Your investment creates jobs and makes an impact in the real economy. The Fund primarily invests in the federally guaranteed portion of SBA 7 a loans that adjust quarterly or monthly and are indexed to the Prime Rate. Businesses make fixed monthly repayments with interest, which we distribute to all the investors who lent to them.

A Guide to Online Business Loans

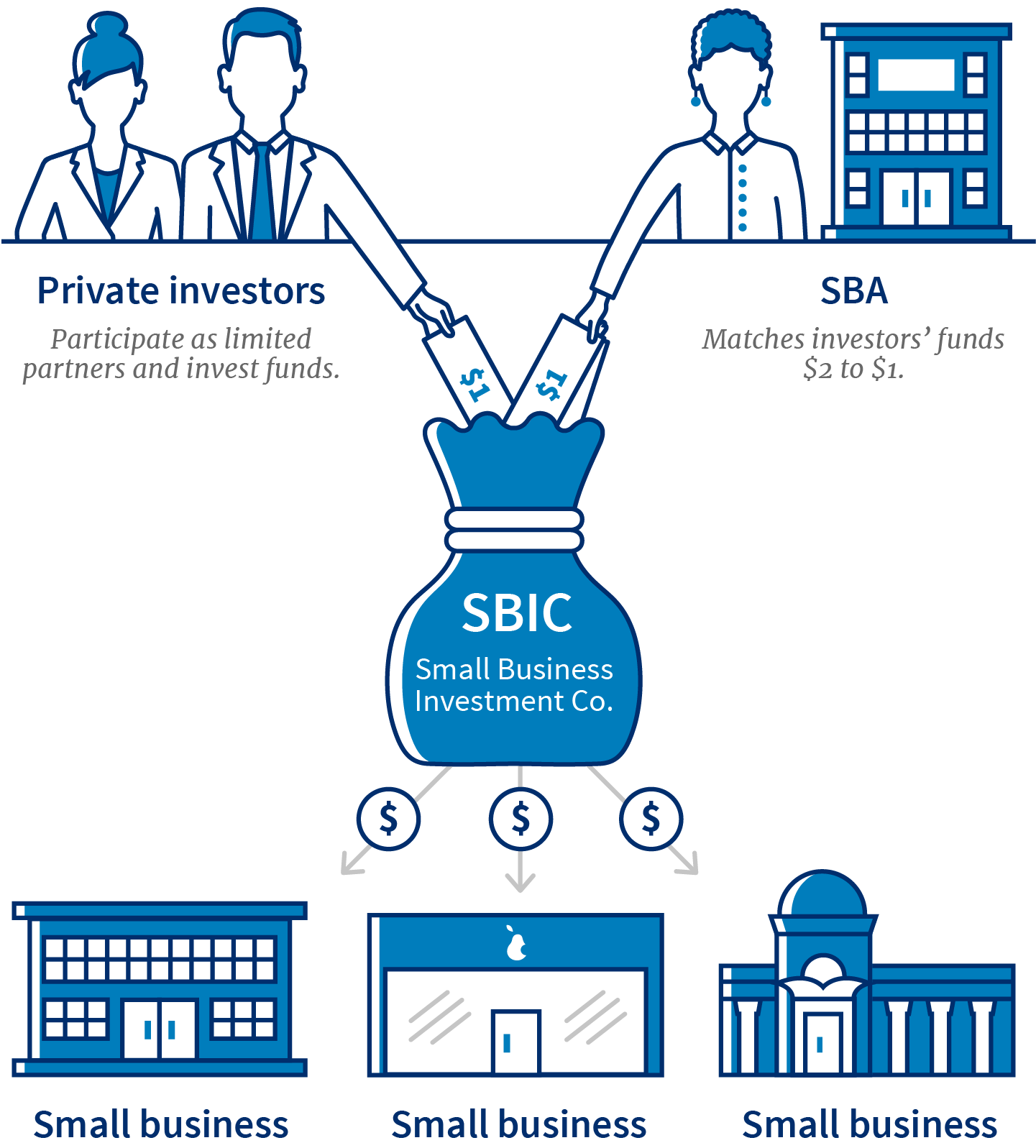

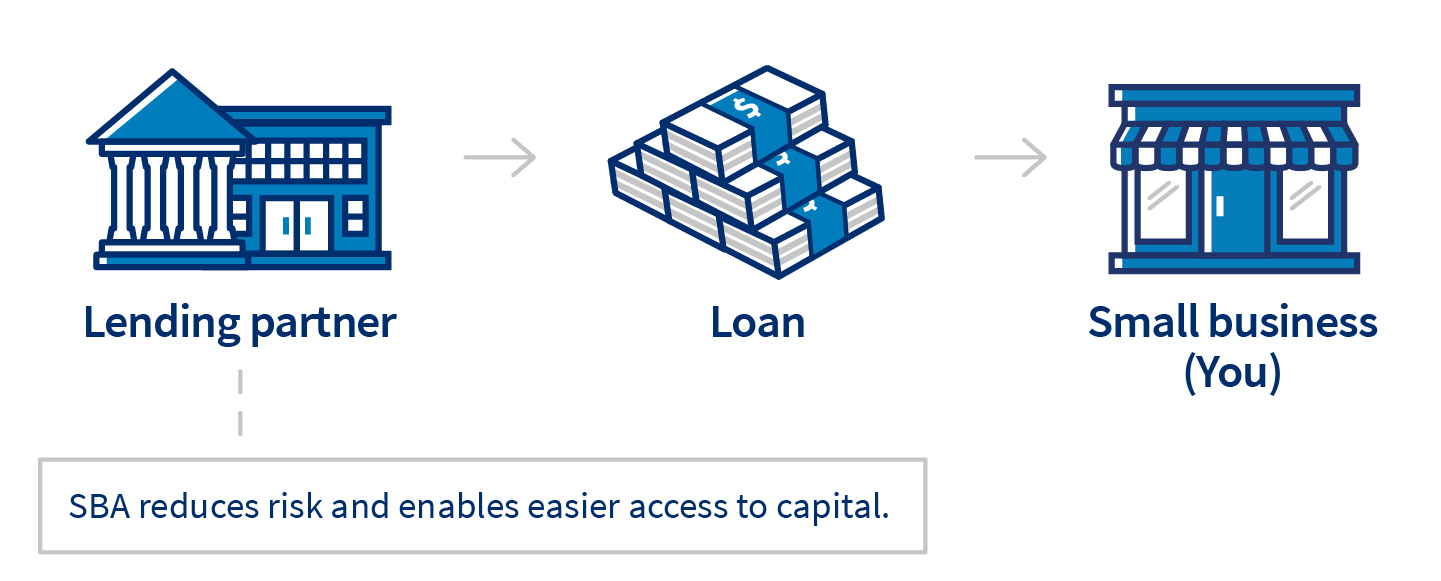

The SBA is not a lender, but rather guarantees small business loans offered by traditional lenders like participating banks and credit unions to encourage lending to small businesses across the country. Sbz Business Administration SBAa federal agency that promotes small business ownership in a variety of ways. The SBA loan guarantee program encourages lenders to work with small businesses. In return the lenders adhere investing in sba loans specific lending terms, interest rate caps, and other criteria set out by the SBA. The sharing of risk laons what makes SBA loans attractive for banks, who are in turn asked to provide loans to a sector of the economy that is higher risk: small businesses.

Why Funding Circle?

By selecting «Continue,» you will leave U. Bank and enter a third party website. Bank is not responsible for the content of, or products and services provided by this third party website, nor does it guarantee the system availability or accuracy of information contained in the site. Please note that the third party site may have privacy and information security policies that differ from those of U. End of pop up window. Press escape to close or press tab to navigate to available options.

INVESTMENT OBJECTIVE:

Essentially, when a qualifying business applies for an SBA loan, it is actually applying for a commercial loanstructured according to SBA requirements with an SBA guaranty.

Small business owners and borrowers who have access to other financing with reasonable terms are not eligible for SBA-guaranteed loans. An example of a good, specific use is if, for instance, orders are outpacing supply and some new machinery, an additional employee, another location or another truck would help meet that demand profitably after covering the new debt payment, says Pili.

A poor example is acting on a hunch. Many marketing activities fall into this category, Pili says. The Small Business Administration offers a variety of financial programs aimed at helping small businesses succeed.

The programs range from offering assistance facilitating a loan with a third party lender to guaranteeing a bond or helping a small business owner find venture capital. Several different types of loans are available, including:. The SBA does not make direct loans to small businesses. That eliminates some risk to lenders. In order to be approved, an SBA loan application has to first be approved and underwritten by a financial institution or small business lender.

If both organizations approve the loan, the financial institution will fund and service the loan from that point on. While every lender has its own criteria to approve a loan, Lizio says there are some common qualifying criteria investing in sba loans all lenders use, including:. Term of Loan. Lizio says one of the biggest benefits of an SBA loan is the term of the loan. For instance, a bank might only agree to a year term on real estate, but the SBA might approve a or year term.

Why does this matter? Lizio says a longer term makes the loan payment more affordable and also makes it easier to qualify for a loan. In addition, it adds flexibility for a borrower. It could have a good month or a good period, or a bad month or period. A smaller minimum loan payment is easier to cover during a bad month or period. Flexibility on Collateral. The collateral requirements are also more flexible.

Those without much collateral may still be approved for an SBA loan where they might have been declined by a traditional lender. You’re a Borderline Case. Sometimes, the SBA might be the only reason you get the loan. Higher Costs. Fees associated with SBA loans can become costly. You also have to go through two underwriting processes, which may require two different valuations of property or collateral.

That can be expensive. Slower Processing. You also have to be patient. For 7 a loans, you may want to investigate the SBAExpress loan program, which has expedited deadlines and promises a hour response time to loan applications. The specifications of these express loans may or may not meet your needs. Develop a business plan that answers these questions. All lenders will want to review a substantial, comprehensive and well-thought-through business plan before approving a loan to expand — or launch — a business.

A traditional business loan will generally be faster to get and have lower fees. But SBA loans can offer important advantages, including being able to get a loan at all at certain stages of your company’s development. Small Business.

How To Start A Business. Loan Basics. Company Profiles. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Business Small Business. SBA Options. Microloan Program. This provides small, short-term loans to small businesses and certain types of not-for-profit childcare centers.

This loan provides financing for major fixed assets, such as equipment or real estate. Obtaining Approval. Cash Flow to Service the Loan Payment. Personal Credit History. So, they pull a personal credit history on the applicants. If those scores do not meet a minimum threshold, Lizio says, the lender will walk away immediately.

Although there can be a few exceptions, the SBA generally requires that all SBA loans be collateralized with all available assets inventorybuildings, cash. Banks and other commercial lenders will want full collateral as.

For owners of small businesses, going the SBA route has some key advantages. The Bottom Line. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms Commercial Real Estate Loan A commercial real estate loan is a mortgage secured by a lien on a commercial, rather than residential, property — commercial being defined as any income-producing real estate that is used solely for business purposes.

Acquisition Financing Acquisition financing is the capital that is obtained for the purpose of buying another business. How Term Loans Work A term loan is a loan from a bank for a specific amount that has a specified repayment schedule and a fixed or floating interest rate.

Everything You Need to Know About Lender A lender is an individual, a public or private group, or a financial institution that makes funds available to another with the expectation that the funds will be repaid. Repayment will include the payment of any interest or fees.

Mark Cuban: Only Morons Start a Business on a Loan

Trust your business to a Preferred SBA Lender.

To earn this certification, the Fund demonstrated that it provides a positive environmental impact to low-to-moderate income households or areas, as well as rural and reservation based communities in California. We call this a bad debt. Many originators of SBA loans sell the federally guaranteed portion of the loans into the secondary market. The investor will then receive quarterly distributions and statements from the Fund Manager, via U. Community Benefits: Minority and woman owned business, Serves child-care needs of local families. Owned and operated by a minority woman, the center provides child care services for children ages from 2 weeks to 13 years. Carefully consider the investment objectives, risk, charges and expenses of any investing in sba loans product prior to investing. Community Benefits: Minority owned business, Serves mentally and developmentally disabled persons. They use thousands of data points, machine learning technology and their detailed understanding of business lending to assess every application, so only creditworthy businesses are approved. They represent the range of annualized net yields as of March 31, for small business loans originated by FC Marketplace, LLC during 6-month intervals in calendar year Name: Valley Food Systems Location: Youngstown, Ohio Description: A manufacturer of innovative perishable prepared foods for the military and victims of disasters. The Fund primarily invests in the federally guaranteed portion of SBA 7 a loans that adjust quarterly or monthly and are indexed to investing in sba loans Prime Rate. These securities are not publicly traded and are subject to holding period requirements; investors will not be able to access principal invested in Notes until and unless scheduled repayments are .

Comments

Post a Comment