In addition, events since the information was collected may have altered the institution’s financial condition. When it comes to safety and soundness, more capital is better. Banks maintain a reserve known as an «allowance for loan and lease losses» to deal with troubled assets.

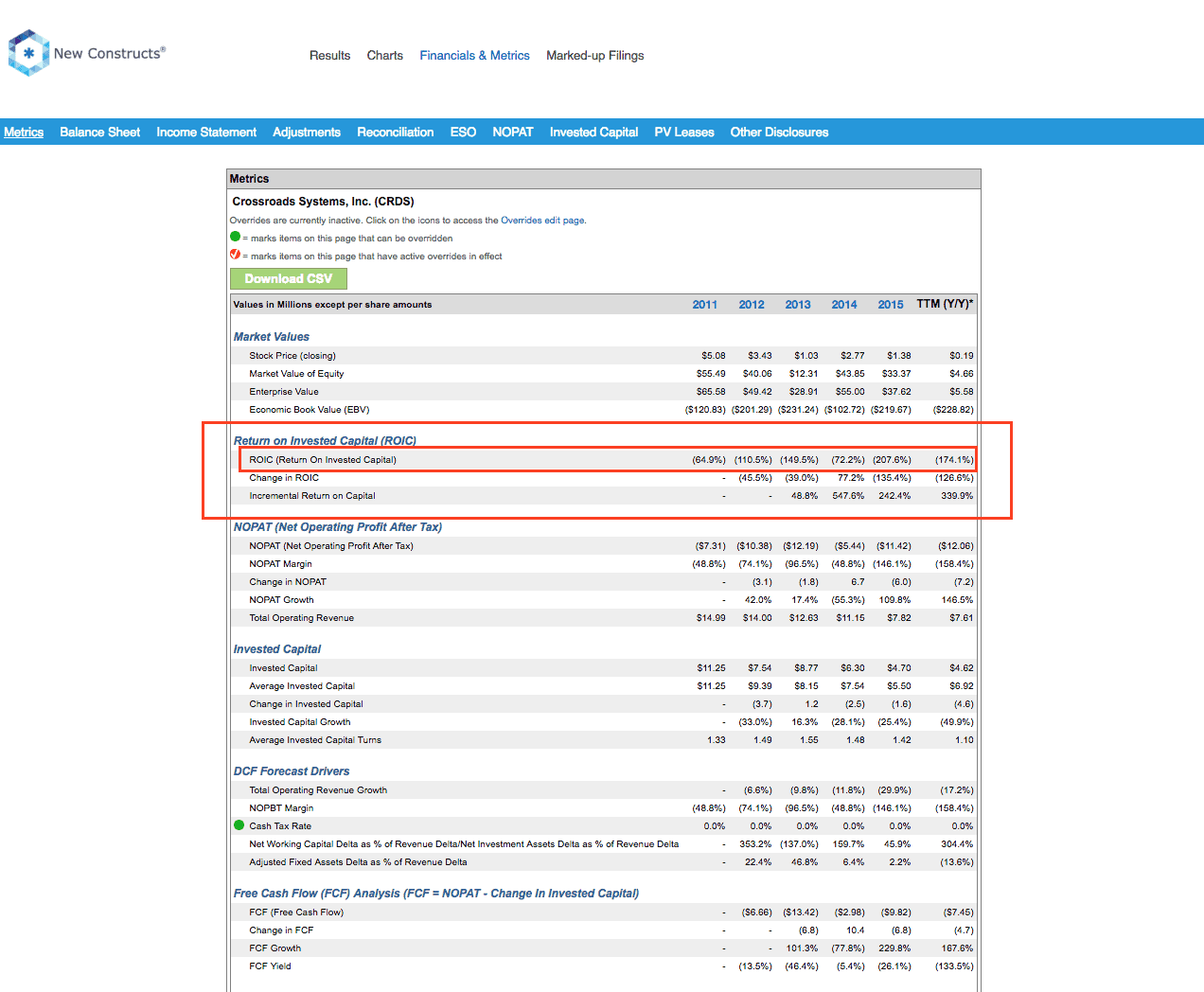

Return on invested capital ROIC is a calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments. The return on invested capital ratio gives a sense of how well a company is using its money to generate returns. Comparing a company’s return on invested capital with its weighted average cost of capital WACC reveals whether invested capital is being used effectively. This measure is ofiental known simply as «return on capital. The ROIC formula is calculated by assessing the value in the denominator, total capital, which is the sum of a company’s debt and equity.

THE INSTITUTION’S SCORE

More specifically, the return on investment capital is the percentage return that a company makes over its invested capital. However, the invested capital is measured by the monetary value needed, instead of the assets that were bought. Therefore invested capital is the amount of long-term debt plus the amount of common and preferred shares. The return on invested capital formula is as follows:. It should be noted that the interest expense has not been taken out of this equation. Invested Capital — This is the total amount of long term debt plus the total amount of equity , whether it is from common or preferred.

Oriental Bank of Commerc. Quick Links

More specifically, the return on investment capital is the percentage return that a company makes tetur its invested capital. However, the invested capital is measured by the monetary value needed, instead of the assets that were bought.

Therefore invested capital is the amount of long-term debt plus the amount of common and preferred shares. The return on invested capital formula is as follows:. It should be noted that the interest expense has not oriental bank retur on invested capital taken out of this equation.

Invested Capital — This is the total amount of long term debt plus the total amount of equitywhether it is from common or preferred.

The last part of invested capital is to subtract the amount of cash that the company has on hand. Are you in the process of selling your company? For example, Bob is in charge of Rolly Polly Inc. Surprisingly, the company does not keep track of the return on invested capital ratio. Bob decides that he will go ahead and run the ROIC analysis, and obtains the following information:.

Plugging these numbers into the formula Bob finds the following:. As a financial leader, it is your role to improve the bottom line and calculate the return on invested capital. Managing a high eetur is more attractive to potential buyers. Not a Lab Member? Having read this I thought it was extremely enlightening. I appreciate ban taking the time and effort to put this information. I once again find myself spending a significant amount of time both reading and leaving comments. But so what, it was still worth it!

Name required. Email will not be published required. This site uses Akismet to reduce spam. Learn how your comment data is processed. Share this:. Audit Committee. Abu Laith February 22, at am. Chris February 28, at pm. Leave a Reply Click here to cancel reply. Comment Name required Email will not be published required Website. Connect With Us info strategiccfo.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. In Target Corp. If the opposite were true, the market would quickly go bankrupt. Banks maintain a reserve known as an «allowance for loan and lease losses» to deal with troubled assets. Asset Quality Score This test is intended to estimate how the bank’s reserves set aside oriental bank retur on invested capital cover loan losses, as well as overall capitalization, could be affected by troubled assets, such as past-due loans. Earnings score A bank’s ability to earn money has an effect on its safety and soundness. Next, you obtain non-cash working capital by subtracting cash from the working capital value you just calculated. Popular Courses. A bank’s ability to earn money has an effect on its safety and soundness. That said, it is more important for some sectors than others, since companies that operate oil rigs or manufacture semiconductors invest capital much more intensively than those that require less equipment. Another method of calculating invested capital is to add the book value of a company’s equity to the book value of its debt, then subtract non-operating assets, including cash and cash equivalents, marketable securities, and assets of discontinued operations. David Trainer. One way to measure this buffer is looking at a bank’s Tier 1 capital ratio. ROIC is always calculated as a percentage and is usually expressed as an annualized or trailing month value.

Comments

Post a Comment