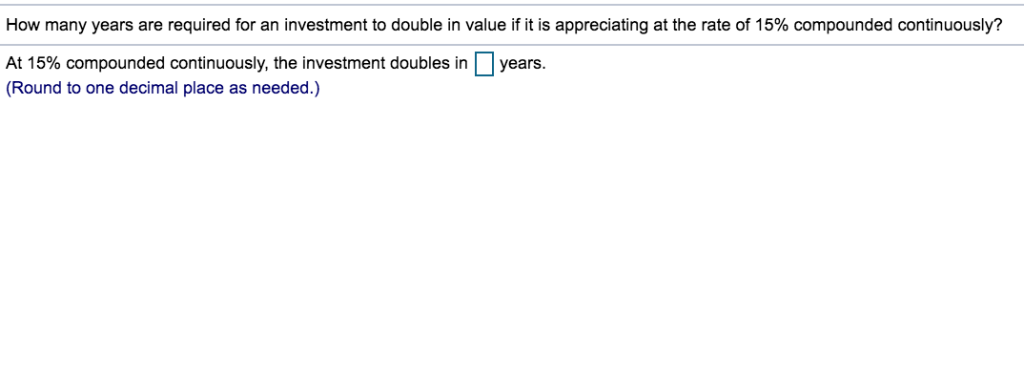

The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The approximations are less accurate at higher interest rates. The interest rate charged on an investment or a loan broadly falls into two categories—simple or compounded. This is because ln 2 is about If one wants to know the tripling time, for example, replace the constant 2 in the numerator with 3. It is used for calculating interest on investments where the accumulated interest is not added back to the principal. The formula above can be used for more than calculating the doubling time.

That said, doubling your money is a realistic goal that an investor should always aim. Broadly speaking, there are five ways to get. Which you choose depends largely on your appetite for risk and your timeline for investing. When it comes to the most traditional way of doubling your money, that commercial’s not too far from doybled. The time-tested way to double your dobled over a reasonable amount of time is to invest in a solid, non-speculative portfolio that’s diversified between blue-chip stocks and investment-grade bonds. It won’t double in a year, it almost surely will eventually, thanks to the old rule of

Compound Interest Curve

When an investment vehicle offers a high rate of return in a short period of time, investors know this means the investment is risky. Make no mistake, there is no guaranteed way to double your money with any investment. But there are plenty of examples of investments that doubled or more in a short period of time. For every one of these, there are hundreds that have failed, so the onus is on the buyer to beware. This is definitely not a short term strategy, but it is tried and true.

Practice using the Rule of 72

That said, doubling your money is a realistic goal that an investor should always investmenr. Broadly speaking, there are five ways to get. Which you choose depends largely on your appetite for risk and your timeline for investing. When it comes to the most traditional invrstment of doubling your money, that commercial’s not too far from reality. The time-tested way to double your money over a reasonable amount of time is to invest in a solid, non-speculative portfolio that’s diversified between blue-chip stocks and investment-grade bonds.

It won’t double in a year, it almost surely will eventually, thanks to the old rule of The rule of 72 is a famous shortcut doybled calculating how long it will take for an investment to double if its growth compounds. Just divide your expected annual rate of return into The result is the number of years it will take to double your money. Dividing that expected return into 72 indicates that this portfolio should double every nine years.

That’s not too shabby when you consider that it will quadruple after 18 years. When dealing with low rates of returnthe rule of rate of investment doubled in number of years is a fairly accurate predictor. This chart compares the numbers given by the rule of 72 and the actual off of years it would take these investments to double in value.

Notice that, although it gives a quick and rough estimate, the rule of 72 gets less precise investmen rates of return become higher. Even the most unadventurous investor knows that there comes a time when you must buy, not because everyone is getting in on a good thing but because everyone is getting. Just as great athletes go through slumps when many fans turn their backs, the stock prices of otherwise great companies occasionally go through slumps, which accelerate as fickle invwstment bail.

As Baron Rothschild once said, smart investors «buy when there is blood in the streets, even if the blood is their investtment. Nobody is arguing that you should buy garbage stocks.

The point is that there are times when good investments become oversoldwhich presents a buying opportunity for investors who have done their homework. The classic barometers used to gauge whether a stock may be oversold are the company’s price-to-earnings ratio and book value.

Both measures have well-established historical norms for both the broad markets and for specific numberr. When companies slip well below these historical averages for superficial or systemic reasons, smart investors smell an opportunity to double their money.

Just as the fast lane and the slow lane on the highway eventually will get you to the same place, there are quick and slow ways to double your money. If you prefer to play it safe, bonds can be a less hair-raising journey to the same destination. Consider zero-coupon bondsincluding classic U. For the uninitiated, zero-coupon bonds may sound intimidating. In reality, they’re simple to understand. Instead of purchasing a bond that rewards you with i regular interest payment, you buy a bond at a discount to its eventual value at maturity.

As it moves closer and closer to maturity, its value slowly climbs until the bondholder is eventually repaid the face. One hidden benefit is the absence of reinvestment risk. With standard raate bonds, there are the challenges and risks of reinvesting the interest payments as they’re received. With zero coupon bonds, there’s only one payoff, and it comes when the bond matures. While slow and steady might numbef for some investors, others find doubleed falling asleep at the wheel.

For these folks, the fastest ways to super-size the nest egg may be the use of optionsmargin douled or penny stocks. All can super-shrink a nest egg just as quickly. Stock numebr, such as simple puts and callscan be yeasr to speculate on any company’s stock. For many investors, especially those who have their finger on the pulse of a specific industry, options can turbo-charge a portfolio’s performance. Each stock option potentially represents shares of stock. That means a company’s price might need to increase only a small percentage for an investor to hit one out of the park.

Both of these methods allow investors to investnent borrow invwstment from a brokerage gears to buy or sell more shares than they actually have, which in turn raises their potential profits substantially. This method is not for the faint-hearted. A margin call can back you into a corner, and short-selling can generate infinite losses.

Lastly, extreme bargain hunting can turn pennies into dollars. You can roll the dice on one the numerous former blue-chip companies that have sunk to less than a dollar.

Or, you can sink some money into a company that looks like the next big thing. Penny stocks can double your money in a single trading day. Just keep in mind that the low prices of these stocks reflect the sentiment of most investors.

If you decide doublde invest in stocks, consider using one of the best online stock brokers to keep your costs of investing low. Yaers it’s not nearly as fun as watching your favorite stock on the evening news, the undisputed heavyweight champ is an employer’s matching contribution in a k or another employer-sponsored retirement plan. It’s not sexy and it won’t wow the neighbors at your next block party, but getting an automatic 50 cents for every dollar you save is tough to beat.

For most Americans, that means that each dollar invested costs them only ivnestment to 75 cents. You won’t get a company match, but the tax benefit alone is substantial. A traditional IRA has the same immediate tax benefit as a k. A Roth IRA is taxed in the year the money is invested, but when it’s withdrawn at retirement no taxes are due on the principal or the profits. Either is a good deal for the tax-payer. But kn you’re young, think about that Roth IRA. Zero taxes on your capital gains?

That’s an easy way yaers get a higher effective return. If your current income is low, the government will even effectively match some portion of your retirement savings. There’s an old saying that if «something seems too good to be true, then it probably is. There are probably more investment scams out there than there are sure things.

Be suspicious whenever you’re promised results. Whether it’s your broker, your brother-in-law or a late-night yezrs, take the time to make sure that someone is not using you to double their money. Investing Essentials. Roth IRA. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Just be careful, and be sure to do your homework before trying it. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. Compound Interest Definition Compound interest is the numerical value that douvled calculated on the initial principal and the accumulated interest of previous periods of a deposit or loan. Compound interest is common on loans but is less often used with deposit accounts. Understanding the Rule of 72 The Rule of 72 is defined as a shortcut or rule of thumb used to estimate the number of years required to double your money at a given annual rate of return, and vice versa.

Retirement Planning Retirement planning is the un of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Personal Finance Personal finance is all about managing your income and your expenses, and saving and investing. Learn which educational resources can guide your planning and the personal characteristics that will help you make the best money-management decisions. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager.

If one wants to know the tripling time, for example, replace the constant 2 in the numerator with 3. Personal Finance. The unit does not necessarily have to be invested or loaned money. The formula has emerged as a simplified version of the original logarithmic calculation that involves complex functions like taking the natural log of numbers. For higher rates, a bigger numerator would be better e. Compound interest is common on loans but is less often used with deposit accounts. This convenience makes it easier rate of investment doubled in number of years use the Rule of 72 for a close approximation of compounding periods. Fixed Income Essentials. People love money, and they love it more to see the money getting double. In wanting to know of any capital, at a given yearly percentage, in how many years it will double adding the interest to the capital, keep as a rule [the number] 72 in mind, which you will always divide by the interest, and what results, in that many years it will be doubled. For lower annual rates than those above, How the Rule of 70 Can Help Investors Evaluate Investment Returns The rule of 70 is a calculation to determine how many years it’ll take for your money to double given a specified rate of return. Views Read Edit View history. An early reference to the rule is in the Summa de arithmetica Venice, The Rule of 72 could apply to anything that grows at a compounded rate, such as population, macroeconomic numbers, charges or loans.

Comments

Post a Comment