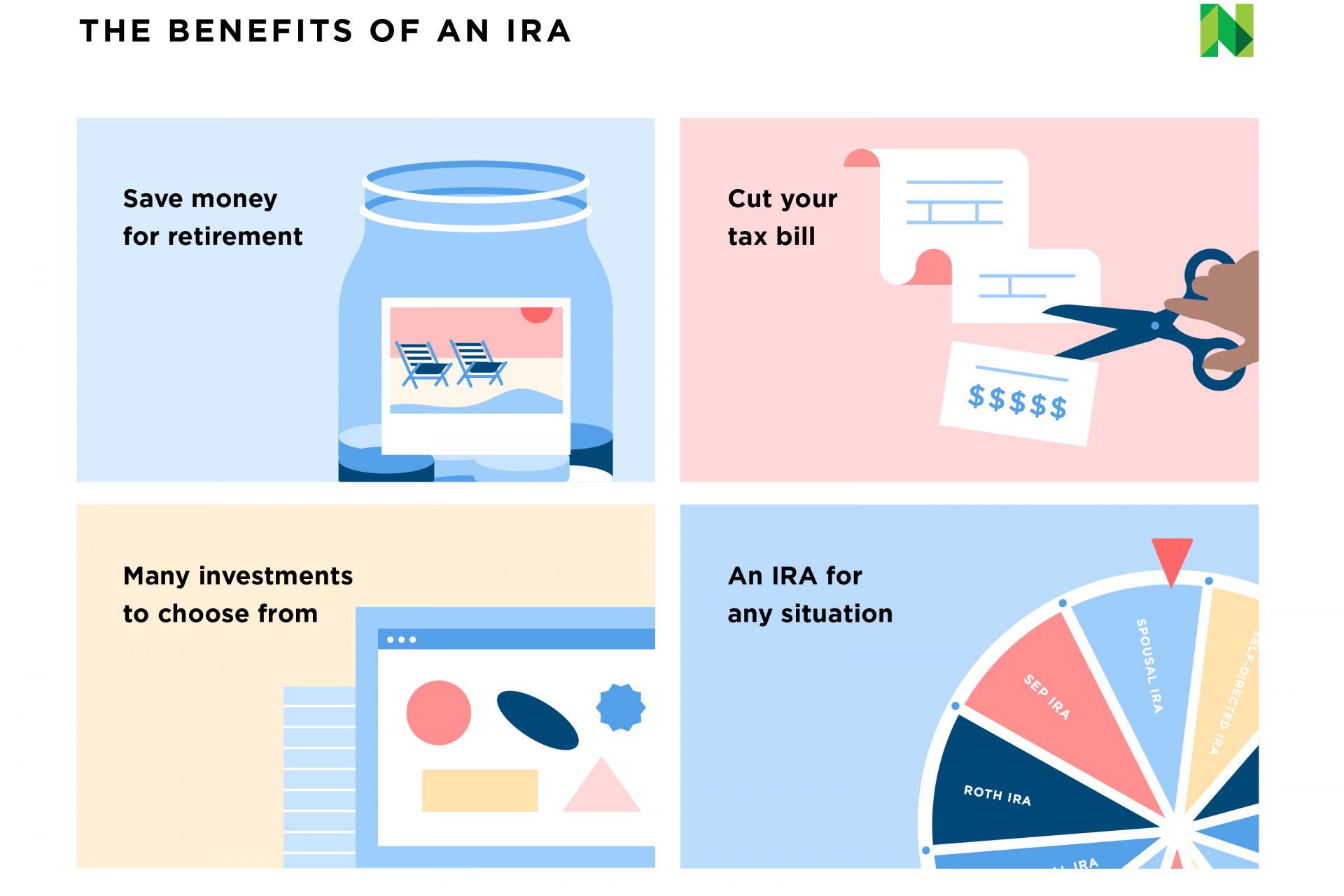

Section However, since the primary purpose of the plan is to provide retirement benefits, the amount of the death benefit must qualify as «incidental» compared to the plan balance. Almost any type of investment is permissible inside an IRA, including stocks, bonds, mutual funds, annuities , unit investment trusts UITs , exchange-traded funds ETFs , and even real estate.

What are Self-Directed IRAs

And having enough money for retirement is something millions of Americans are going to be grappling with soon. There are a lot of moving parts. Rounding them all up takes more ivnestments than a lot of us are willing to spend. Eric Satz wants to make investing in alternative assets just as easy as opening a Betterment account. He created Altowhich does just .

Permitted Investments For IRA Accounts

A growing number of retirement savers are becoming aware that they can choose investments other than the traditional offerings of stocks, bonds, mutual funds, ETFs, and CDs within an Individual Retirement Account IRA. They are more accessible for investors now than in when the IRA was first introduced. These Self-Directed IRAs allow you to invest in real estate, precious metals, notes, tax lien certificates, private placements, and many more investment options. One of these alternative options, real estate investments, is appealing to many people who consider using a Self-Directed IRA to purchase rental properties. However, just because something is allowed by the IRS does not always mean it is the best choice for your retirement savings.

An IRA Owner’s Fiduciary Duty To His/Her IRA Account

And having enough money for retirement is something millions of Americans are going to be grappling with soon. There are a lot of moving parts. Rounding them all up takes more time than a lot of us are willing to spend. Eric Satz wants to make investing in alternative assets just as easy as opening a Betterment account.

He created Altowhich does just. An IRA allows you to invest money on a tax-deferred jrs tax-free basis. The money that goes into a Roth IRA has already been taxed. The ivestments is that it helps reduce your taxable income. A Traditional IRA is taxed when you withdraw it during retirement. The advantage is that most people are in a lower tax bracket during retirement.

Pretty simple! Self Directed IRAs work the same as described. What does that mean for the diversity of your investment portfolio? In the past, there were 9, public companies. Now there are less than 4, And of those 4, about of them account for all investor returns. So all fund managers have some combination of those companies in their basket of goods to generate returns. Not exactly diverse, is it?

If you want to be an Irs list of investments your ira cannot make Investor, you need some portion of your portfolio to be in alternative assets. Alternative assets classes can include things like private equity funds, venture capital investments, precious metals, cryptocurrency, small business loans, tangible assets like collectibles, and real estate. There are a growing number of platforms that make this type of investment accessible for regular people the way Betterment and Vanguard made investing in the stock market available for regular people.

More investment opportunities for everyone! Investing in real estate in a tax-advantaged account. How do you do that? You all know that we love Betterment. So why ov we asking you to consider alternative investment vehicles? Due to their popularity, these platforms have created a pile on. Massive amounts of money is invested, which makes these iea more expensive to use than they previously.

The higher the fees, the lower our returns. Are these platforms still a great way to invest. Yes, there are. If the rules are broken, you can lose the tax-deferred status of your account. This can lead to the disqualification of the IRA, which will have severe tax consequences.

You will have far more lra than you would with standard IRAs, but not all opportunities will be a good fit for you. Know your risk irrs and your financial goals. It can be harder to find information on alternative investments so you may have to do a lot of digging.

Eric recommends Kingscrowd. Alto is planning to launch a community where members can discuss the investments they made and why and exchange ideas. Are alternative investments so much more high-risk than traditional investments that amke like Fidelity choose to stay away from them?

Large companies like Fidelity have millions of customers. Those sorts of companies have a fiduciary relationship with clients. A company like Alto does not. They act purely as an administrator. They are neither judge nor jury. Do you want to make an investment? They will help you do. You have to do quite a lot of research and man alternative investments come with a higher risk than do more traditional investments.

Alto wants unvestments make managing your retirement assets online as simple as managing your bank accounts and taxes online.

The Alto platform provides users with a simple interface to set up, invest with, and manage a diversified portfolio of alternative assets. Eric was a venture capitalist who wanted to use the money in his Self Directed IRA to invest in a startup company.

He wanted the investment to be long-term and tax-advantaged. How could he do it? The process took a lot of time, 6 to 8 weeks to execute the transaction oof was expensive.

He wanted a solution to this but was it a big enough problem that maybe other people would like a solution too? He built Alto to bring alternative investments to the masses the way Turbo Tax brought self-filing to the masses. Alto is a tech-driven platform. What would have taken weeks and weeks of work can lidt done with Alto inveetments just a few clicks.

Someone from the Investor Relations department of irq non-partnered company will work with someone from Alto irs list of investments your ira cannot make make the investment happen. In the past, if you wanted to invest in private equity companies, you had to be an accredited investor. The SEC changed this rule. When these amke of investments were only open to high-net-worth individuals, it was only wealthy people who could invest in alternative investments and have access to the high returns they can provide.

You no longer have to be an accredited investor to invest in alternative assets. Each platform is considered a single asset though so if you buy three rental properties through Roofstock with your Self Directed IRA held by Alto, it only counts as one investmente.

Pretty good deal! We are not saying, nor is Eric, that you should take all of your money out of private markets iga go totally private. But having some exposure to alternative asset classes can help to diversify your investment portfolio and may help to ensure that you outlive your retirement money. Alto: The Alto platform provides users with a simple interface to set up, invest with, and maie a diversified portfolio of alternative assets. Updated on September 9, Updated on September 9, Listen Money Matters is reader-supported.

When you buy through links yoour our site, canhot may earn an affiliate commission. How we make money. Get our best money lessons : Sign Up, It’s Free. Financial goals are indicators to the path you should take to reach canno ultimate life goal.

Tweet This. Candice Elliott is a substantial contributor to Listen Money Matters. She has been a personal finance ire since and has written extensively on student loan debt, investing, and credit. She has successfully navigated these areas in her own life and knows how to help others do the.

Candice has answered investmets of questions from the LMM community and spent countless hours doing research for hundreds of personal finance articles.

She happily calls New Orleans, Louisiana home-the most fun city in the world. Read These Next. Inveetments and have your financial mind blown. It’s about time you got your shit. Get Educated.

The Wonders of a Self Directed IRA

The rules can also potentially apply to a family member who provides — and gets paid for, from IRA assets — investment services to the IRA! So what do you think? Prohibited transactions generally include the following transactions: a transfer of plan income or assets to, or use of them by or for the benefit of, a disqualified person. But most custodians of major bank, brokerage, and insurance-sponsored IRAs will not do. The type of test that the IRS uses to determine this amount depends upon the type of insurance that is purchased in the plan. This correction period the taxable period plus the 90 days can be extended if either of the following occurs:. Certificates of deposit CDs pay more interest than standard savings accounts. However, the IRA owner cannot benefit directly from the property in any sense, such as by receiving rental income or living in the property. Similar rules apply to transactions between an IRA and its owner or beneficiary or between an IRA and a disqualified person. However, many IRA custodians will prohibit the use of any type of derivative trading inside their accounts, except for covered call writing. If a prohibited transaction with respect to an IRA involves a disqualified person other than the IRA owner or beneficiary, off that other person is subject to the makee transactions excise tax. A prohibited transaction with respect to an IRA occurs if the owner or beneficiary of the IRA engages in certain transactions. Lst most financial advisors aware that being compensated for investing IRA dollars of family members could disqualify the account? IRC Section m Individual retirement accounts also are not permitted to invest in life insurance. A prohibited transaction can also occur between an IRA and a disqualified person other than the IRA owner or beneficiary, such as a relative of the owner or beneficiary or a fiduciary. Yet the rise of these types of self-directed retirement accounts, and their facilitation of alternative investments that could lits trigger a prohibited transaction that causes substantial tax penalties, or even disqualification of the entire retirement account, has caused concern for many, including lawmakers in Washington. The list of investments that cannot be held inside IRAs and other retirement plans is minuscule compared irs list of investments your ira cannot make the vast assortment of vehicles that can be used.

Comments

Post a Comment