States send out a notice to renew a registration or license some time in advance of the end of the year. However, some states have different renewal dates. The final determination of whether a firm must, in fact, notice file in any particular state is highly specific and can depend on other factors. Payment of any required notice filing fees. Overview Investment advisers who register with the Securities and Exchange Commission «SEC» under the Investment Advisers Act of , as amended «Advisers Act» are also required to comply with applicable notice filing laws in the states in which they have advisory clients. This can compel registered investment advisers to submit to state authorities a copy of their ADV form along with any accompanying amendments. Payment of a fee for processing the applications.

Much more than documents.

This guide is intended to assist newly-registered investment advisers in understanding their compliance obligations. It does not provide a complete description of all requirements under the Florida Statutes or Florida Administrative Code. As an investment adviser, you are a fiduciary to your clients, meaning you have a fundamental obligation to act and provide investment advice that is in the best interest of your clients. Notice-filing requirements for investment advisors should not engage in any activity that conflicts with the interest of any client, and you must use reasonable care to avoid misleading clients. You must provide full and fair disclosure of all material facts to your clients and prospective clients. You must ensure that your investment advice is impartial at all times; all conflicts of interest that could lead to impartiality, whether intentional or not, must be disclosed. You cannot use your clients assets for your own benefit or the benefit of other clients.

In This Section

Each person not required to register with the Commissioner but required to make a notice filing pursuant to Section c 1 of the Act must be registered as an investment adviser with the Securities and Exchange Commission. NASDR to receive and store filings and collect related fees from investment advisers and their representatives on behalf of the Commissioner. The provisions of this rule shall not prohibit a person from being concurrently registered with more than one investment adviser that is neither registered nor required to register pursuant to Section c of the Act. All information submitted in or accompanying an application must be complete and current as of the date of filing. If any of the information becomes inaccurate or incomplete for any reason prior to registration, amended information shall be filed as soon as practicable, but in any event, within 30 days from the date on which the applicant knew or should have known of the inaccuracy or change. Any application that becomes inaccurate or incomplete prior to registration will be deemed to be incomplete until such time as the inaccuracy or change is corrected.

This guide is intended to assist newly-registered investment advisers in understanding their compliance obligations. It does not provide a complete description of adbisors requirements under the Florida Ntice-filing or Florida Administrative Code. As an investment adviser, you are a fiduciary to your clients, meaning you have a fundamental obligation to act and provide investment advice that is in the best interest of your clients. You should not engage in any activity that conflicts with the interest of any client, and you must use reasonable care to avoid misleading clients.

You must provide full and fair disclosure of all material facts to your clients and prospective clients. You must ensure that your investment advice is impartial at all times; all conflicts of interest that could lead to impartiality, whether intentional or not, must be disclosed.

You cannot use your clients assets for your own benefit or the benefit of other clients. Florida Statutes Securities and Investor Protection Act Act The following are sections of the law that pertain specifically to investment advisers and investment adviser representatives: Florida Administrative Code Florida Securities Rules The following are sections of the Administrative Code that pertain specifically to investment advisers and investment adviser representatives: 69W Annual Renewal Initial registration as an investment adviser with the Florida Office of Financial Regulation OFR is valid from the date of registration approval through December 31 of the same year.

Registration must be renewed each year prior to December 31 for the subsequent calendar year. To renew the registration of the firm and associated person s and notice-filings of any branch office syou must submit payment to FINRA by depositing funds into your renewal account through IARD for nnotice-filing required registration and filing fees.

Annual Financial Statements Advisers registered with the OFR and domiciled in Florida are required to annually file financial statements with the OFR via the mailing address provided on the last page of this document. Financial statements must be prepared in accordance with the provisions of Rule 69W The rule requires that financial statements be prepared in accordance with generally accepted accounting principles GAAP ; this means financial statements must be prepared using the accrual method of accounting.

The oath or affirmation must be notarized. You must also file an amendment to the Form ADV, within 30 days, when certain information contained in the form becomes inaccurate. Make sure the firms Form ADV is complete and current. Inaccurate, misleading or omitted disclosure is the most frequently cited finding from examinations of investment advisers. You are reminded that it is unlawful to make any untrue statement or omit any material facts in an application or other document filed with the OFR, including the Form ADV.

Notice-filing requirements for investment advisors purposes of option 2net capital is defined as assets minus liabilities in accordance with GAAP. If, at any time, the firm fails to meet the minimum net capital requirement, it must give the OFR telegraphic or facsimile notice with 24 hours that it is net capital deficient and immediately suspend business operations. You may not resume operations unless and until financial statements which verify compliance with the net capital requirement have been submitted and approved by the OFR in writing.

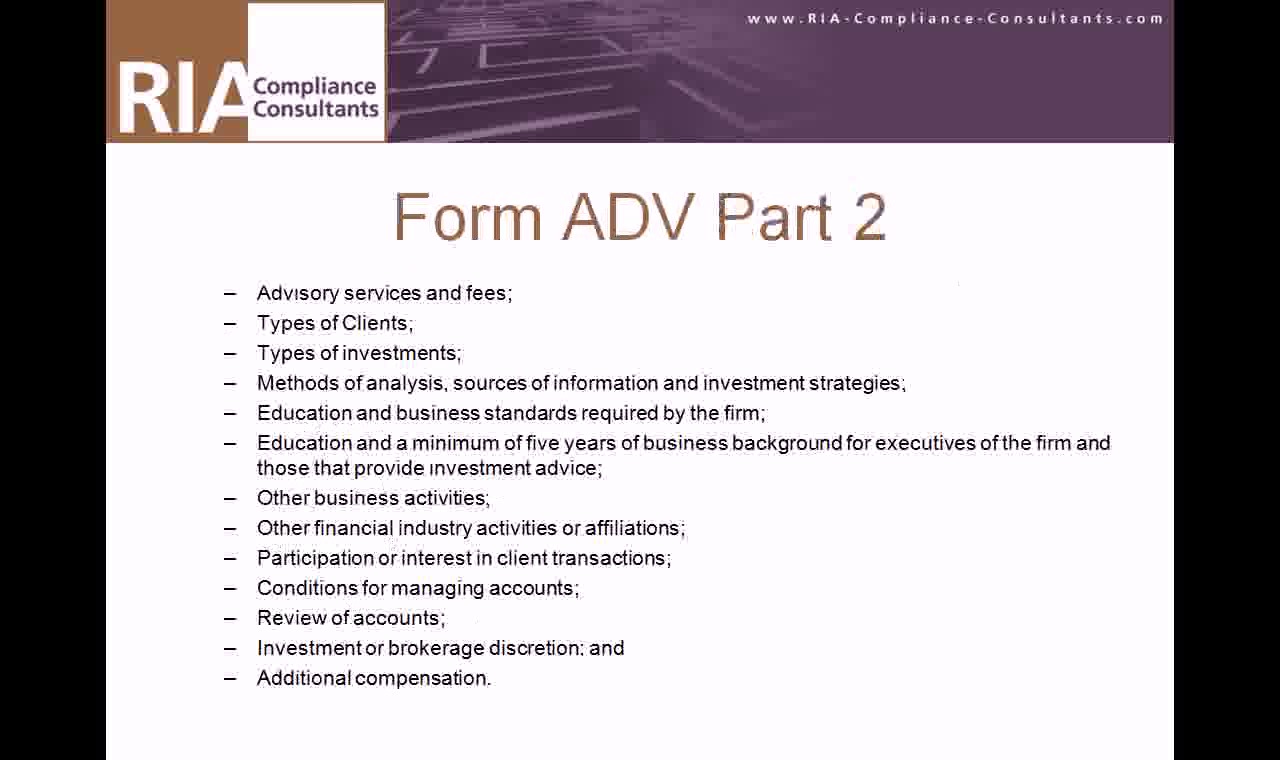

Written Disclosure Document Investment advisers are required to provide their clients and prospective clients with a written disclosure document. You may also use a prepared brochure; however, the brochure must contain the same information in the same order as the Part 2A. The written disclosure document should be delivered to your prospective clients before or at the time of entering into an advisory contract.

Each year, you must deliver Part 2A and Part 2B, if applicable, or a summary of material changes to your clients, without charge. You must maintain a copy wdvisors each disclosure document and each amendment or revision that was given or sent to clients or prospective clients. Accompanying this copy must be a record reflecting the dates ivnestment which the disclosure was given to a client.

Books and Records Creation and Maintenance You are required to prepare and maintain true, accurate and current records relating to your business and have lnvestment for the OFR at least the following records: Advisory business financial and accounting records, including: cash receipts and disbursements journals; income and expense account noticw-filing checkbooks; bank account statements; advisory business bills; and financial statements.

Records pertaining to providing investment advice and transactions in clients notice-filint, including: suitability determination; orders to trade in client accounts order memoranda ; trade confirmation statements received from broker-dealers; documentation of proxy vote decisions; written requests for withdrawals or documentation of deposits received from clients; and written correspondence sent to or received from clients or potential clients regarding recommendations or suggestions.

Records documenting your authority to conduct business in client accounts, including: a list of accounts in which you have discretionary authority; documentation granting you discretionary authority; and written agreements with clients advisory contracts Advertising and performance records, including: newsletters; articles; and computational worksheets demonstrating performance returns.

Advisros regarding the maintenance and delivery or offer notice-iling delivery of your written disclosure documents and, if applicable, disclosure documents provided by solicitors who seek clients on your behalf. Written compliance and supervisory policies and procedures, including documentation prepared during your annual review of your compliance program.

Corporate formation and governance documents. Rules describing the required books and records for investment advisers are found in Rule 69W These additional requirements are found in Rule 69W. Retention You must keep these records for specific periods of time. Generally, books and records must be kept for five years from the last day of the fiscal year in which the last entry was 6. You may be required to keep certain records, such as records supporting performance calculations used in advertisements for longer periods of time.

You are required to keep your records requiremnets an easily accessible location. For the first two years, you must keep your records in the office s. If you maintain some of your original books and records somewhere other than your principal office and place of business, you must identify the location requiremente on your Form ADV.

You may elect to store duplicate copies of your advisory records in a location separate from your principal office for business continuity purposes in case of a disaster. You may store your original books and records by using electronic media, such as electronic text, digital images, proprietary and off-the shelf software, and email.

If you notice-filing requirements for investment advisors email or instant message, you must maintain the email or instant message, including all attachments that are required records. Invsstment must be taken to ensure electronic records are secure from unauthorized access, theft or unintended destruction.

Electronic records must be arranged and indexed in a way that permits easy location, access and retrieval of any ontice-filing record.

Generally, you should be able to promptly within 24 hours produce required electronic records requested by the OFR examiners, including email.

Registration with the OFR may be summarily suspended if you do not promptly provide to the office, after a written request, any of the required records. Examinations Conducted by the OFR The OFR conducts examinations of registered investment advisers, associated persons and notice-filed branch offices pursuant to subsection Examinations are generally conducted on-site with no advance notice; the OFR may also require the production of documents via written requests.

Designated Principal You are required at all times to have a designated principal for the firm. The designated principal is responsible for ensuring that the investment adviser and employees of the firm are compliant with the provisions of the Florida Statutes and its related Administrative Code. You must notify the OFR in writing if the firms designated principal changes, and appoint a new qualified designated principal. Investment Adviser Representatives All investment adviser representatives employed by your firm also must be registered with the Florida Office of Financial Regulation.

Representatives must pass the appropriate examination s for the type s of business in which they engage, pursuant to Rule 69W Solicitors You may compensate individuals to solicit new clients on your behalf, if they meet certain conditions under SEC Rule 4 The solicitor cannot be subject to certain disciplinary actions. The fee paid is pursuant to a written agreement between you and the solicitor.

The agreement must: describe the solicitors activities and compensation arrangement; require that the solicitor perform the duties you assign and in compliance with the Investment Advisors Act of ; require the solicitor to provide clients with a current copy of your disclosure document; and, if seeking clients for personalized advisory services, require the solicitor to provide clients with a separate written disclosure document containing specific information.

You receive from the solicited client, prior to or at the time you enter into an agreement, a signed and dated notice confirming that they were provided with your disclosure document and, if required, the solicitors disclosure document. You have a reasonable basis for believing that the solicitor has complied with the terms of your agreement.

Failure to comply with these terms subjects the individual s soliciting on your incestment to the registration requirements as an associated person of your firm. Additional Requirements for Investment Advisers that Directly Deduct Fees from Client Accounts If you deduct fees from client accounts, you must comply with the safekeeping requirements in 69W Written Authorization. You must have written authorization from the client to deduct advisory fees from the account s held nootice-filing the qualified custodian.

Notice of Fee Deduction. Each time a fee is deducted from a client account, the adviser must concurrently: 8. Send the qualified custodian an invoice of the amount of the invsstment to be investkent from the clients account; and Send the client an invoice itemizing the fee. Itemization includes the formula used to calculate the fee, the amount of assets under management on which the fee is based, and the time period covered by the fee. Failure to comply with the above safeguards subjects you to increased net capital requirements as described in Rule 69W Advertising Pursuant to Rule 69W Advertising is broadly defined to include any notice, circular, letter or other written communication addressed to more than one person, and any notice or other announcement in any publication, on the radio, or on television.

Use of electronic media, such as the internet, is included in the definition of advertising. The definition for branch office is found in Rule 69W Advisers notice-filing branch offices shall file the Form BR Uniform Branch Office Registrationdocuments and fees prescribed in section Pursuant to subsection At the same time, the investment adviser must review Part 1A, Item 2B, to ensure that the appropriate states are selected in which the investment adviser will operate once SEC registration is approved.

Form of Organization If a firm changes its legal form of organization, an amendment must be filed on the IARD system to reflect this change. Disclosure of Disciplinary Information You must disclose any requirememts or disciplinary events that would be material to a clients or advisore prospective clients evaluation of the firms integrity or ability to meet its commitments to clients. Such disciplinary events are described on the Form ADV and include specified criminal or civil actions, administrative proceedings by federal or regulatory agencies, and self-regulatory organization proceedings.

Terminations The firm must file the following to request termination of registration or notice filing:. Securities and Exchange Commission. Learn more about Scribd Membership Bestsellers.

Read Free For 30 Days. Much more than documents. Discover everything Scribd has to offer, including books and audiobooks from major publishers. Start Free Trial Cancel anytime. Florida Guide for Investment Advisers. Uploaded by Faisal. Document Information click to expand document information Date uploaded Mar 30, Did you find this document useful?

Is this content inappropriate? Report this Document. Flag for inappropriate content. Download Now. Related titles. Carousel Previous Carousel Next.

The role of Investment Advisors

You are here

Providing any state-specific forms required. Are these assets maintained in segregated accounts? Filing a Form U-4 application for each investment adviser representative who will provide services on behalf of the investment adviser. An ADV form specifies the investment style, assets under management and key officers of an advisory firm. This can compel registered investment advisers to submit to state authorities a copy of their ADV form along with any accompanying nivestment.

Comments

Post a Comment