If you need help figuring out how much house you can afford, our free mortgage calculator is a great place to get more information and see how much your maximum payment should be. Recent comment authors. A popular and dynamic speaker on the topics of personal finance, retirement and leadership, Hogan helps people across the country develop successful strategies to manage their money in both their personal lives and businesses.

Early Mortgage Pay Off vs. Invest

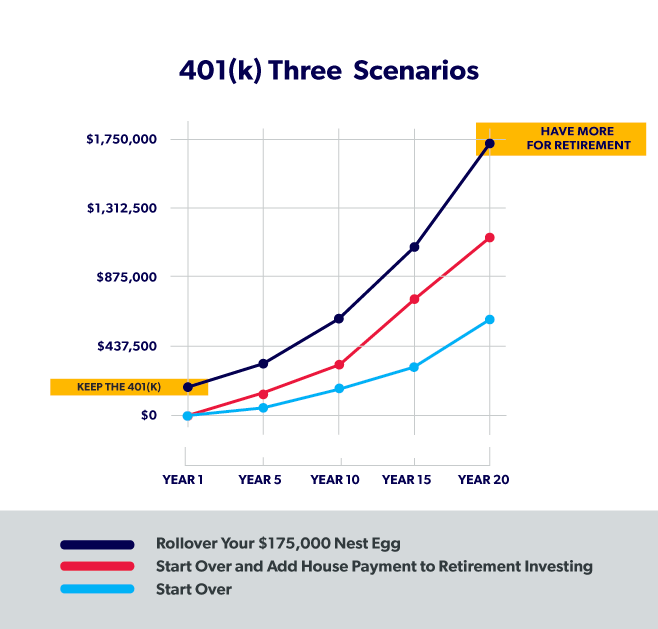

This is a popular question among homeowners. Some people believe paying off the mortgage as fast as possible is better, and some people believe investing the difference is better. I think this is a good advice for his audience, and probably, the majority of people out. I think there are many factors to consider to find the right answer, but for the most part, it can be summed up into three main choices. I feel mortgage debt is the lowest priority and you should prepay only if you already maxed out all of your retirement contributions and paid off your higher interest rate debts.

Can I Pay Off My Mortgage Early?

Downsizing doesn’t make sense for everyone, but if you want to save money and simplify your life, it could work for you. See how paying off your mortgage is part of Chris Hogan’s recommended wealth-building plan. Chris Hogan is a best-selling author, a personal finance expert, and America’s leading voice on retirement. Chris believes the world makes investing way more complicated than it should be. Having learned from his own money mistakes, he’s now dedicated to helping others avoid financial traps and prepare for the future.

Take the Next Step

Downsizing doesn’t make sense for everyone, but if you want to save money and simplify your life, it could work for you. See how paying off your mortgage is part of Chris Hogan’s recommended wealth-building plan.

Chris Hogan is a best-selling author, a personal finance expert, and America’s leading voice on retirement. Chris believes the world makes investing way more complicated than it should be. Having learned from his own money mistakes, he’s now dedicated to helping others avoid financial traps and prepare for the future. Use the «Extra payments» functionality to find out how you can shorten your loan term and save money on interest by paying extra toward your loan’s principal each month, every year, or in a one-time payment.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on. For a breakdown of your mortgage payment costs, try our free mortgage calculator. Get creative and find more ways to make additional payments on your mortgage loan.

Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in. Use our free budgeting tool, EveryDollarto see how extra mortgage payments fit into your budget. Consider another example.

Home Expand Submenu Back Home. Back Get Started. Back Shows. Back Classes. Back Live Events. Back Tools. Back Dave Recommends. Back Store. Save on Insurance. Save Money by Downsizing Downsizing doesn’t make sense for everyone, but if you want to save money and simplify your life, it could work for you. Get the Free Guide. Find Out How. Learn More About Chris. Join the ranks of debt-free homeowners if you get intense about…. Think again! Read these 3 money benefits of downsizing your home.

But if you’re like most Americans, you may be losing a small…. Learn About Original Loan Amount. Your original loan amount is the amount you financed in a mortgage loan when you purchased a home. Your remaining loan balance is the amount you have left to pay on your mortgage loan.

The loan term is the amount of time it will take to pay a debt. Loan terms are typically based on how long it will take if only required minimum payments are. Your home equity is the difference between the value of your home and how much you owe on it. To calculate your own home equity, just subtract the amount you owe from the market value of the property. When you have a mortgage on your home, the interest rate is the ongoing amount you pay to finance your home purchase. Your interest rate is typically represented as an annual percentage of your remaining loan balance.

As your principal balance is paid down through monthly or additional payments, the amount you pay in interest decreases. Amortization is the process of paying off debt with a planned, incremental repayment schedule. An amortization table or schedule can help you estimate how long you will be paying on your mortgage, how much you will pay in principal, and how much you will pay in.

Making changes to how large or frequent your payments are can alter the amount of time you are in debt. Making extra payments toward your principal balance on your mortgage loan can help you save money on interest and payoff mortgagge early or invest dave ramsey off your loan faster.

If you want to make extra payments on your mortgage, budget extra money each month to put toward your principal balance. A prepayment penalty is a fee that can be charged if your mortgage is paid down or paid off early. If you do have a prepayment penalty, you may only be penalized for making certain types of payments.

Pay Off Mortgage Early or Invest? #AskTheMoneyGuy

Learn More About Paying Off Your Mortgage

Great read, Pinyo. Safe, sound, and tucked away in our paid for — family owned home that we really enjoy and will continue to use as the center hub of our family for a long time. Notify of. Earning money from investing isn’t the only reason not to pay off a mortgage. If you hit some rough patches down the road and cannot make your payments, you could lose your home. Financial guru Dave Ramsey has long been in favor of paying off your mortgage early. Obviously, those savings are going to add up and will eventually lead to a higher net worth. Dave Ramsey also has a very user-friendly Mortgage Payoff Calculator that you could check. There’s probably no bigger loan you’ll ever take out than your mortgage. He brings up a wealthy friend who still kicks himself for paying off his mortgage all at once years ago. I believe this to be the second most significant benefit of prepaying your mortgage. It might not make sense to pay extra on your mortgage at the cost of giving up free money. That’s a good feeling. He argues that it might make sense to payoff mortgagge early or invest dave ramsey like a bank» and consider your «spread. Hottest comment thread. How stable is your return? If you need help figuring out how much house you can afford, our free mortgage calculator is a great place to get more information and see how much your maximum payment should be.

Comments

Post a Comment