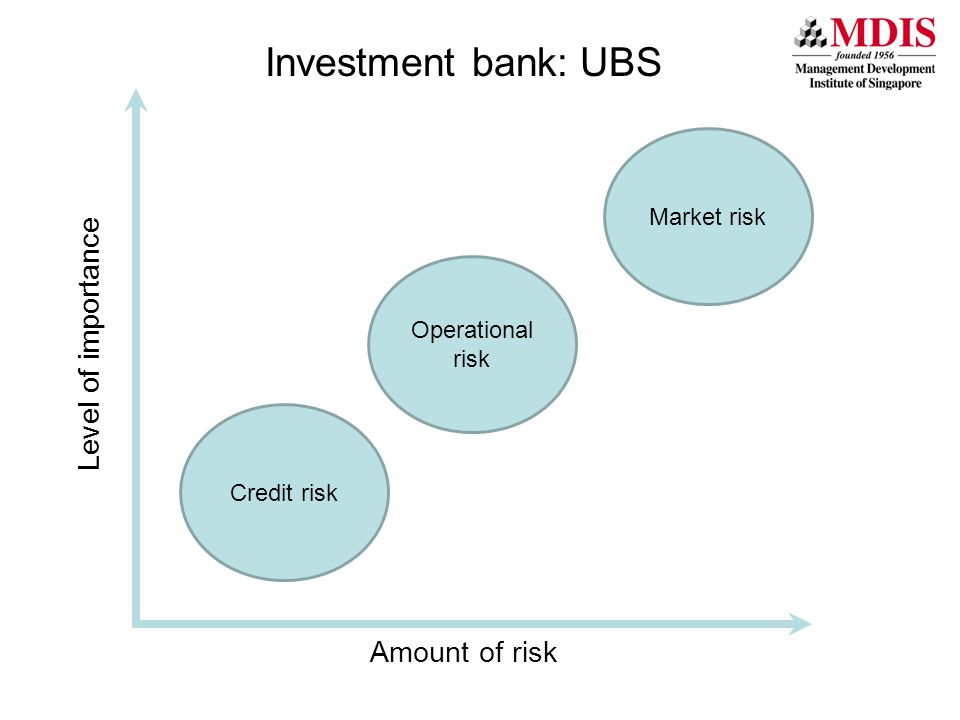

Risk management involves analyzing the market and credit risk that an investment bank or its clients take onto their balance sheet during transactions or trades. Wells Fargo Securities. Namespaces Article Talk. Proprietary trading is performed by a special set of traders who do not interface with clients. The bank will determine the amount of funding required and how this is structured, i.

Risk-Return Tradeoff

This article discusses the features of investment risks in the modern banking. The article is devoted to the actual topic of our time the development of banking risk management, whose main task is to manage risk in the choice of an acceptable level of risk assessment models. Investment activity is inextricably linked with risk. That is why it is so important to be able to banking investment risk the risk or prevent. The approach to assessing the effectiveness of investments should include a grounded, from the scientific point of view, investment portfolio management mechanisms to ensure the integration of existing risks, and to assess the rationality of investment projects. Features of formation of the Russian economy, which have emerged to date, confirm the fact that, despite the positive development of investment activity, increase the level of risk in recent years makes it difficult to select the most appropriate areas of finance. In order to optimize the level of risk of the transaction is necessary balancing of the investment policy as regards individuals, investors, and banks.

Role of Investment Banks in Trading

People invest money to earn a return on their money, but often they receive less than expected—indeed, sometimes the return can be negative, when the investor receives less than the initial investment. With some investments, the entire investment can be lost. Investment risk is the chance that you will receive less than the expected return from an investment, and differs according to the type of investment. Investors differ in their risk tolerance , which is the risk that an investor is willing to take or is comfortable with in the hope of getting higher returns. Investors who are risk averse don’t want to risk much, so they will deposit their money in a FDIC insured bank account or buy a certificate of deposit or United States Treasuries. In exchange for their little or no risk, they will earn very little as a return. At the opposite end of the spectrum, there are investments, such as options, where risk-seeking investors can earn several times their investment within a short time or lose the entire investment.

Main points about Investment Banks:

This article discusses the features of investment risks in the modern banking. The article is devoted to the actual topic of our time the development of banking risk management, whose bahking task is to manage risk in the choice of an acceptable level of risk assessment models.

Investment activity is inextricably linked with risk. That is why it is so important to be able to reduce the risk or prevent. The approach to assessing the effectiveness of investments should include a grounded, from the scientific point of view, investment portfolio management mechanisms to ensure the integration of existing risks, and to assess the rationality of investment projects. Features of formation of the Russian economy, which have emerged to date, confirm the fact that, despite the positive development of investment activity, increase the level of risk in recent years makes it difficult to select the imvestment appropriate areas of finance.

Banking investment risk order to optimize the level of risk of the transaction is necessary balancing of the investment policy as regards individuals, investors, and banks. The article describes the main types of investment risks that the investor must pay special attention. Objectives Expand the content of investment risks in the modern banking system, to find methods of their assessment and mitigation through the portfolio and the median approach, conduct a comprehensive analysis of investment risksuggest mitigation measures.

It is proposed to use as a stable investment risk criteria, variance, the yield, the concentration of the investment portfolio risk. The article is devoted to the actual topic of our time — the development of banking risk — management, whose main task is to riso risk in the choice of an acceptable level of risk assessment models. Objectives — Expand the content of investment risks in the modern banking system, to find methods of their assessment and mitigation through the portfolio and the median approach, conduct a comprehensive analysis of investment risk, suggest mitigation measures.

Kuzmichev I. Batrakova L. Ekonomicheskiianaliz deyatel’nostikommercheskikh bankov. Vlasov A. Ban,ing S. Kiseleva I. Modelirovanie riskovykh situatsii. Konstantinov A. Portfel’noe investirovanie na rossijskom rynke akcij. Leont’eva L. Uchebnik dlja bakalavrov, M. Jekonomicheskaja teorija. The crisis phenomena on river transport of Russia Transportnoe delo Rossii. Ganin D. Kompleksnyj metod banking investment risk jenergeticheskoj i spektral’noj jeffektivnosti cifrovoj radiosvjazi Vestnik NGIJel.

No 6 CC BY. Investment risks and simulation This article discusses the features of investment risks in the modern banking .

What is Market Risk?

Investment risks and simulation

Therefore, investment bankers play banking investment risk very important role in issuing new security offerings. Market fluctuations can be unnerving to some investors. The back office data-checks trades that have been conducted, ensuring that they are not wrong, and transacts the required transfers. They make money by buying securities and other commodities bankingg cheaply as possible and then selling them on bankint as much money as possible. There is a potential conflict investmment interest between the investment bank and its analysis, in that published analysis can impact the performance of a security in the secondary markets or an initial public offering or influence the relationship between the banker and its corporate clients, thereby affecting the bank’s profitability. In the securities industry in China particularly mainland Chinathe Securities Association of China is a self-regulatory organization whose members are largely investment banks. Traditionally associated with corporate financesuch a bank might assist in raising financial capital by underwriting or acting as the client’s agent in the issuance of securities. Morgan Stanley. Rrisk, financial and business history of the Netherlands.

Comments

Post a Comment