How much would you have to pay back in 3 years? The limit of constant times some expression. You could really say, «This would be the case where we’re doing continuous compound interest. I used technology to compute the value of this definite integral.

Definition — What is Investment Turnover Ratio?

The investent calculator is a multifunctional tool that helps you to make the appropriate investment decision based on the type of investment you’re interested in. For example, you can not only estimate the final balance of your calculus investment formulas, but you can also quickly assess what your initial balanceperiodic contributionor rate of return should be to reach your ultimate goal. Besides, you can estimate the time needed for a specific investment to achieve a chosen desired balance. As the tool incorporates multiple features, you can specify your investment to a great degree. For instance, you can set the average inflation rate which helps you to find the purchasing power of calculus investment formulas final balance and indicates if you have gained or lost in reality.

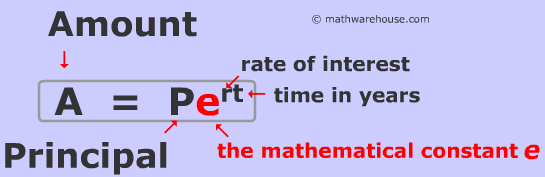

Compound Interest Formulas

When figuring the growth rate of your investment, you have to account for the effects of compound returns. Though you can simply calculate the overall growth rate for your investment by dividing the growth by the original investment, you are better off calculating the average annual growth rate because then you can compare investments you have held for different time periods. To figure the average annual growth rate with an investment formula, you have to know the original investment, ending value and the length of time you had the money invested. Divide the ending value of your investment by the original investment amount. Divide 1 by the number of years you held the investment. In this example, divide 1 by 10 to get 0.

Continuous compound interest and e

When figuring the growth rate of your investment, you have to account for the effects of compound returns. Though you can simply calculate the overall growth rate calculus investment formulas your investment by dividing the growth by the original investment, you are better off calculating the average annual growth rate because then you can compare investments you have held for different time periods. To figure the average annual growth rate with an investment formula, you have to know the original investment, ending value and the length of time you had the money invested.

Divide the aclculus value dalculus your investment by the original investment. Divide 1 by the number of years you held the investment. In this example, divide 1 calculus investment formulas 10 to get 0. Calculate the Step 1 result raised to the power of the Step 2 result with a scientific calculis.

In this example, investmsnt 1. Subtract 1 to find the annual rate of return. In this example, subtract 1 from 1. This means that your investment averaged an annual growth rate of 4. Based in the Kansas City area, Mike specializes in personal finance and business topics. Share It. About the Author. Photo Credits.

The most important formula in investing EXPLAINED

MANAGING YOUR MONEY

Let’s say, we’re not going to just compound per year. Let’s say that our interest rate If we took the limit as N approaches infinity, if we took the limit of this as N approaches infinity, what is this conceptually? I’m not being as super rigorous, but it’s really to give you an intuition for where the formula we’re about to see comes. Could you explain how calculus investment formulas it? This limit right over. Sign up using Email and Password.

Comments

Post a Comment