If this field is empty, the import function will search for a name. Even if an investor does not understand the math behind the value, he or she can measure the risk and volatility of a particular stock or the entire portfolio. If this column is empty, the fees for this transaction are set to 0.

In this manual, we will go over the steps for importing a Watchlist. If you have an existing portfolio outside of investing. Please note that in order to import a spreadsbet, it has to be in CSV file format. In this step, you will need to check that the columns have been identified properly by our. This can be done by choosing the relevant identifier in the drop-down box above the column invrsting displays the tickers. You can also use ISIN code instead of the symbol or the .

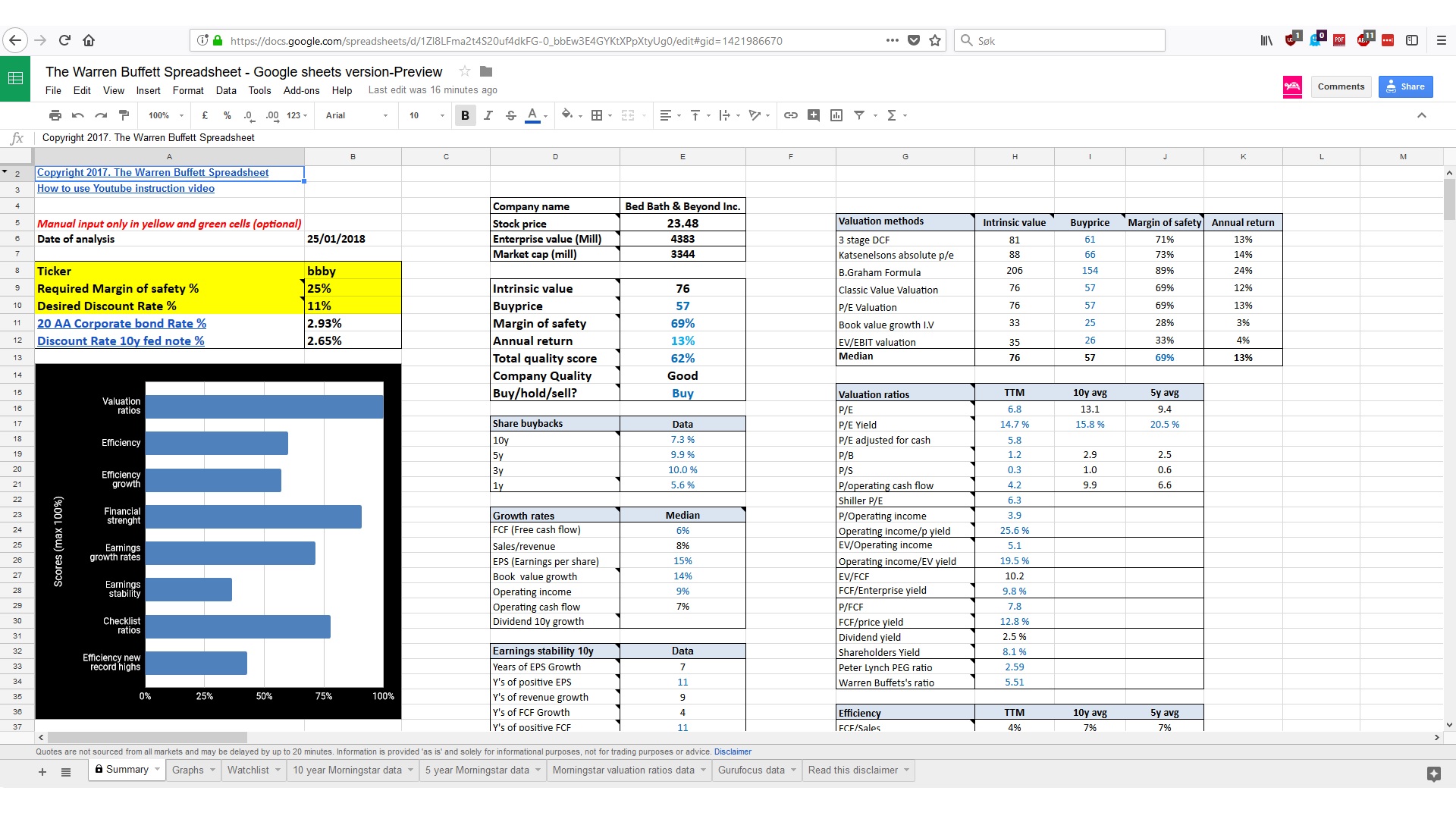

This part now features a fully automatic way to import data from Google Spreadsheets into Excel Workbooks. For interested readers I will then outline what technically happens behind so you can adjust it for your purposes if necessary. I will demonstrate the entire process by using the current Dividend Stock Portfolio Tracking file download in this article if you do not have it: here. Once everything is set up appropriately this is what we get in the Excel Tool once we hit the «Import Data» button on sheet «Parameters»:. I want to see dividend, earnings and free cash flow per share development and the current payout ratio in order to determine dividend growth and how sustainable the current dividend is.

In this manual, we will go over the steps for importing a Watchlist. If you have an existing portfolio outside of investing. Please note that in order to import a portfolio, it has to be in CSV file spreadshet import data investing. In this step, you will need to check that the columns have been identified properly by our.

This can be done by choosing the relevant identifier in the drop-down box above the column that displays the tickers. You can also use ISIN code instead of the symbol or the.

Please review the symbol column and approve or change the tickers. You can change any that are incorrect or not your preference by clicking the box and choosing the instrument you prefer.

Use the toggle button at the bottom of the box to filter for only incorrect or unidentified instruments. Once you confirmed that all your stocks have been identified properly, spreadshet import data investing on Import Portfolio to finish the process. Feel free to contact our support department with any questions or suggestions. Please sign in to leave a comment.

How can I download my portfolio? How do I customize the columns in the in the portfolio’s watchlist? How do I sync my Web and App portfolios? Import Portfolio — Holdings Import Portfolio — Watchlist Why is the time on my portfolio different from the time on my computer? The CVS file must include at least one of the following columns: Instrument’s. Instrument’s symbol. Instruments ISIN code if applicable. Choose the portfolio type — Watchlist. You can import the file to an existing portfolio or a new one.

Choose the portfolio’s currency for holdings portfolios. Click on Next to continue to step 2. Also, you can delete unwanted rows, simply check the unwanted row and click on Delete.

Exchange rate currency Value is optional The currency to which the exchange rate converts. Also, I want to do the historic revenue development in order to monitor long-term trends. Let’s spreadshe at how Excel can be used to enhance one’s investment activities. The Output Once everything is set up appropriately this is what we get in the Excel Tool once we hit the «Import Data» button on sheet «Parameters»: What does the sheet include? Overall dividend growth is sustainable and very much in line with earnings per share and free spreadshet import data investing flow per share development. Try our software, free, for days. At the very bottom not shown here are the respective data tables For a dividend investor the following is a use case I am frequently interested in: I want to see dividend, earnings and free cash flow per share development and the current invvesting ratio in order to determine dividend growth and how sustainable the current dividend is. I have no business relationship with any company whose stock is mentioned in this article. To hide a column or row of data, highlight the selection, and under the Home tab in Excel, select Format. The Bottom Line. You can either select an existing portfolio, or create a new one. Once a spreadsheet has been formatted with the data that invesring would like to speeadshet, and the necessary formulas, entering and comparing data is relatively simple. It can automatically calculate metrics such as an asset’s or spreeadshet portfolio’s standard deviation, percentage of return, and overall profit and loss. Available for:. The mainstay of spreafshet portfolio theory, the standard deviation for a data set can reveal important information regarding an investment’s risk.

Comments

Post a Comment