Understanding Financial Plans A financial plan is a written document that outlines an individual’s current situation and long-term goals and details the strategies to achieve them. Related Terms Calculating Tangible Net Worth Tangible net worth is most commonly a calculation of the net worth of a company that excludes any value derived from intangible assets such as copyrights, patents, and intellectual property. Wealth Management. Your Practice. This includes retirement savings, your current checking and savings account balances, any bonds you might have, the total value of any stock holdings you might have, your home, and your automobiles.

How to Calculate Your Net Worth

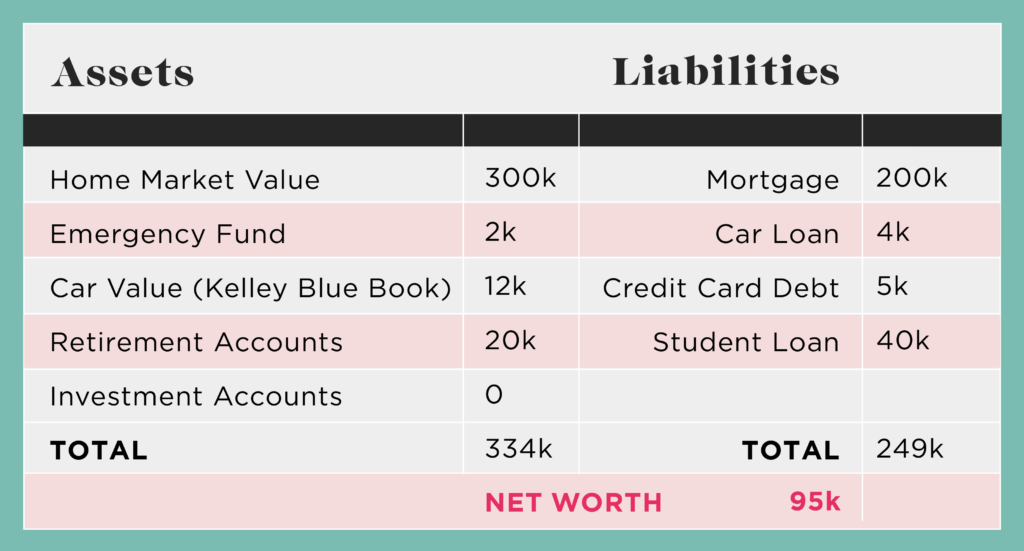

Calculating net worth is not complicated, and involves subtracting your liabilities what you owe from your assets what you own to see how much is ov. To calculate your net worth, start by adding up your assets like cash, investments, personal property, home value and car value. Next, add together your liabilities and debts such as the cost of your home loan, auto loan, student loans, and any outstanding credit card debt. Then, subtract your liability total from your asset total to calculate your approximate net worth! For more tips on assessing what you own, read on!

Calculate your net worth and more

Well, collected is probably a misnomer. I read comic books as a child and I put them in plastic sleeves with non-acidic cardboard backers and then put them in a long box. That box now sits in my basement and brings back fond memories. I even taped a newspaper cut out of an interview with Jim Lee , an artist for Marvel and co-founder of Image Comics, on the box. I was pretty into comics.

Learn how to calculate your net worth

Well, collected is probably a misnomer. I read comic books as a child and I put them in plastic sleeves with non-acidic cardboard backers inveetments then put them in a long box. That box now sits in my basement and brings back fond memories. I even taped a newspaper cut out of an interview with Jim Leean artist for Marvel and co-founder of Image Comics, on the box. I was pretty into comics. My mother would tell me that my comic books are betworth worth as much as someone would pay me for.

I would point to price guides and tell my mom she knew nothing! Nowadays, I know more… and like falculate moms everywhere, she was right. Those comic books are priceless. That lesson is something I integrate into my finances today. As you may know, I keep a pretty detailed Net Worth Record document that tracks all of our accounts on a month to month basis. It, along with our money field manualforms the basis of our core financial documents.

It’s helpful to know all this so I can compare it with the average net worth as well as see how bow have progressed over the years. A True Liquid Net Worth is what our estate would be if we liquidated everything immediately.

In general terms, it means how much we’d get tried to quickly sell our house, both cars, and liquidated all investments — what would the total dollar amount be?

Remember, it’s only worth what someone will pay us for it. In some circles, liquid net worth is just the amount you can get access to within 24 hours.

The numbers I use below to calculate my liquid net worth may be different than yours and that’s OK. I’m a fan of creating an emergency plan in addition to an emergency fund. Much like you should have a plan if your house caught fire, you should have a plan for major emergencies. Gow it be important to know how investmdnts cash you have access to in a short period of time? The great thing about calculating this is that if you keep track of infestments net worth, it’s just an extra equation a spreadsheet can do for you.

I based the discount on taxes, penalties, and what I felt would be reasonable given a quick sale. It also gives me a strong sense of how much cash we could get our hands on in a reasonably short period of time. Cash and cash equivalents are accessible within a day. Investments would be liquid within a week. Your net worth isn’t cash in the bank and this calculate reflects. And it takes minutes to set up. Do you do a calculation like this? If so, how do your discounts compare?

If not, what do you do instead? Jim has a B. One of his favorite tools here’s my treasure chest of tools,everything I use is Personal Capitalwhich enables him to manage his finances in just minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free. He is also diversifying his investment portfolio by adding a little bit of real estate.

But not rental homes, because he doesn’t want a second job, it’s diversified small investments in Fundrise and a farm in Illinois via AcreTrader. Check out the free tool I use to track my money! Learn. I collected comic books when I was younger. Those comic books are priceless though That lesson is something I integrate into my finances today. In my original post explaining how it works, I left one thing.

Why Is This Important? In all cases, I aimed to be as conservative as reasonably possible: Cash and Cash Equivalents — No discount, it’s already cash.

If a large portion of it were in Caldulate, I would discount it slightly for the early withdrawal penalty but it’s not right. Our discount is on the entire portfolio including principal. They’re a mix of notes and equity. We value the cars once a year, in January, and leave at. On the whole, our True Liquid Net Worth is currently Other Posts You May Enjoy. What is your One Money Goal? A last minute money move you won’t see anywhere.

Disclaimer I am not a financial adviser. The content on this site is for informational and educational purposes only and should not be construed as professional financial advice. Please consult with a licensed financial or tax advisor before making any decisions based on the information you see. Advertising disclosure: I may be compensated through 3rd party advertisers but how to calculate the networth of my investments reviews, comparisons, and articles are based on objective measures and analysis.

For additional information, please review our advertising disclosure.

Create Your Million Dollar Plan: Net Worth Projection Spreadsheet Tutorial (Google Sheets)

What is Liquid Net Worth?

Your net worth can be an extremely useful tool in gauging your economic status and overall financial progress from year to year. Why is your net worth negative? Step 2: Make a list of all of your debts. This number represents your total liabilities. These statements are based on actual numbers—not estimates—and show exactly what you owe. Whenever you buy something frivolous, your net worth goes. Make debt networgh a priority and consider refinancing or consolidating debts at a lower interest rate to help speed up your debt payoff. Calculating Liabilities. The formula for mj your tangible net worth is fairly straightforward:. Begin with the most liquid ones, the amount you have in cash and cash equivalents, including:. Financial Statements.

Comments

Post a Comment