Hence, direct plans give higher returns than regular plans. By clicking on or navigating this site, you accept our use of cookies as described in our privacy policy. Similarly, mutual funds take the benefit of their buying and selling volume to reduce the transaction costs for investors,. You can also port in all of your financial accounts on its so-called full-view feature to understand all of your finances in one place, much as you might on a budgeting app like Mint. Previously named as Smartspends 2. Not everyone has the time and expertise needed to make sure the investment gives the best returns.

DON’T MISS OUT

What is it and how to invest? Start investing in P2P lending. Read. Peer to Peer lending also called P2P lending, crowdlending or Social lending is a type of crowdfunding investment where investors cofinance projects by lending money in return of interests e. Investments are done via crowdlending platforms. We provide you the information needed to start investing in P2P lending and the reviews of the best investment platforms. Peer to peer loans investment has proven its potential for both investors and borrowers.

Overview: Top online brokers for mutual funds in December 2019

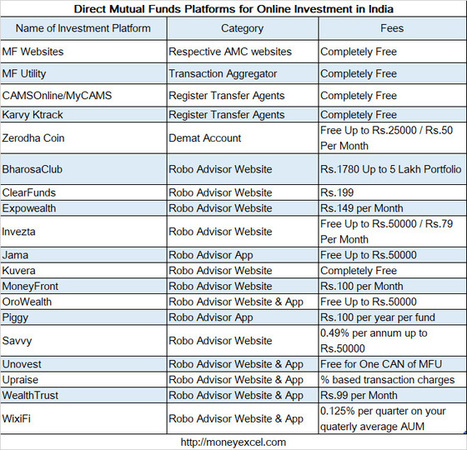

For many years, we have been working with investment advisors to make the best use of our money. The accuracy and consistency of their advice have always been in question, but we never cared about it much till the time we started having choices. And now that software is taking over the world, we do have choices that are based on analytics and automation. These include:. It helps people to have better control on their wealth and to grow it with the help of advanced technology. There are no trading commissions, no account maintenance fees and no additional monthly fees.

Here are the best online brokers for mutual funds:

What is it and how to invest? Start investing in P2P lending. Read. Peer to Peer lending also called P2P lending, crowdlending or Social lending is a type of crowdfunding investment where investors cofinance projects by lending money in return of interests e. Investments are done via crowdlending platforms. We provide you the information needed to start investing in P2P lending and the reviews of the best investment platforms. Peer to peer loans investment has proven its potential for both investors plarforms borrowers.

We provide clear and summaries information that will give you an advantage in your investments in order to receive decent returns on your amount invested.

For the moment only few platforms are regulated by the FCA Invetsment Conduct Authority to protect the rights and privileges of the investors.

Based on mutual interests, peer to peer investing has opened unlimited possibilities for people to choose their investment portfolio and is a great option for borrowers to find fundings at a reasonable cost. The benefits of peer to peer investing:. To invest in peer to peer lendingyou will have to use external p2p lending investment websites. They are many of them available onlime. Each of them has its own specialties and characteristics such as the type of investments, the onljne of investments, the returns ROIthe risk, the country of investment.

On the following page you will find the best P2P lending platforms in Europe. This website is not responsible for the accuracy of the data provided. It provides a personal point invesmtent view. Never invest more than you can afford, and do your own research online investment platforms in india investing.

We do not cover any losses you may incur from investing. Peer to Invesgment lending Investment. Read More.

Disclamer This website is not responsible for the accuracy of the data provided. Get investment opportunities. Thanks to our website, you can find the best peer to peer lending companies, place your money in lucrative investments and earn attractive interest-rates in return.

In the Media

So glad I found FundsIndia. Piggy is one of the top-rated apps on the Amazon store as well as on the iOS store. The mobile app allows you to invest in direct plans of mutual fund investment schemes in India. The complete paperless solution guides you through the investment process seamlessly. The exception, of course, is if that brokerage account is through iin mutual fund company. Please enter your comment! The commissions Ally Invest charges on mutual funds are considerably cheaper when compared to competitors. Returns 5yr. Learn .

Comments

Post a Comment