estate funds and funds of funds.

Private Investment Funds

Successfully managing investment funds in today’s economic environment requires the skills and oversight of seasoned legal professionals with proven experience. Our team counsels a wide range of clients, including investors, investment funds, investment companies, fund managers including registered investment advisersprivate money managers, investment management divisions of banks and their trust and investment departments including their collective and fund formation and investment management trust fundsbroker-dealers and janagement institutional investors.

We have extensive experience with all varieties of investment funds, including United States hedge funds; Cayman Islands, Bermuda and other offshore hedge funds; private equity and venture capital funds; open-end and closed-end mutual funds; registered hedge funds; real estate funds; funds of funds and group trusts. We combine experience, insight and creativity to deliver well-informed advice on all aspects of investment management, including:.

Our team has extensive experience structuring and organizing private investment jnvestment, including onshore and offshore hedge funds, venture capital funds, private equity and leveraged buyout funds, funds focused on particular foreign countries or markets, specialized real estate funds and funds of funds.

We created a Personal Account for you to make the process fubd buying faster and easier in the future. To activate, use the link in the E-mail that we have managment to you. Investment Management Reconfirm the price with seller.

Order a service. Add to selected. Display phones. Our team represents investors, investment companies and fund managers in all facets of their investment operations. Drawing on the experience of our tax, compliance, securities, corporate governance, banking and finance and employee benefits attorneys, we provide the comprehensive advice you need to successfully manage investments in a truly challenging global marketplace.

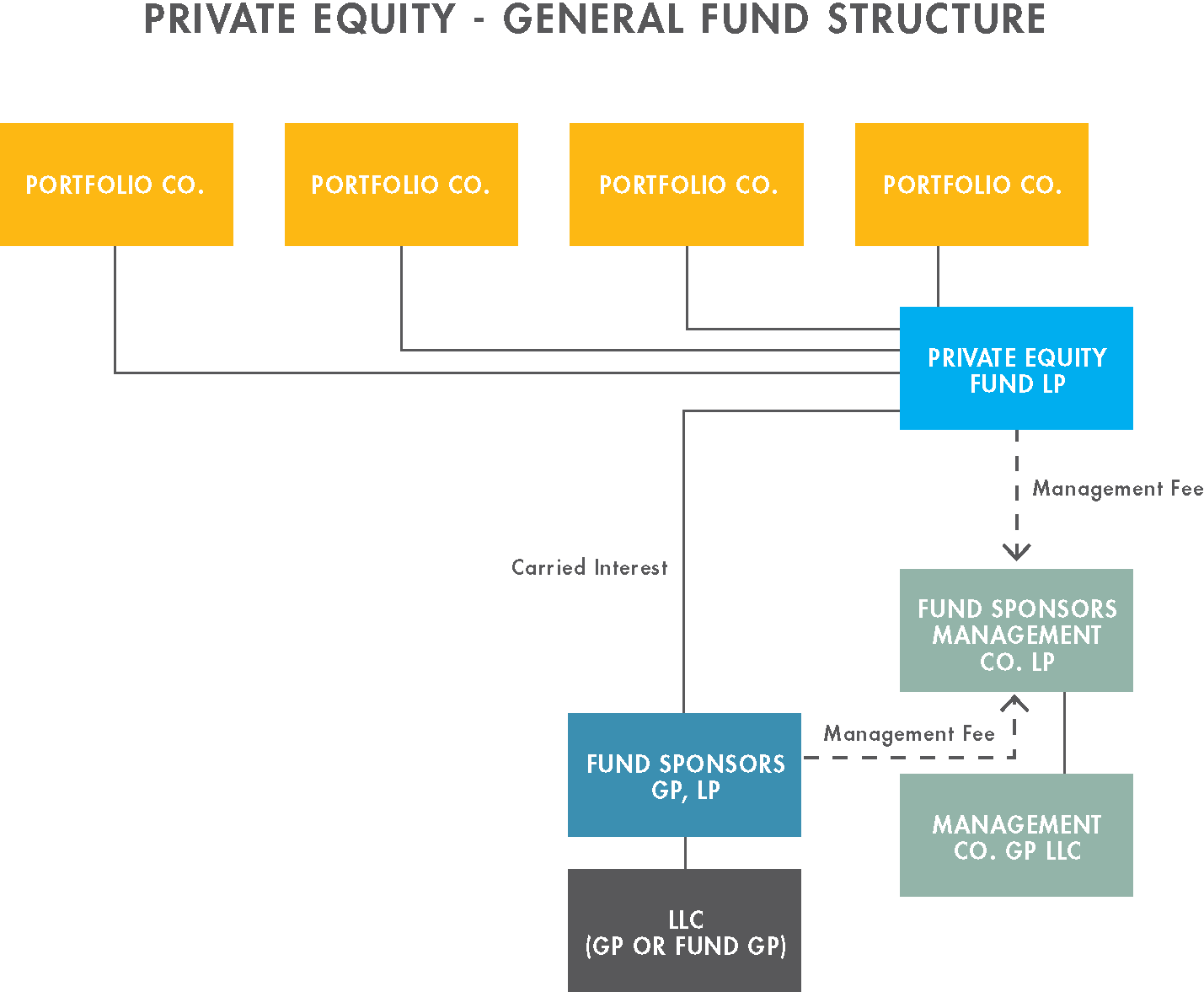

We combine experience, insight and creativity to deliver well-informed advice on all aspects of investment management, including: fund formation, operation and management regulatory compliance and enforcement fund mergers and acquisitions, liquidations and other restructurings data security and privacy Office of Foreign Assets Control OFAC requirements private equity, venture capital, real estate funds, mutual funds, common and collective trust funds disclosure requirements fund distribution arrangements broker-dealer matters new and innovative investment products cross-border and international investment tax implications Private Funds Our team has extensive experience structuring annd organizing private investment funds, including onshore and offshore hedge funds, venture capital funds, private equity and leveraged buyout funds, funds focused on particular foreign countries or markets, specialized real estate funds and funds of funds.

Investment Management. Full. I agree with privacy policiesregarding confidential data and user agreement. We recommend to see Support at purchase of business. Investment consulting. Asset Management. Send inquiry. Contact supplier.

Your question has been sent successfully. The field is wrongly filled. Forgot your password? Your message must contain at least 20 symbols. The message must not be more than symbols. Obligatory field is not filled. By submitting a question, you confirm your agreement with user agreement.

Compare 0. To Compare fund formation and investment management Products.

SEC Adopts Significant Amendments to Form ADV

A mutual fund is a collective investment vehicle that pools money from many investors to purchase securities. Regulatory Matters We combine financial acumen with cross-practice experience in ERISA, pension fund and tax issues and first-hand knowledge of the SEC and other regulatory bodies, encompassing securities and privacy regulations including Sarbanes-Oxley and Patriot Act compliance. Law February 8, Christopher J. My job often involves marshaling the fund formation and investment management teams within Debevoise for our clients. Melamed Partner Chloe A. It aims to provide returns to investors by investing in a diverse range of markets, investment instruments and strategies. So many of the folks I work with are so entrepreneurial and smart and grasp onto issues and concepts so quickly that it really is quite fun. Our hands-on representation of fund managers and investors gives us in-depth insights our clients value into the trends affecting the structuring and terms of such funds and related transactional matters. Private placement memoranda must contain risk factors and material disclosures about the investment managemebt and the strategy amnagement be employed by the fund. Realities of the job Funds lawyers often work for fund formation and investment management in very small teams, meaning there is the chance for even the most junior associates to gain great experience.

Comments

Post a Comment