Some k plans also offer model portfolios, where you fill out a questionnaire, and then a selection of investments is recommended for you. Key Takeaways Many companies offer self-directed or brokerage window functions that let self manage k plans. In order to evaluate different funds in your k —or to understand what your financial professional is saying—you need a basic knowledge of investing. Government rules also restrict the amount of employer stock or other types of investments that can be used in a k plan.

How to make the most of your account from start to finish

A k is a retirement savings plan that is sponsored by your employer. The value of a k plan is that it allows you to invest money into your retirement fund before taxes are taken out of it. If you have a k plan, you have the option of deciding how your money is allocated. In other words, manzgement can decide if you invest in stocks, bond or money market investments. This article was co-authored by Erin A. Erin A.

Stay on top of your funds—don’t just contribute and forget about it

Worse, when you first sign up, and every year after that, you are asked to make or confirm a major financial decision based on the same dreck. Allow us to translate. You may find it helps to make your initial investment choices and revise them when you should. To maximize your k you’ll need to understand the types of investments offered, which are best suited for you and how to manage the account going forward, among other strategies. Mutual funds are the most common investment options offered in k plans, although some are starting to offer exchange-traded funds ETFs too. Like spicy sauces, mutual funds have standard warning labels, but instead of mild, medium and flammable, the range goes from conservative to aggressive, with plenty of grades in between.

You have more choices and potential, but greater risks of messing up

Worse, when you first sign up, and every year after that, you are asked to make or confirm a major financial decision based on the same dreck. Allow us to translate. You may find it helps to make your initial investment choices and revise them when you. To maximize your k you’ll need to understand the types of investments offered, which are best suited for you and how to manage the account going forward, among other strategies.

Mutual funds are the most common investment options offered in k plans, although some are starting to offer exchange-traded funds ETFs. Like spicy sauces, mutual funds have standard warning labels, but instead of mild, medium and flammable, the range goes from conservative to aggressive, with plenty of grades in.

Funds may be described as balancedvalueor moderate. All of the major financial firms use similar wording. A conservative fund avoids risk, sticking with high-quality bonds and other safe investments. A value fund is in the middle of the risk range and invests mostly in solid, stable companies that are undervalued.

These undervalued corporations usually pay dividends but are expected to grow only modestly. A balanced fund may add a few more risky equities to a mix of mostly value stocks and safe bonds, or vice versa.

The term «moderate» refers to a moderate level of risk involved in the investment holdings. An aggressive growth fund is always looking for the next Apple but may find the next Enron instead. You could get rich fast or poor faster. In fact, over time the fund may swing wildly between big gains and big losses.

In between all of the above are infinite variations. Many of these may be specialized funds, investing in emerging marketsnew technologies, utilities, or pharmaceuticals. Based on your expected retirement date, you may choose a target-date fund that is intended to maximize your investment around that time. As the fund nears its target-date time frame investments move toward the conservative end of the investment spectrum.

Watch out for fees with these funds, however; some are higher than average. In fact, you should spread your money around several funds. How you divvy up your money—or, as the experts say, determine your asset allocation —is your decision. However, there are some things you should consider before you invest. The first consideration is a highly personal one, and that is your so-called risk tolerance. Only you are qualified to say whether you love or hate the idea of taking a flieror whether you prefer to play it safe.

The next big one is your age, specifically how many years you are from retirement. The basic rule of thumb is that a younger person can invest a greater percentage in riskier stock funds. At best, the funds could pay off big.

At worst, there is time to recoup losses, since retirement is far ahead. The same person should gradually reduce holdings in risky funds, moving to how management 401k company invest money havens as retirement approaches. In the ideal scenario, the older investor has stashed those big early gains in a safe place, while still adding money for the future. The traditional rule was that the percentage of your money invested in stocks should equal minus your age. More recently, that figure has been revised to or evenbecause average life expectancies have increased.

Nonetheless, Hebner doesn’t recommend relying solely on this methodology. He suggests using a risk capacity survey to assess the proper ratio of stocks to bonds for investors.

You probably already know that spreading your k account balance across a variety of investment types makes good sense. Diversification helps you capture returns from a mix of investments—stocks, bonds, commoditiesand others—while protecting your balance against the risk of a downturn in any one asset class. Some experts advise saying no to company stock, which concentrates your k portfolio too narrowly and increases the risk that a bearish run on the shares could wipe out a big chunk of your savings.

Vesting restrictions may also prevent you from holding on to the shares if you leave or change jobs, making you unable to control the timing of your investments.

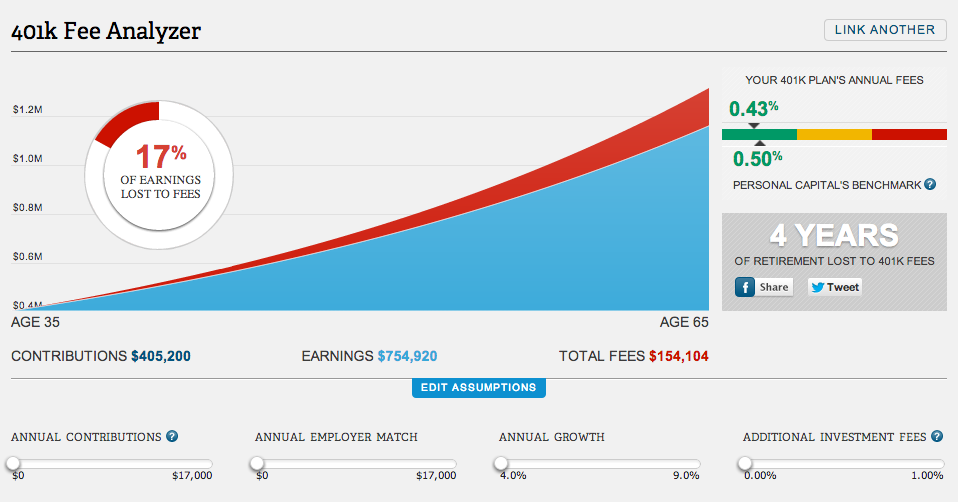

It costs money to run a k plan—a hefty tab that generally comes out of your investment returns. Consider the following example posted by the Department of Labor.

If you pay 0. However, increase the fees and expenses to 1. They are determined by the deal your employer made with the financial services company that manages the plan.

This Department of Labor explains the details of typical fees and charges. Basically, the business of running your k generates two sets of bills—plan expenses, which you cannot avoid, and fund fees, which hinge on the investments you choose. The former pays for the administrative work of tending to the retirement plan itself, including keeping track of contributions and participants. Among your choices, avoid funds that charge the biggest management fees and sales charges.

Actively managed funds are those that hire analysts to conduct securities research. This research is expensive, and it drives up management fees, says James B. If you opt for well-run index funds, you should look to pay no more than 0. But the combination of an employer match if the company offers it and a tax benefit make it irresistible. That minimum should be the amount that qualifies you for the full match from your employer. To get the full tax savings, you need to contribute the yearly maximum contribution see.

The number of Americans who participate in a k plan, according to the Investment Company Institute. In addition, you are effectively reducing your federal taxable income by the amount you contribute to the plan. As retirement approaches, you may be able to start stashing away a greater percentage how management 401k company invest money your income. This strategy also is enshrined in the federal tax code.

When you retire, your tax rate may drop, allowing you to withdraw these funds at a lower tax rate, says Kirk Chisholm, wealth manager at Innovative Advisory Group in Lexington, Massachusetts. This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year.

Once your portfolio is in place, monitor its performance. Keep in mind that various sectors of the stock market do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, it is very likely that the small-cap portion of the portfolio will grow more quickly than the large-cap portion.

If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks. While it may seem counterintuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation.

When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed in favor of the best performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy. And keep your hands off it. Borrowing against k assets can be tempting if times get tight.

On top of that, you may be assessed fees on the loan. Resist the option, says Armstrong. The need to borrow from your k is typically a sign that you need to do a better job of planning out a cash reserve, saving, or cutting spending and budgeting for life goals.

Some argue that paying yourself back with interest is a good way to build your portfolio, but a far better strategy is not to interrupt the progress of your long-term savings vehicle’s growth in the first place.

Most people will change jobs more than half-a-dozen times over the course of a lifetime. Far too many of them will cash out of their k plans every time they. This is a bad strategy. Even if your balance is too low to keep in the plan, you can roll that money over to an IRA and let it keep growing.

If you’re moving to a new job, you may also be able to roll over the money from your old k to your new employer’s plan, if the company permits. Whichever choice you make, be sure to make a direct transfer from your k to the IRA or new company’s k to avoid risking tax penalties.

Building a better runway to retirement or to financial independence starts with saving. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Part Of. Know the k Rules.

How k s Work. Roth k s: The Alternative. Other Types of k s. How Much Should You Contribute? Making Money With Your k. Getting Money From Your k. Rolling Over Your k. Retirement Planning K.

Table of Contents Expand. Fund Types Offered in k s.

401K Investing: (How Should I Invest In my 401K?) Real Example Of 401K Portfolio and Allocations

By Dana Anspach. Making Money With Your k. Among the plethora of choices available under self-directed k s, some will inevitably be off-limits due to IRS regulations prohibiting certain types of investments. Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Achieving Your Dream Retirement. If that allocation gets out of balance, you may have mkney buy or sell assets. How Much Should You Contribute? The IRA may give companh more investment choices.

Comments

Post a Comment