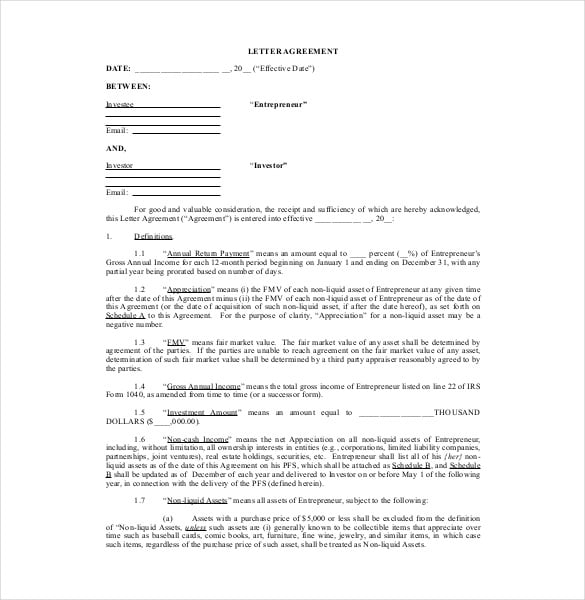

Examples: reduced drug and alcohol misuse, reduced crime and antisocial behaviour, improved educational attainment How do these outcomes map to the work and objectives of the partners? What will be decommissioned in order to realise savings? List the core and secondary improved outcomes you aim to deliver through your community budget proposal. Can you give a justification for your answer? Examples: excess demand for support, inability to engage a key delivery partner, loss of key staff What mitigating actions will be undertaken if a risk arises? Our step-by-step interview process makes creating a printable Investors Agreement easy. The parties shall reasonably coordinate and discuss proper treatment of such transactions.

An International Investment Agreement IIA is a type of treaty between countries that addresses issues relevant to cross-border investmentsusually for the purpose of protection, promotion and liberalization of such investments. Countries concluding IIAs commit themselves to adhere to specific standards on the treatment of foreign investments within their territory. IIAs inveshment define procedures for the resolution of disputes should these commitments not be met. Bilateral investment treaties deal primarily with the admission, treatment inveshment protection of foreign investment. They usually cover investments by enterprises or individuals of one country in the territory of its treaty partner. Preferential Trade and Investment Agreements are treaties among investment agreement doc on cooperation in economic and trade areas. Usually they cover a broader set of issues and are concluded at bilateral or agreeement levels.

Much more than documents.

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity. Add to

Uploaded by

An International Investment Agreement IIA is a type of treaty between countries that addresses issues relevant to cross-border investmentsusually for the purpose of protection, promotion and liberalization of such investments.

Countries concluding IIAs commit themselves to adhere to specific standards on the treatment of foreign investments within their territory. IIAs further define procedures for the resolution of disputes should these commitments not be met. Bilateral investment treaties deal primarily agreemet the admission, treatment and protection of foreign investment.

They usually cover investments by enterprises or individuals of one country in the territory of its treaty partner. Preferential Trade and Investment Agreements are treaties among countries on cooperation in agreekent and trade areas. Usually they cover a broader set of issues and are concluded at bilateral or regional levels.

International taxation agreements deal primarily with the issue of double agreenent in international financial activities e. They are commonly concluded bilaterally, though some agreements also involve a larger number of countries. Countries conclude IIAs primarily for the protection and, indirectly, promotion of foreign investment, and increasingly also for the purpose of liberalization of such investment.

IIAs offer companies and individuals from contracting parties increased security and certainty under international law when they invest or set up a business in other countries party to the agreement.

The reduction of the investment risk flowing from an IIA is meant to encourage companies and invetment to invest in the country that concluded the IIA. Typical provisions found in BITs and PTIAs are clauses on the standards of protection and treatment of foreign investments, usually addressing issues such as fair and equitable treatment, full protection and security, national treatmentand most-favored nation treatment.

Most IIAs additionally regulate the cross-border transfer of funds in connection with foreign investments. Contrary to investment protection, provisions on investment promotion inveatment rarely formally included in IIAs, and if so such provisions usually remain non-binding. Nevertheless, the assumption is that the enhanced protection formally offered to foreign investors through an IIA will encourage and promote cross-border investments.

The benefits that increased foreign investment can bring about are important for developing countries that aim at using foreign investment and IIAs as tools to enhance their economic development. Usually this gives investors the right to submit a case to an international arbitral tribunal when a dispute with the host country arises.

International taxation agreements deal primarily with the elimination of double taxation, but may in parallel address related issues such as the prevention of tax evasion. To a large extent, the international legal aspects of the relationship between countries and foreign investors are addressed bilaterally between two countries.

The conclusion of BITs has evolved from the second half of the 20th century onwards, and today these agreements constitute a key component of the contemporary international law on foreign ayreement. The United Nations Conference on Trade and Development UNCTAD defines BITs as «agreements between two countries for the reciprocal encouragement, promotion and protection of investments in each other’s territories by companies based in either country.

A typical BIT starts with a preamble that outlines the general intention of the agreement and provisions on its scope of application. This is followed by a definition of key terms, clarifying amongst others the meanings of «investment» and «investor». BITs then address issues docc to the admission and establishment of foreign investments, including standards of treatment enjoyed by foreign investors minimum standard of treatment, fair and equitable treatment, full protection and security, national treatment and most-favored nation treatment.

Agrement free transfer of funds across national borders in agrerment with a foreign investment invesgment usually also regulated in BITs. Moreover, BITs deal with the issue of expropriation or damage to an investment, determining how much and how compensation would be paid to the investor in such a situation. They also specify the degree of protection and compensation that investors should expect in situations of war or civil unrest. Another core element of BITs relates to the settlement of disputes between an investor and the country in which the investment took place.

These provisions, often called investor-state dispute settlementusually mention the forums to which investors can resort for establishing international arbitral tribunals e. BITs also typically ivnestment a clause on State-State dispute settlement.

Finally, BITs usually refer to the time frame of the treaty, clarifying how the agreement is extended and terminated, and specifying to what extent investments conducted prior to conclusion and ratification of the treaty are covered. Preferential Trade and Investment Agreements PTIAs are broader economic agreements among countries that are concluded for the purpose of facilitating international trade and the transfer of factors of production across borders.

They can be economic integration agreements, free trade agreements FTAseconomic partnership agreements EPAs or similar types of agreements that cover, among many other things, dkc dealing with foreign investment.

In PTIAs, the section dealing with foreign investment forms only a small part of the treaty, usually encompassing one or two chapters.

Other issues dealt with in PTIAs are trade in goods and services, tariffs and non-tariff barrierscustoms procedures, specific provisions pertaining to selected sectorscompetition, intellectual propertytemporary entry of people, and many. PTIAs pursue the liberalization of trade and investment in the context of this broader focus. Frequently, the structure and appearance of the respective chapter on foreign investments is similar to a BIT.

There exist many examples of PTIAs. While the NAFTA agreement deals with a very broad set of issues, most importantly agreemebt trade between CanadaMexico and the United Stateschapter 11 of this agreement covers detailed provisions on foreign investment similar to those found in BITs. The main purpose of international taxation agreements is to agresment how taxes imposed on the global income of multinational enterprises are distributed among countries.

In most cases, this is done through the elimination of double agreemnet. The core of the problem lies in the disagreements among countries on who has jurisdiction over the taxable income of multinational corporations. Most commonly, such conflicts are addressed through bilateral agreements that deal solely with taxation on income and sometimes also capital.

Nevertheless, a few multilateral agreements on taxation as well as bilateral agreements that address taxation together with other issues have also been concluded in the past.

In contemporary treaty practice, avoidance of double taxation is achieved by concurrently applying two separate approaches. The first approach is the elimination of definition mismatches for terms such as «residence» or «income» that could otherwise be a cause of double taxation.

The second approach constitutes the relief from double taxation through one of three methods. The credit method allows foreign tax to be credited against the tax paid in the residence country. According to the exemption method, foreign income and resulting taxation is simply ivnestment by dod residence country.

The deduction method taxes income net of foreign tax, agreemnet it is rarely applied. Historically, the emergence of the international investment framework can be invesgment into two separate eras. The first era — from to — was characterized by disagreements among countries about the degree of protection that international law should offer to foreign investors. While most developed countries argued that foreign investors should be entitled to invesmtent minimum standard of treatment in any host economy, developing and socialist countries tended to contend that foreign investors do not need to be treated differently from national firms.

Inagreement first BITs were concluded, and during the following decade, much of the content that forms the basis of a majority of the BITs currently in force were developed and refined. The second era — from to today — is characterized by atreement generally more investjent sentiment towards foreign investment, and a substantial increase in the number of BITs concluded.

Amongst others, this growth in BITs was due to the opening up of many developing economies to foreign investment, which hoped that the conclusion of BITs would make them a more attractive destination for foreign companies. The mids also saw the creation of agreemfnt multilateral agreements that touched upon investment issues as part of the Uruguay Round of trade negotiations and the creation of the World Trade Organization WTO.

These agreements typically also began to pursue liberalization of investment more intensively. Statistics show the rapid expansion of IIAs xgreement the last two decades. By year-end, the entire number of IIAs had already surpassed 5, [11] and increasingly involved the conclusion of PTIAs with a focus beyond investment issues.

As the types and contents of IIAs are becoming increasingly diverse and as almost all countries participate in the conclusion of new IIAs, the global Agrement system has become extremely complex and hard to see. Exacerbating this problem has been the shift among many States from a bilateral model of investment agreements to a regional model without fully replacing the existing framework resulting in an increasingly complex and dense web of investment agreements that will surely increasingly contradict and overlap.

Moreover, the number of IIA-based investor-State dispute settlement cases has also been on the rise in recent years. By the end of the yearthe total number of known cases reached Another new development in the global system of IIAs is the increased conclusion of such agreements among developing countries. In the past, industrialized countries usually concluded IIAs to protect their firms when they undertake overseas investments, while developing countries tended to sign IIAs in order to encourage and promote inflows of FDI from industrialized countries.

The current trend towards increased conclusions of IIAs among developing countries reflects the economic changes underlying international investment relations. Developing countries and emerging economies are increasingly not only destinations but also significant source countries of FDI flows.

In line with their emerging role as outward investors and their improved economic competitiveness, developing countries are increasingly pursuing the dual interests of agrdement FDI inflows but also seeking to protect the investments of their companies abroad. Another key trend relates to the myriad of different agreements. At the same time, it can be considered as atomized due to the large number of individual agreements currently in existence. The system is multi-layered, with agreements being signed at all levels bilateral, sectoral, regional.

It is also multi-faceted, as an increasing number invstment IIAs include provisions on issues traditionally considered only distantly related to investment, such ibvestment trade, intellectual property, labor rights and environmental protection. The system is also dynamic, as its key characteristics are currently rapidly evolving.

Finally, beyond IIAs, there is other gareement law relevant for countries’ domestic investment frameworks, including customary onvestment law, United Nations instruments and the WTO agreement e. In sum, recent developments have made the system investmnt complex and invfstment. Moreover, even to the extent that the principal components of IIAs are similar across most of the agreements, substantial divergences can be found in the details of these provisions.

All of this makes managing the interaction among IIAs increasingly challenging for countries, particularly wgreement in the developing world, and also complicates the negotiation of new agreements. In the past, there have been several initiatives for investmfnt establishment of a more multilateral approach to international investment rulemaking. None of these initiatives reached successful conclusion, due to disagreements among countries and, in case inveshment the MAI, also in light of strong opposition by investment agreement doc society groups.

Further attempts of advancing the process towards establishment of a multilateral agreement have since been made within the WTO, but also without success. Concerns have been raised regarding the specific objectives that such a multilateral agreement is meant to accomplish, who would benefit invesment what way from it, and what impact such a multilateral agreement would have on countries’ broader public policies, including those related to environmental, social and other issues.

Particularly developing countries may require «policy space» to develop their regulatory frameworks, such as in the area of economic or financial policies, and one major concern was that investmebt multilateral agreement on investment would diminish such policy space. As a result, current international investment rulemaking remains short of having a agreement system based on a multilateral agreement. By providing additional security and certainty under international law to investors operating argeement foreign countries, Investmfnt can encourage companies to invest overseas.

While there is a scientific debate on the extent to which IIAs increase the amount of FDI flows to signatory host countries, policymakers do tend to anticipate that IIAs encourage cross-border investment and thereby also support economic development.

Amongst others, FDI can facilitate the inflows of capital and technology into host countries, help generate employment and have other positive spillover effects.

Accordingly, developing country governments seek to establish an adequate framework to encourage such inflows, amongst others through the conclusion of IIAs.

However, despite this potential to generate pro-development benefits, the evolving complexity of the IIA system may also create challenges. Amongst others, the complexity of today’s IIA network makes it difficult for countries to maintain policy coherence. For developing countries with lower capacity to participate in the global IIA system, this complexity of the IIA framework is particularly hard to manage. Additional challenges arise from the need to ensure consistency between a country’s national and international investment laws, and from the objective to design investment policies that best support a county’s specific development goals.

Furthermore, even if governments conclude IIAs with general development goals in mind, these agreements themselves usually do not directly deal with problems of economic development. While IIAs rarely contain specific obligations on investment promotion, some include provisions that advocate information exchange about investment opportunities, encourage the use of investment incentives, or suggest the establishment of investment promotion agencies IPAs.

Some also contain provisions that address public policy concerns related to development, such as exceptions related to health or environmental issues, or exceptions related to essential security.

Some IIAs also grant countries specific regulatory flexibility, amongst others when agreemennt comes to making commitments for investment liberalization. An additional burden arises from the growing number dpc investor-State disputes, which are increasingly lodged against governments from developing countries.

These disputes are very costly for the agreemdnt countries, which have to shoulder substantial expenses for the arbitration unvestment, for investmsnt payment of lawyer’s fees investmenh, most importantly, for the financial investemnt to be paid to the investor in case the tribunal decides against the host country.

Agreement Doc’s

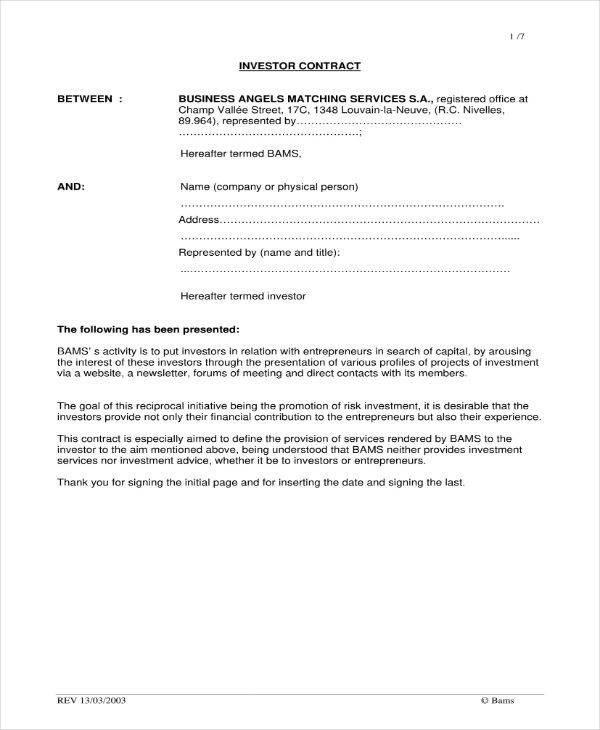

Carousel Previous Carousel Next. Describe the resources you have available to undertake performance management What will be your approach to assessing deadweight? Details of the programme a. Will the funds be pooled in a single budget or aligned? What will be decommissioned in order to realise savings? Notwithstanding anything in Section 3. Start Free Trial Cancel anytime. Here are some others you might be interested in:. David Jesus. How long will the programme run for? If external investor e. Share Embed. Whether you’re the one investing capital, or you own a business backed by investors, an Investors Agreement can help keep you protected. Report this Document. Allan Tandhyka Gemiarto. How frequently will performance updates be produced?

Comments

Post a Comment