Responses provided by the virtual assistant are to help you navigate Fidelity. Login Register. When realized, capital gains are calculated assuming the appropriate capital gains rates. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. You should begin receiving the email in 7—10 business days.

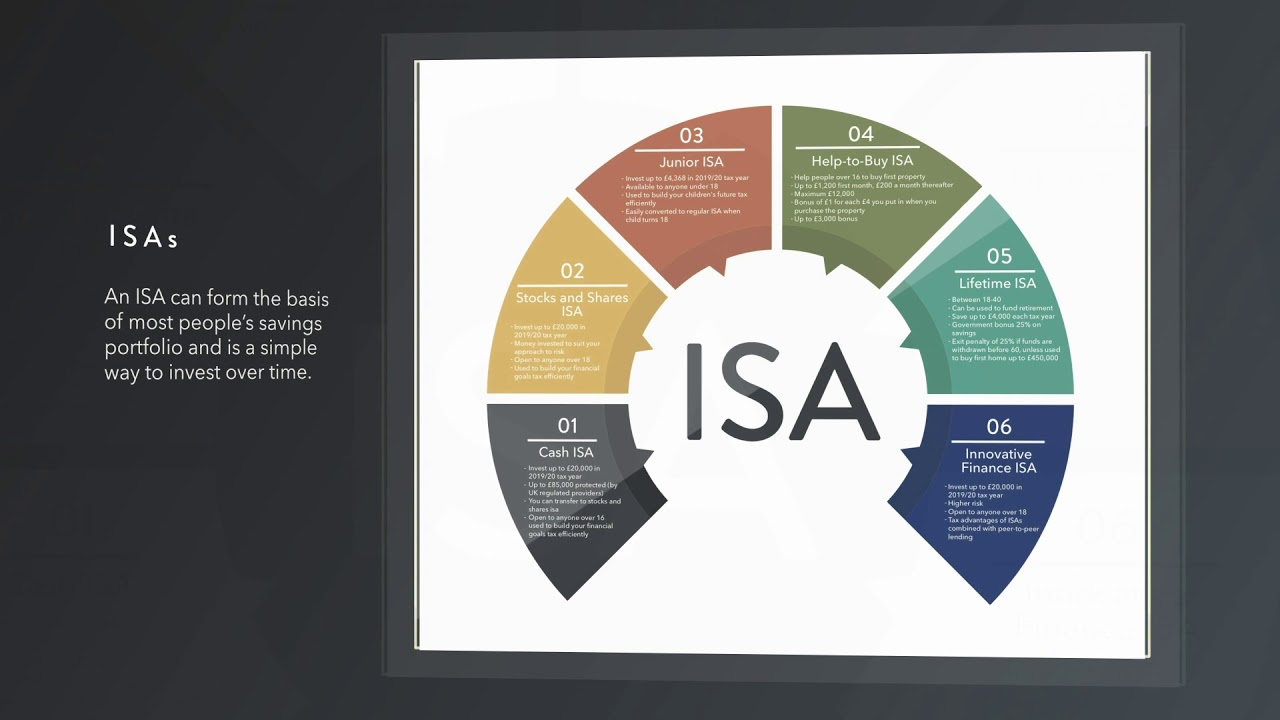

Make the most of your ISA allowance

By selecting «Continue,» you will leave U. Bank and enter a third-party website. Bank is not responsible for the content of, or products and services provided by this third-party website, nor does it guarantee the system availability or accuracy of information contained in the site. Please note that the third-party site may have privacy tax efficient investing brochure information security policies that differ from those of U. End of pop up window. Press escape to close or press tab to navigate to available options.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Tax efficiency is essential to maximizing investment returns. Unfortunately, the complexities of both investing and the U. Put bluntly, tax efficiency is a measure of how much of an investment’s profit is left over after the taxes are paid. The more an investment relies on investment income rather than a change in its market price to generate a return, the less tax-efficient it is for the investor. Generally, the higher your tax bracket rate is, the more important tax-efficient investing becomes.

Key takeaways

By selecting «Continue,» you will leave U. Bank and enter a third-party website. Bank is not responsible for the content of, or products and services provided by this third-party website, nor does it guarantee the system availability or accuracy of information contained in the site. Please note that the third-party site may have privacy and information security policies that differ from those of U.

End of pop up window. Press escape to close or press tab to navigate to available options. You might find it helpful to bookmark this page so you have easy access to definitions when you need. Are you new to online investing or do you prefer to have guidance from experienced investment professionals?

Exclusively for our customers, log into usbank. Start investing. Learn. A computer-driven calculation designed to provide a mathematical solution that can be applied to a specific problem.

In the investment world, algorithms are used to help guide specific investment strategies or securities trades. An asset class is a group of similar types of investments, such as stocks, bonds, cash equivalents and real estate. Within each of those broader asset classes, sub-asset classes exist to help further define investment choices i.

Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. A portfolio constructed of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

The diversification score measures the diversity of the investment classes and individual securities within a portfolio. A lower score means that your portfolio could benefit from greater diversification. Unlike mutual funds, an ETF is a fund that trades like a common stock on a stock exchange, similar to the way stocks are bought and sold throughout the trading day. ETFs typically have higher daily liquidity and lower fees than mutual fund shares. Because it trades like a stock, an ETF does not have its net asset value NAV calculated once at the end of every day like a mutual fund does.

Instead, its price varies throughout the day. The objective is to manage assets in a way that captures opportunity by taking on greater risk in the early years of the investment time horizon, and then reduces risk as the date of retirement approaches to preserve accumulated wealth. Transferring specific investments from an account held with one financial institution to an account at a different financial institution without actually selling the investments.

Monte Carlo simulations are used to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables. One way to employ a Monte Carlo simulation is to model possible movements of two components of asset prices: drift, which is a constant directional movement, and a random input, representing market volatility. Historical price data can be analyzed to determine the drift, standard deviation, variance and average price movement for a security.

A portfolio is a grouping of financial assets such as stocks, bonds and cash equivalents, as well as their funds counterparts, including mutual, exchange- traded and closed funds.

Rebalancing is the process of restoring a portfolio to its target allocation. As a result, a portfolio may end up overweight in one asset class and underweight in another asset class. To bring the portfolio back to its target allocation, assets are adjusted and rebalanced by selling a portion of the asset that is overweight and purchasing more of the position that is underweight.

A REIT is a type of security that invests in real estate through property or mortgages and often trades on major exchanges like a stock. Risk tolerance means the amount of volatility and loss — especially the ups and downs of the market — that an investor can accept. Risk tolerance is typically gauged by a questionnaire that categorizes investors on tax efficient investing brochure spectrum from Aggressive to Moderate to Conservative.

Tax efficient investing refers to the practice of making investment decisions that minimize the impact of short-term assets held less than one year and long-term capital gains and losses which are often taxed at different rates per the IRS tax code. This practice is most frequent in taxable investment accounts, where consideration is given to hold positions with gains at least a year to get favorable tax treatment, and selling positions with a loss to offset positions sold for a gain.

Note that the tax implications of buying or selling a position is only one of many considerations for maximizing an investors overall return. A strategy to sell securities that have lost value to help reduce taxes on realized capital gains.

Capital gains are realized when an investment position is sold for a profit — or when a fund or ETF sells securities for a gain — and passes the earnings on to the individual shareholder. Tax loss harvesting offsets those gains by selling positions at a lower price than what was paid for those assets. In investing, time horizon refers to the amount of time before the assets are needed for a specific goal.

For example, if a person intends to retire in 20 years, that would be the length of their investment time horizon before spending assets to fund their retirement. A wash sale is a transaction where an investor sells a losing security to claim a capital loss, only to repurchase it again for a bargain.

Wash sales are a method investors employ to try and recognize a tax loss without actually changing their position. The effectiveness of this strategy has been greatly reduced with the implementation of the IRS day wash rule, where a taxpayer cannot recognize a loss on an investment if that investment was purchased within 30 days of sale before or after sale.

Investing in ETFs may bear indirect fees and expenses charged by ETFs in addition to its direct fees and expenses, as well as indirectly bearing the principal risks of those ETFs. ETFs may trade at a discount to their net asset value and are subject to the market fluctuations of their underlying investments. Investment and Insurance products and services including annuities are:.

Wealth Management — U. Bancorp Investments is a marketing logo for U. Bancorp Investments. Bancorp Investments and its representatives do not provide tax or legal advice. Your tax and financial situation is unique. Investment and insurance products and services including annuities are available through U. Bancorp Investments, the marketing name for U. Bancorp Investments, Inc.

Bancorp and affiliate of U. Pursuant to the Securities Exchange Act ofU. Bancorp Investments must provide clients with certain financial information. The U. Bancorp Investments Statement of Financial Condition is available for you to review, print and download. Bancorp Investments Order Processing information. Skip to main content. Investing Automated Investor Are you new to online investing or do you prefer to have guidance from experienced investment professionals?

Start investing Learn. Diversification score. Monte Carlo Simulation. Tax-efficient investing. You are here:. Return to content, Footnote 1.

Why You NEVER Own Mutual Funds In a Taxable Account Part 1

Is a stocks and shares ISA right for you?

These tax-aware strategies can help you maximize giving:. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. Please Click Here to go to Viewpoints signup page. The benefits of choosing Tax-Managed Model Strategies Pre-allocated strategies meet various risk-tolerance levels Aimed to maximize the after tax-returns of an investment with the intention of minimizing distributions Multi-asset diversification and multiple money managers and efficienf help manage overall portfolio risk Important product changes Effective June 11,the Tax-Managed Model Strategies were reallocated. The funds and the SPP may not be appropriate for all investors. Like retirement, there are no shortcuts when it comes to saving, but there are some options that can help your money grow tax-efficiently. The data assumes reinvestment of income and does not account for transaction costs.

Comments

Post a Comment