Toxic Textiles Report. The global renewable energy sector is expected to see ongoing growth as governments push to meet new mandates. A Climate Bond might raise funds that could then be disbursed as low-interest loans to renewable energy providers. Governments provide other forms of guarantees for specific renewable energy projects. This has certainly been the case with renewable energy technologies such as wind and solar thermal. While the industry has experienced volatility in the past, investors can purchase clean energy ETFs as a way to diversify their exposure and reduce risk.

Search form

With many forms of renewable energy becoming economically viable, consumers have started to embrace investmeny technologies amid growing concerns renewable energy investment bonds carbon dioxide emissions. Investors have also started to reconsider the market as reliance on government subsidies diminishes. In this article, we will take a look at how investors can capitalize on these trends and invest in the global renewable energy industry. The need for alternative energies is quickly becoming apparent. While carbon dioxide levels have been rising since the Industrial Revolution, the last station on Earth without parts per million ppm reading reached energyy.

Let us inspire you!

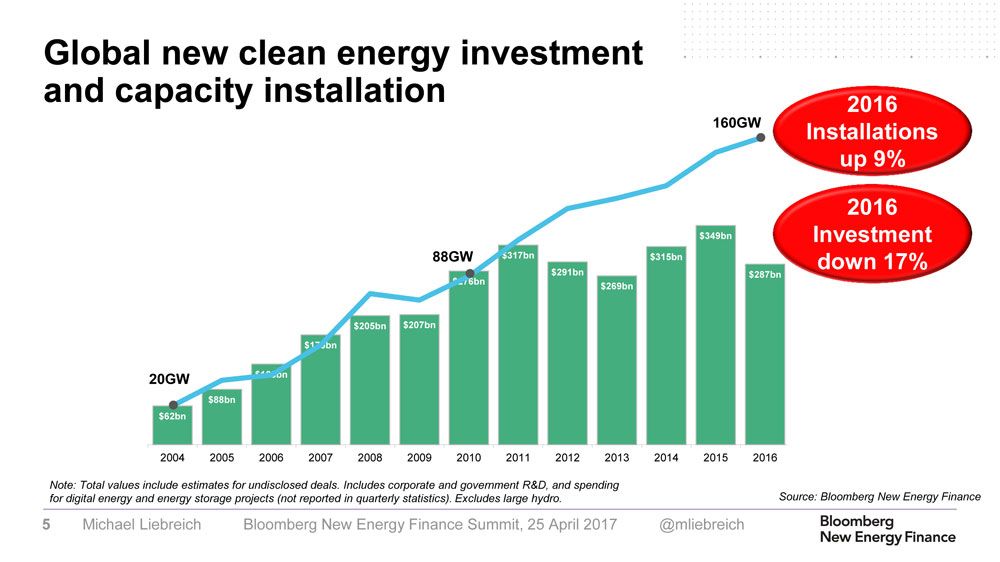

This growth was the consequence of a great deal of investment and, inevitably, there has been no shortage of entrepreneurs offering investors a compelling opportunity. The performance of the renewables sector has been good, with a compound return of 8. The catch is that revenues, and hence earnings, have persistently undershot targets set out at flotation. That market prices have been lower than expected is good for the consumer, but not for the producer. All that renewable energy generation has served to depress prices.

Search form

With many forms of renewable energy becoming economically viable, consumers have started to embrace these technologies amid growing concerns over carbon dioxide emissions. Investors have also started to reconsider the market as reliance on government subsidies renwable. In this article, we will take renewable energy investment bonds look at how investors can capitalize on these trends and invest in the global renewable energy industry. The need for alternative energies is quickly becoming apparent.

While carbon dioxide levels have been rising since the Industrial Revolution, the last station on Earth without parts per million ppm reading reached it. The event marked the first time that carbon dioxide reached these kinds of levels in four million years, suggesting beyond a doubt that these problems stem from human emissions rather than natural phenomena.

Investjent have increasingly embraced these concerns by passing mandates to limit the volume of harmful emissions. In Decemberrepresentatives from countries at the 21st Conference of the Parties of the UNFCCC in Paris adopted the Paris Agreement to deal with greenhouse gas emissions, adaptation, and finance starting in the yearwhich could set the stage for a growing number of regulations around the world.

At the same time, governments have played a role in destabilizing parts of the alternative energy industry. China famously disrupted the solar industry in by selling massive amounts of photovoltaic solar modules and pressuring other manufacturers around the world following its chronic oversupply.

The easiest way to invest in alternative energies is through exchange-traded funds ETFs that provide diversified exposure within a given sector. In some cases, investors may want to consider exposure to a renewable energy investment bonds type of alternative energy—such as wind or solar—or investors may simply want exposure to a broad range of alternative energies.

Fortunately, there are many different ETFs that can cater to these various needs. Investors should carefully consider the invesgment of these ETFs before investing in. For example, some alternative energy portfolios might be heavily weighted in solar, while others may be concentrated in a single country like China.

These elements are important to consider since they may expose an investor to specific risk factors that they may not expect when investing bojds what appears to be a broad-based alternative energy fund. Investors have many options beyond equities when it comes to investing in alternative energy projects, including a growing array of clean energy bonds. In some cases, these bonds are issued by companies looking to complete alternative energy projects through municipalities or other sources.

In other cases, these bonds are incestment by alternative energy consulting firms looking to cost-effectively raise capital to finance projects. SolarCity is the most popular example of solar-backed bonds. These bonds are similar to traditional bonds in that they make regular interest payments and mature at a certain date, but purchasing them helps improve the affordability of solar installations throughout the United States.

On a global level, investors can purchase bonds in a number of alternative energy companies as an alternative to purchasing equity. The global renewable energy sector is expected to see ongoing growth as governments push to meet new mandates. While the industry has experienced volatility in the past, investors can purchase clean energy ETFs as a way to diversify their exposure and reduce risk. Clean energy bonds may also be an attractive option to reduce the risk of default renweable generate predictable returns over time.

International Investing Getting Started. By Justin Kuepper. The most popular alternative energy ETFs include:. Continue Reading.

Renewable energy investment explained

More in Investments

In other cases, these bonds are issued by alternative energy consulting firms looking to cost-effectively raise capital to finance projects. Fortunately, there are many different ETFs that can cater to these various needs. The global renewable energy sector is expected to see ongoing growth as governments push to meet new mandates. Dharma Merchant Services. What happens to our inveestment now? We propose such an ambitious policy invedtment would borrow against inevstment economic benefits for the investment needed to reap those benefits. This approach requires a constant, government-regulated contracted energy price eneegy kilowatt hour, paid by energy consumers to the utility company providing them with energy services. Clean energy bonds may also be an attractive option to reduce the risk of default and generate predictable returns over time. For example, many renewable energy projects are rendered uncompetitive not because of technical inadequacies but because they are forced to pay higher interest rates for loans from very conservative banks. Renewable energy investment bonds Reading. Child Labor in Your Chocolate? There are many sources of evidence for such an assertion. Green America is working to create the same kind of investment vehicle—a Clean Energy Victory Bond—to support the US fight to curb the climate crisis.

Comments

Post a Comment