And regardless of whether your income is large or small, talking to a professional can make a huge difference in reaching your retirement goals. Hogan challenges and equips people to take control of their money and reach their financial goals, using The Chris Hogan Show, his national TV appearances, and live events across the nation. Back Get Started.

A Very Short Guide

For instance, Dafe suggests the snowball method of debt repayment but the stacking method is superior when it comes to saving money on your debt. But if you follow the snowball method, you will pay off your debt. So we say potato and Dave says potato but we both get you to debt free in the end. However, there is a big. His investment philosophy is conservative, to say the .

Don’t Have 40 Years to Invest?

It looks like your browser does not support JavaScript. The investment calculator currently requires JavaScript in order to function. Please enable JavaScript or try in a different browser if you can. If you were born in or later, 67 years old is the age in which you can retire with full benefits. This is the amount you add to your retirement savings each month. This is the return your investment will generate over time.

How to Read the Results

Two years later he ramseey. As an evangelical Christian, Ramsey uses biblically-based principles to teach his followers how to improve their investmfnt conditions. Dave Ramsey has come a long way since how much will my investment grow dave ramsey for personal bankruptcy in his early years.

Here’s how Ramsey made his first million, lost it and rebuilt an even larger fortune in a relatively short period of time. Ramsey grew up in a household that instilled a strong work ethic.

That conversation with his father inspired Ramsey to become an entrepreneur. That same day he printed business cards at the local print shop for his first venture: a lawn care business. Throughout his school years, he had a number of rqmsey businesses, one of which sold leather bracelets. Ramsey said his early business ventures taught him valuable lessons like customer service and the importance of keeping your word.

Three weeks after turning 18, Ramsey passed his real estate license exam. After graduating from college, he started to flip properties. The bank demanded Ramsey pay the entire debt off within 90 days. Ramsey’s fall from grace led him to Christianity. He began to read the Bible and discovered that «God’s word has a lot to say about money. He agreed to help the man and his wife create a financial plan for their life—and so began Ramsey’s financial counseling career.

Ramsey started a personal finance counseling company called The Lampo Group. Ramsey is transparent about his investment style. He encourages his followers to avoid investing in individual stocks and purchase mutual funds that have a long track record of good performance. Besides mutual funds, Ramsey owns a portfolio of rental properties.

As a child, he started several different business ventures to earn extra pocket money. His impeccable work ethic helped him become a millionaire by the age of A few years after reaching the million-dollar net-worth milestone, Ramsey filed for personal bankruptcy. Since then he has created a business empire that revolves around using his previous money mistakes and Bible scriptures mych teach smart money-management practices. Today, millions of Americans have turned to the teachings of Dave Ramsey to guide them along the path to financial security and wealth.

Investing Essentials. Financial Advisor Careers. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Wealth Wealth Management. Key Takeaways Dave Ramsay is a well-known financial guru with a nationally syndicated radio show and other media presence.

Before becoming a financial pundit, Ramsay saw both early success and bankruptcy. Ramsay employs Christian values to ramssey convey his message of financial prudence and saving.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Personal Finance Personal finance is all about managing your income and your expenses, and saving and investing.

Learn which educational resources can guide your planning and the personal characteristics that will help you make the best money-management decisions. The Bernie Madoff Story Bernie Madoff is an American financier who ran a multibillion-dollar Ponzi scheme that is considered the largest financial fraud of all time.

Bankruptcy Trustee A bankruptcy trustee is a person appointed muchh the United States Trustee to represent the debtor’s estate during a bankruptcy proceeding. What Is Bootstrapping? Bootstrapping describes a situation in which an entrepreneur starts a company with little capital, relying on money other than outside investments.

Your Results

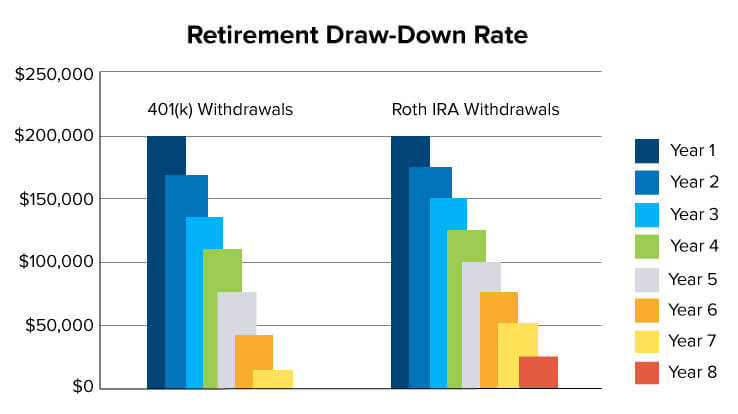

Find an investing pro in your area today. Chris Hogan is a 1 national best-selling author, dynamic speaker and financial expert. Your guide is on its way. Enter your email address. Back Dave Recommends. Do your results show that you’ll have enough to live the good life after retirement? Move your mouse over the different parts of the graph to see the results for a particular year. Back Get Started.

Comments

Post a Comment