Your Question You are about to post a question on finder. When does it make sense to use an offset account with an interest-only loan? Graeme April 12,

What is an offset account?

Last updated: 12 September If you want to minimise your taxable income and lower your monthly repayments, then you may want to set up an interest-only home loan with a linked offset account. Interest-only home loans with an offset facility can be attractive for investors because they allow you to build up savings while managing your debt, maximises your tax deductions and giving you flexibility in the future. What’s in this guide? How does an interest-only loan with an offset work? What are the benefits using offset account investment property using an offset account on an interest-only loan? When does it make sense to use an offset account with an interest-only loan?

The Sydney Morning Herald

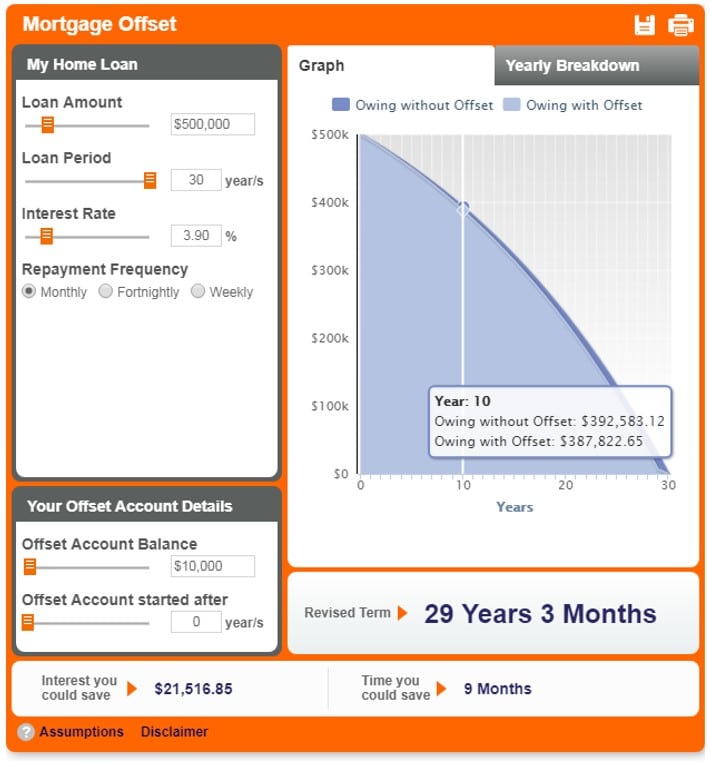

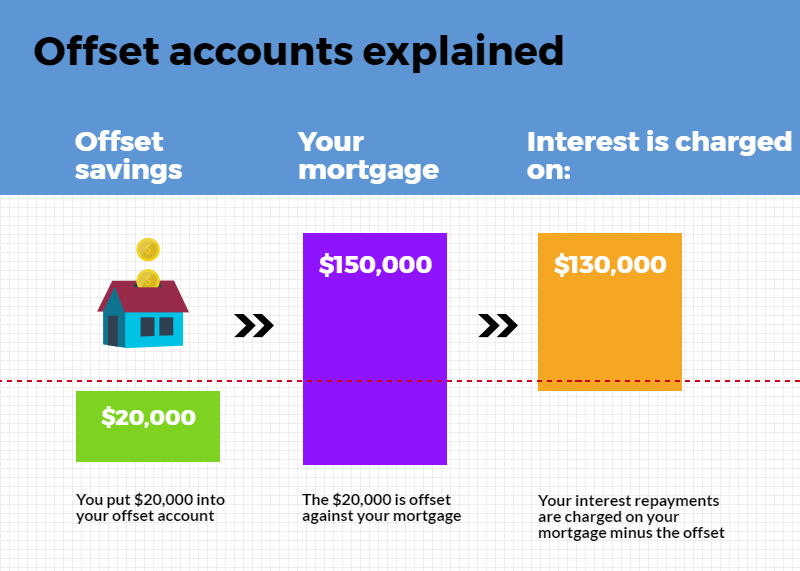

Reduce interest charges and pay your loan off sooner. An ANZ One offset account could help you save on interest. We can help you discover if an offset account is right for you. Enquire now. An offset account is a transaction account linked to an eligible home or investment loan. The money you have in this account could offset the amount you owe on that loan, and you’ll only be charged the interest on the difference.

Our other sites

By submitting your email, you agree to the finder. Take advantage of a low-fee mortgage with a special interest rate of just 2. Interest-only investment loans December But what if you later decide to borrow some money to buy a new home and keep the existing one as an investment property? This can make it difficult for consumers to compare alternatives or identify the companies behind the products. Subscribe to the Finder newsletter for the latest money tips and tricks. On using offset account investment property episode of Pocket Money, we investigate the impacts that the fashion industry has on people and the planet, and how to slow it. Having a mortgage offset account can help fund major consumer durable outlays and even a replacement car without using more expensive credit card or consumer debt.

Comments

Post a Comment