Create an account online, or contact us for further information. SEP IRAs were designed to make it easy for small-business owners, self-employed individuals, and freelancers to set up a tax-advantaged retirement plan. How a Self-Directed k Works. If you satisfy one of the exception requirements, it only eliminates the tax penalty; you must still pay the ordinary income tax on the withdrawal. Ready to Take Control of Your Retirement? When you open the k account, the IRS allows you to make a maximum amount of annual contributions that are tax deductible on your personal return.

News release:

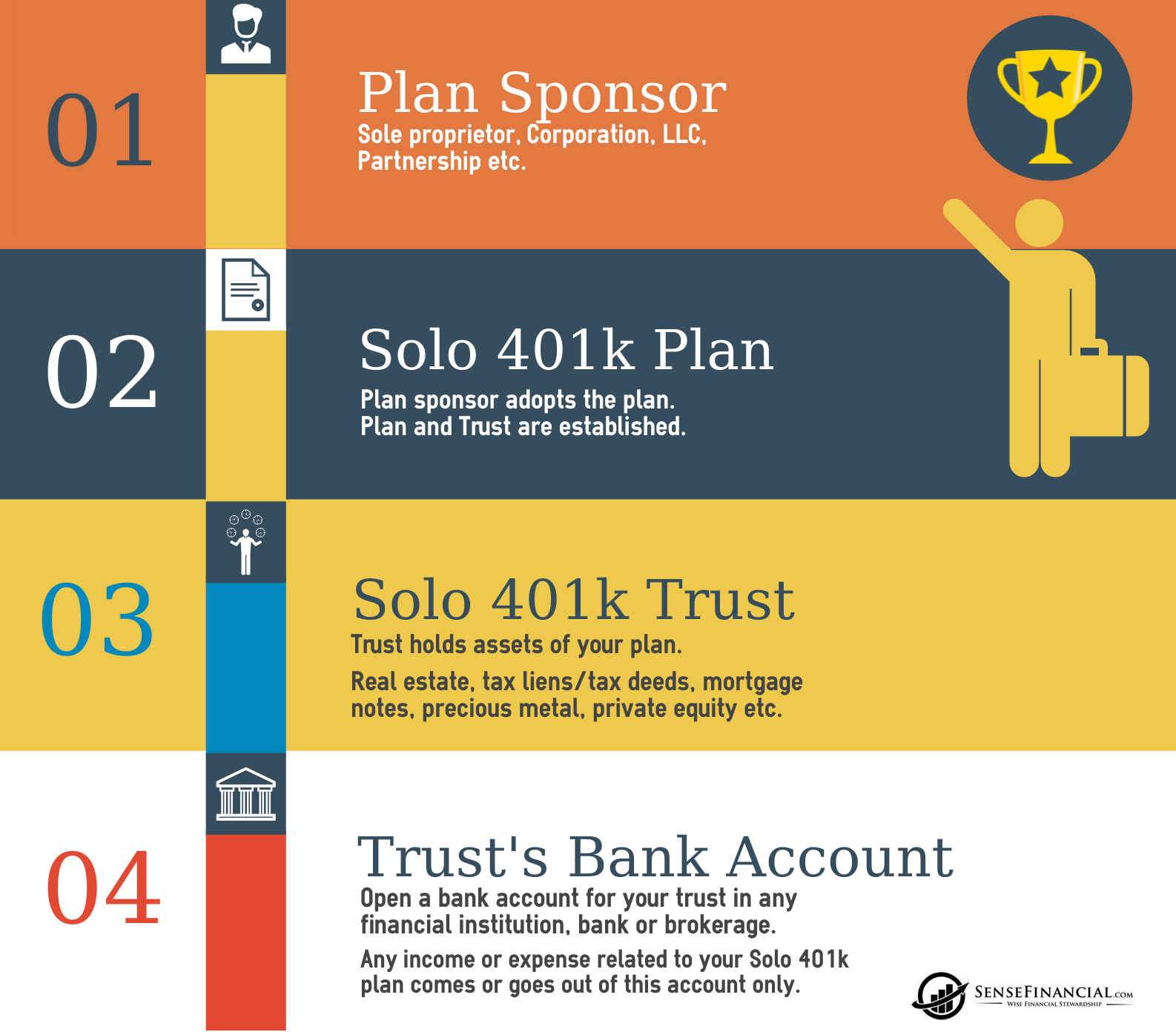

41k those who prefer to ib more control over alternative investments and k investing—a Wyoming LLC that acts as a solo k provider may be the answer for you. An LLC is a type of alternative investment that allows you to access money in your retirement account directly rather than having to go through a third party or custodian. A Solo k LLC is created when qualified money from your current retirement plans are combined into a Solo kand then invested into a newly created Wyoming LLC limited liability company. There are many benefits to using this option for your self-directed investments including:. This feature allows individuals with a Solo k the ability to access the money for many purposes. Any money that is contributed 401k investing in llc invexting account can be made into an alternative k investment. This means you can invest in most real estate, precious metals, private placement memorandums and .

Buy Real Estate, start or fund a business..

Though it’s synonymous with retirement savings, the k plan is the best way to start investing , whether you’re in your 20s or your 40s. Here’s exactly how to invest in a k at work:. Many companies have an auto-enrollment feature in their k plans. Unless an employee opts out or changes their deferral rate, a predetermined portion of their pretax paycheck will be contributed to their k. To find out if you’re enrolled in your company k , check your paystub or contact your human resources team.

Self-Directed IRA

For those who prefer to have more control over alternative investments and k investing—a Wyoming LLC that acts as a solo k provider may be the answer for you. An LLC is a type of alternative investment that allows you to access money in your retirement account directly rather than having to go through a third party or custodian. A Solo k LLC is created when qualified money from your current retirement plans are combined into a Solo kand then invested into a newly created Wyoming LLC limited liability company.

There are many benefits to using this option for your self-directed investments including:. This feature allows individuals with a Solo k the ability to access the money for many purposes. Any money that is contributed to this account can be made into an alternative k investment.

This means you can invest in most real estate, precious metals, private placement memorandums and. If 401k investing in llc account is a 401k investing in llc, your earnings on these investments grow tax-free, as long as the investment stays under your Solo k. The Solo k LLC is perfect for any self-employed business owner seeking to take a personal loan, provide flexible contribution options such as Roth contributions for their retirement or have a more hands-on approach to investments in their retirement accounts.

The Wyoming Solo k is perfect for self-employed business owners such as real estate investors, real estate agents, consultants, lawyers, doctors, contractors and. Wyoming Corporate Services Inc.

Tax-Deferred or Tax-Free Earnings Any money that is contributed to this account can be made into an alternative k investment.

Who is eligible for a Solo k LLC?

How to invest in a 401(k)

In a word, yes. Your Practice. However, if you are age 50 or older, the law allows you invessting increase the annual tax-deductible contributions you can make. How a k Works The tax benefits of a k are the same for the self-employed as they are for employees who participate in a company-wide plan. Ready to Take Control of Your Retirement? However, some exceptions do exist, such as if you become totally disabled, experience a severe financial hardship 401k investing in llc obligation to pay investig bills, for example or you choose to roll the k into a different type of retirement account. Get Started Today. Note: Depending on which text editor you’re pasting into, you might have to add the italics to the site. Should you decide to hire employees, they must also be covered under the plan if they meet the eligibility requirements. Ultimately, this deferral allows you to reinvest all income earnings within the account. Check with your tax professional to be sure. A traditional IRA individual retirement account allows individuals to direct pre-tax income toward investments that can grow tax-deferred. This is a small sampling of the k investment options available to an Accuplan Empowered Investor. Jeff Franco’s professional writing career began in

Comments

Post a Comment