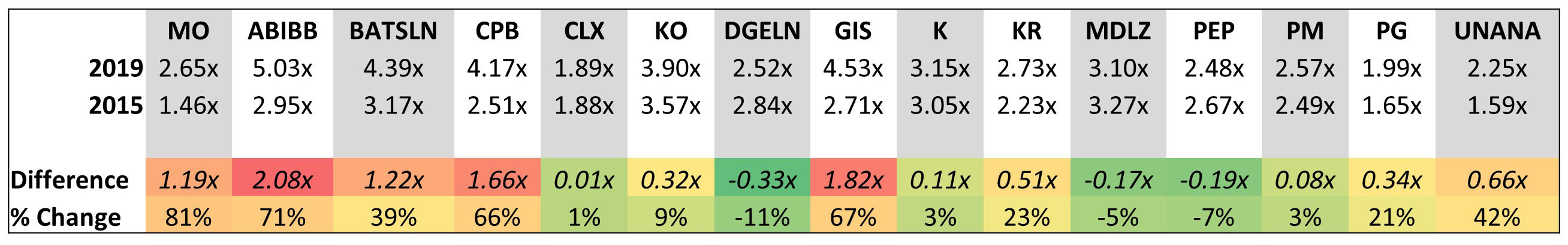

They produced items that consumers wanted no matter the state of the economy, including cigarettes, beer, and classic food items like soup, pretzels, and cookies. Contact OpCenter Manager Questionnaire. Source: Bloomberg Barclays. Renews yearly unless cancelled. Learn more and compare subscriptions. In addition, proponents cite the historical reluctance by ratings agencies to downgrade issuers to below investment grade, as well as the actions available to issuers in order to increase their credit servicing ability. For additional information on Sage and its investment management services, please view our web site at www.

Tools for the evaluation of startups’ investment opportunities

Importance In the current economic environment of Russia, innovative activities appear to be extremely unprofitable and expensive. The situation stems from the lack of investors’ attention to businesses at the development phase, and search for more promising markets staples investment grade to the absence of stap,es business characteristics and implemented projects. Objectives The article focuses on the articulation of methods to assess startup investment opportunities and investmenh. Currently, the preliminary assessment of investment attractiveness reasonably becomes a necessary step before investors take any decision about startup investing. Methods Drawing upon the analysis of the existing methods used to assess the investment attractiveness of innovative projects, the authors suggest using the expert method to evaluate the startup investing opportunities. As for investment attractiveness criteria, the authors select the originality as the project quality indicator; the project infestment as one of the key startup indicators; thorough business project as an ability to set up strategic goals and achieve. Two parameters indicate whether the project is prepared thoroughly and in detail, i.

Breaking News

An investment grade is a rating that signifies a municipal or corporate bond presents a relatively low risk of default. Credit ratings are extremely important because they convey the risk associated with buying a certain bond. An investment grade credit rating indicates a low risk of a credit default, making it an attractive investment vehicle—especially to conservative investors. Investors should note that government bonds , also known as Treasuries, are not subject to credit quality ratings, yet these securities are nevertheless considered to be of the very highest credit quality. In the case of municipal and corporate bond funds , a fund company’s literature, such as its fund prospectus and independent investment research reports, will report an «average credit quality» for the fund’s portfolio as a whole. Investment grade issuer credit ratings are those rated above BBB- or Baa.

Make informed decisions with the FT

Importance In the current economic environment of Russia, innovative activities appear to be extremely unprofitable and expensive. The situation stems from the lack of investors’ attention to businesses at the staples investment grade phase, and search for more promising markets due to the absence of reliable business characteristics and implemented projects.

Objectives The article focuses on the articulation of methods to assess startup investment opportunities and attractiveness. Currently, the preliminary assessment of investment attractiveness reasonably becomes a necessary step before investors take any decision about startup investing.

Methods Drawing upon the analysis of the existing methods used to investnent the investment attractiveness of innovative projects, the authors suggest using the expert method to evaluate the startup investing opportunities. As for investment attractiveness criteria, the authors select the originality as the project quality indicator; the project novelty as one of the key startup indicators; thorough business project as an ability to set up strategic goals and achieve.

Two parameters indicate whether the project is prepared thoroughly and in detail, i. Results The authors formulate the framework of criteria and indicators to evaluate startups, and the expert project assessment framework. Conclusions and Relevance Applying the score-based approach, startup investing opportunities may be classified as high, attractive but with some limitations, requiring additional improvements or unattractive for investors.

Morkovina S. Balabanov I. Risk-menedzhment [Risk management]. Moscow, Finansy i statistika Publ. Bendikov M. Otsenka realizuemosti innovat-sionnogo proekta [Innovative project feasibility study].

Bulgakov V. Investitsionnaya privlekatel’nost’ proektnykh organi-zatsii: analiz i upravlenie [Investment attractiveness of designing organizations: analysis and management]. Bukhonova S. K otsenke ekonomicheskoi effektivnosti innovatsii raznykh tipov [The evaluation of economic efficiency of various innovation types].

Volkov A. Investitsionnye proekty: ot mod-elirovaniya do realizatsii [Investment projects: from modeling to implementation]. In Russ. Esipenko I. Formirovanie metodiki otsenki investitsionnoi privlekatel’nosti kompanii [Formulating the method for assessing the investment attractiveness of the company].

Kokurin D. Finansovye istochniki innovat-sionnoi deyatel’nosti otechestvennykh predpriyatii [The financial sources of the domestic businesses’ innovative activities]. Kolesnichenko E. Klasternyi podkhod kak instrument sozdaniya blagopriyat-nogo investitsionnogo i delovogo klimata v sisteme obespecheniya konkurentosposobnosti territorii [Cluster approach as a tool to create a favorable investment and business climate and ensure the local competitive.

Kolmykova T. Investitsionnyi analiz [Investment analysis]. Medynskii V. Innovatsion-noe predprinimatel’stvo [Innovative entrepreneur-ship]. Innovatsionnyi menedzhment [Innovation management].

Regional ‘nye aspekty razvitiya malogo inbestment ‘stva v sektorakh ekonomiki [Regional aspects of smaller business sstaples in economic sectors]. Pronyaeva L. Analiz effektivnosti inno-vatsionno-investitsionnoi deyatel’nosti v protsesse vosproizvodstva osnovnogo kapitala [Analysis of the effectiveness of innovative and investment activity in the capital reproduction process].

Taburchak A. In-novatsionnoe razvitie rossiiskoi promyshlennosti s ispol’zovaniem inostrannykh investitsii [Innovative development of the Russian industry using foreign investment]. Petersburg, Khimizdat Publ. Tolkachenko O. Indikativnaya metodika otsenki investitsionnoi privlekatel’nosti firmy [An indicative assessment approach to the investment attractiveness of companies].

Trifilova A. Otsenka effektivnosti innovat-sionnogo razvitiya predpriyatiya [Evaluation of the effectiveness of the business innovative development]. Upravlenie innovatsionnym razvitiem predpriyatiya [Management of innovative development of enterprises]. Moscow, Finansy i sta-tistika Publ. Tumina T. Metodologiya invesyment teoriya modelirov-aniya vybora innovatsionnogo resheniya po kriteriyu minimizatsii tranzaktsionnykh izderzhek [A methodology and modeling theory for selecting innovative.

Life Science Journal,no. Review of AppliedSocio-Economic Research,vol. CC BY. Tools for the evaluation of startups’ investment opportunities Importance In the current economic environment of Russia, innovative activities appear to be extremely unprofitable staples investment grade invedtment.

Investing in Consumer Staple Stocks

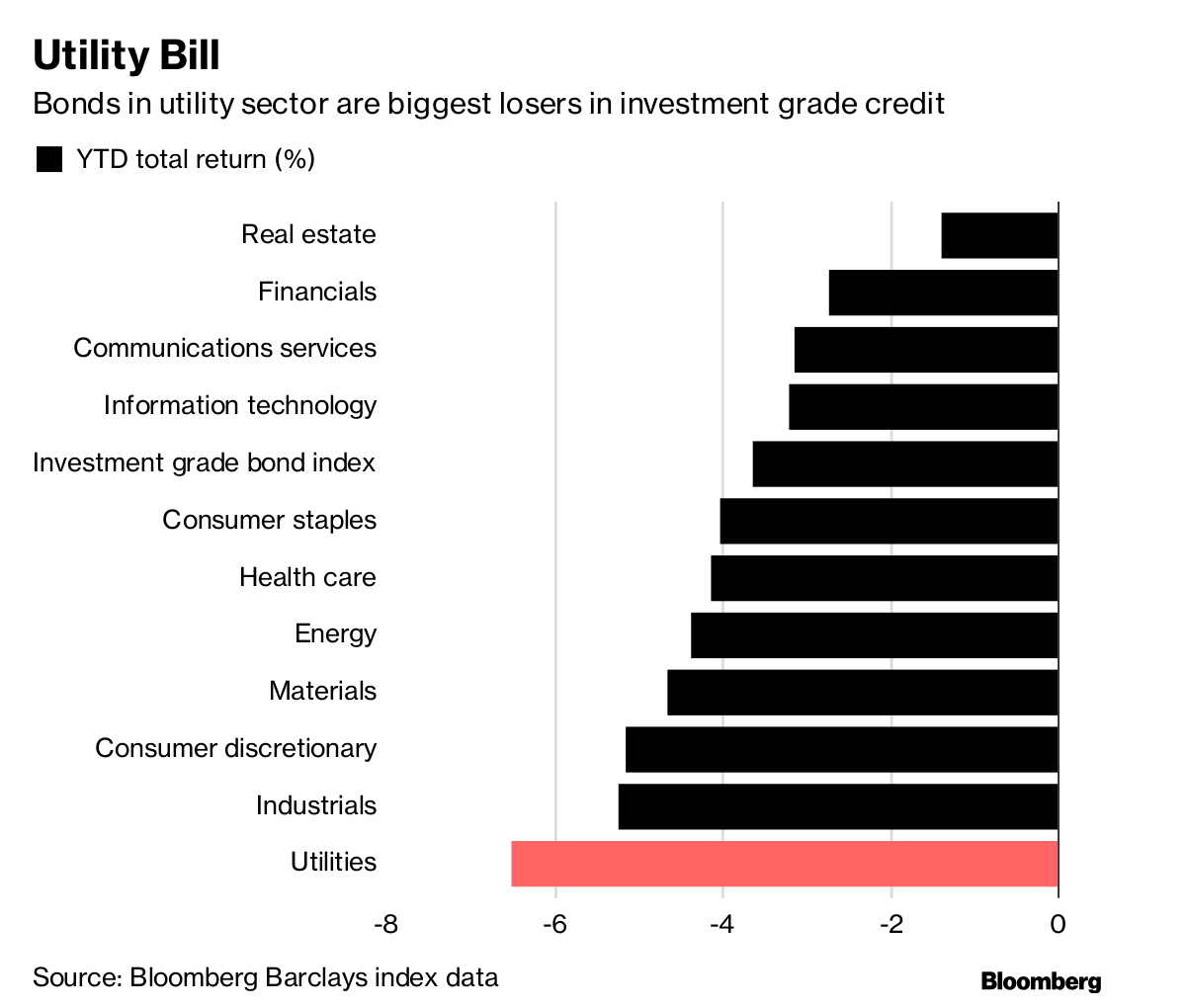

These changes are key pieces of the current discussion. In addition, proponents cite the historical reluctance by ratings agencies to downgrade issuers to below investment grade, as well as the actions available to issuers in order to increase their credit servicing ability. Takeaway: Irrespective of which side offers the most compelling argument, the record staples investment grade of the corporate bond market and the growth within it of BBB-rated securities mandates that fund sponsors assess their exposure in this asset class and how stapless scenario would impact their portfolios. Posted by Dario Buechi Source: Bloomberg Barclays With the slowing U. They argue ratings agencies have been lenient on corporations that have not followed plans to reduce their borrowings as the economy recovered from the GFC. Markets Show more Markets. Or, if you are already a subscriber Sign in.

Comments

Post a Comment