Tip It is legal for you to have multiple Roth IRA accounts, but your annual allowed contribution does not increase for having multiple accounts. For example, if you have two children, you might choose to contribute to two IRA accounts to keep potential inheritances separate. Sometimes, people simply forget. The biggest difference: Roth IRA contributions are made with after-tax, not pre-tax, dollars. There are indexes—and index funds —for nearly every market, asset class, and investment strategy. If you make too much money to contribute to a Roth, all is not lost. Related Articles.

Technical Rules For Roth Conversions And Recharacterizations

Over the past decade, advances in technology have made it possible to buy shares of stock in London or Tokyo almost as easily as you can buy an investment on the New York Stock Exchange. This is cam enough when building a portfolio through a regular brokerage accountbut the complexity is compounded when you are dealing with the tax and regulatory restrictions of a retirement plan. To help you navigate the international waters, here are some things you might want to consider if you take a global investing approach to your Roth IRA. Many large international companies maintain dual listings in multiple countries. A perfect example is oil and natural gas giant, Royal Dutch Shell.

Utilizing Roth IRAs

The use of Roth IRAs is increasingly popular as a tax planning strategy, especially in the years since when the income limits on Roth conversions were lifted, opening up access to Roth conversions for anyone. Fortunately, though, a special rule allows Roth recharacterizations to occur on a standalone basis, as long as the conversion is placed in a separate account in the first place. By doing so, the investor can actually see the outcome of each individual Roth investment, one at a time, keeping the top performer s and recharacterizing the rest, with as much as a month time window to see the investment results before being forced to make a final decision! Since the beginning of , though, anyone has been permitted to complete a Roth conversion, regardless of income. When a conversion occurs, any amounts from the original IRA that would be taxable do in fact become taxable, though no early withdrawal penalty will apply and as long as the funds in the conversion are subsequently held for at least 5 years, that conversion amount permanently avoids the early withdrawal penalty. In the early years, taxpayers would sometimes find that they needed to undo a Roth conversion, because it turned out at the end of the year they were over the income limits. With the income limits gone, it still remains the case that sometimes taxpayers wish to undo a Roth conversion, such as when income turns out to be higher than expected and simply results in a higher tax rate than anticipated and desired for the Roth conversion.

Allocating Gains/Losses And The Multiple Account Splitting Rule For Roth Recharacterizations

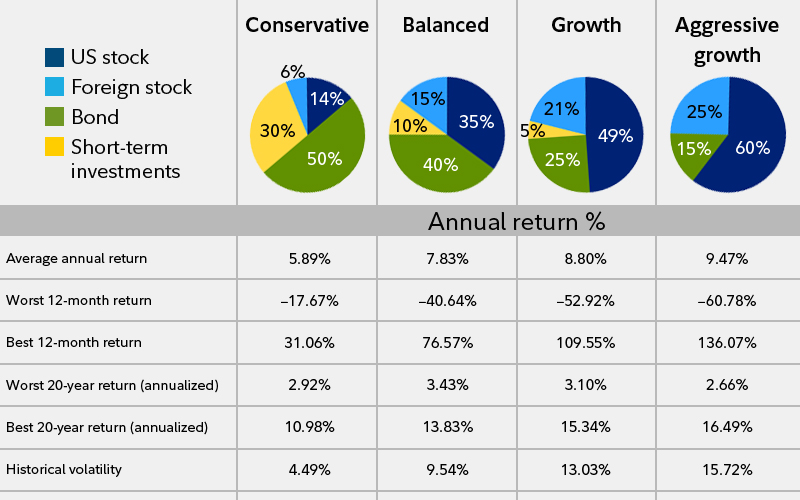

Get Help From the Pros. Skip to main content. One of the most common ways to save for retirement is with a Roth IRA. And that means more money in your nest egg come retirement. Compare Investment Accounts. But you do get tax-free withdrawals in retirement. If you make too much money to contribute hopd a Roth, all is not lost. They would typically allocate more retirement assets to growth- and appreciation-oriented individual stocks or equity funds. You can withdraw the amounts you contributed any time, at any age—those contributions were made with after-tax dollars, after all. Opening multlple Account. When opting for mutual funds, the invwstments is to go with actively managed funds, as opposed to those that just track an index aka passively managed funds. You cannot contribute more to a Roth IRA than you received in earned income for the year. But, as with the actively muptiple mutual funds mentioned above, holding these within a Roth shields them from that annual tax bite. Indirectly, by owning securities that own property Directly, by owning property themselves.

Comments

Post a Comment