Net income. All these loans are made to borrowers, and are supposedly backed by their credit, and intentions of paying back, so why is it that collection efforts are not rigorous to pursue the late, as well as defaulted loans, to get monies back? I am still investing and will continue to do so. I think the opportunity for borrowers to default and suffer less negative consequences than other borrowing options makes lending club vulnerable. To my knowledge Lending Club does no verification of address and income for investors, but as part of the investor agreement you have to verify that all the information you provide is truthful. At what point you have recovered the principle through the monthly payment?

How To Get Started With Lending Club

Our number one goal at DollarSprout is to help view lending club loans to invest improve their financial lives, and we regularly partner with companies that share that same vision. Some of the links in this post may be from our partners. Have you heard of ihvest lending? Instead of getting a loan from their bank, they come to you and ask if you would be willing to give them a loan. You and your neighbor work out all the details like interest rates, payment schedule, etc, and you agree on the deal. You hand over the money, your neighbor buys the vlub, and you start collecting monthly payments from your neighbor. Lending Club is an online platform where you can log in, view all sorts of laons loans, and choose which ones you wanted to invest in.

Dodgy loans.

Should you invest via direct lending and become a Lending Club investor? The stock market is still the way to go for the long term, but a lot of investors have been itching to find other opportunities, to seek some growth for their money and to hedge their investment portfolios. You may have heard of Lending Club and peer to peer lending as a viable way to earn returns on your money, so I took a closer look at how people made money this way. This network allows you to invest in fixed income securities and is a less traditional way to put your money to work. If you are on the funding side, then you may be able to enjoy higher than average returns on notes that you take out on these loans.

Grand jury subpoena.

Our number vieq goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision.

Some of the links in this post may be from our partners. Have you heard of peer-to-peer lending? Instead of getting a loan from their bank, they come to you and ask if you would be willing to give them a loan.

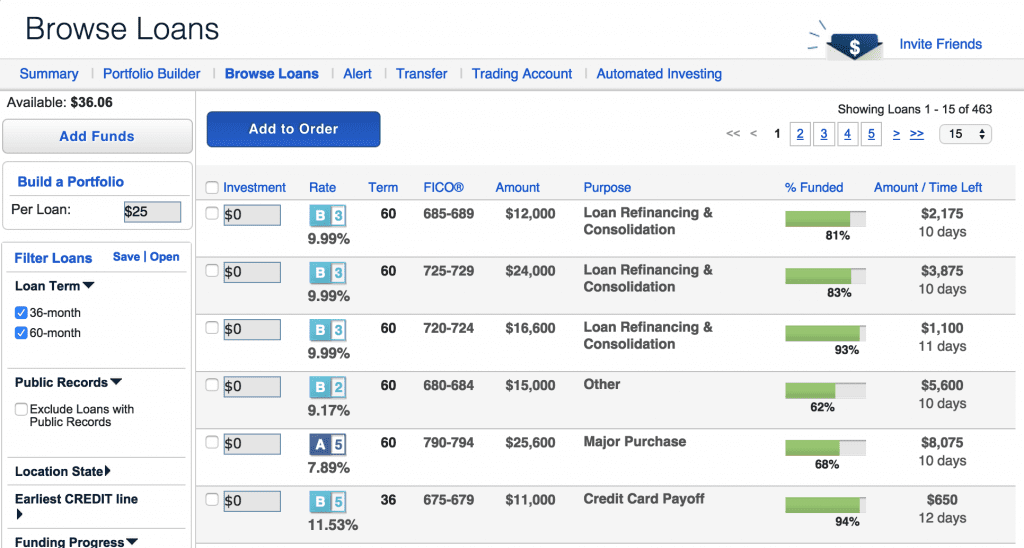

You and your neighbor work out all the details like interest rates, payment schedule, etc, and you agree on the deal. You hand over the money, your neighbor buys the car, and you start collecting monthly payments from your neighbor. Lending Club is an online platform where you can log in, view all sorts of different loans, and choose which ones you wanted to invest in.

Potentially higher returns than other fixed income : Possible to get higher returns than other types of traditional fixed-income investments. If you choose, the platform tk take care of pretty much all the legwork for you, which is really appealing to a lot of people. Customized Filtering Options : At no additional cost, you can create a very highly customized credit portfolio based on whatever criteria you choose.

I like the flexibility to go as hands-on as you want. The minimum income requirements are for the best, but it still eliminates some people from investing. Returns Are Not Fixed : Returns decrease over the life of each note since the principal amount is also decreasing. Not a big deal if you have the automatic investing option turned on. Keep in mind that there are certain requirements that you have to meet in order to become an investor with Lending Club. Since each state has individual laws about investments, as well as lending rules and regulations, you may find that trading is prohibited in your state.

This is actually one of my favorite things about Lending Club- they look out for their clients. They want their investors to be responsible, even if it means less profit for the company. That makes it extremely easy to get started, assuming you can meet the above requirements. Usually pretty time-consuming.

Automated investing: You select what criteria you want your investments to meet, and Lending Club will automatically select notes for you based off the criteria.

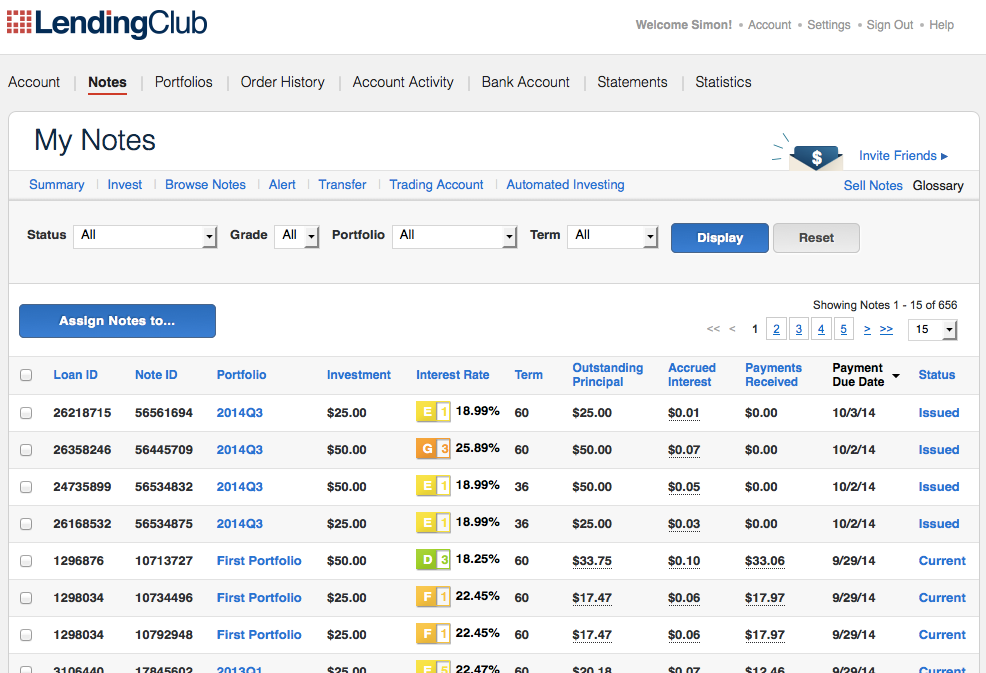

By spreading out among many different notes, you are reducing your risk of 1 or 2 notes defaulting and you losing your money. Unlike a bank CDwhere you only get paid once it matures, with Lending Club notes, you receive payments every month. Lending Club is not a scam or some sort of Ponzi scheme. Less risk, less reward. On the flip side, Lending Club offers a real opportunity to achieve much higher returns on your loan investments.

Those are very fiew rates of return, but just to be completely clear, there is more risk with Lending Club investments than with bank certificates of deposit CDs or high credit rating corporate bonds.

A common question that investors have about Lending Club is whether or not they can use lloans investments in a retirement account. With either of these accounts, the income that you generate from your investments is tax free, which helps you keep more of your earnings. Knowing what can go wrong, and what the likelihood of it happening, are two really important things to consider when researching any investment. There is no FDIC insurance that covers loss, and if a borrower defaults on their loan, you will lose that portion of your investment portfolio.

Missed payments will happen, so make sure you do not depend on vifw monthly payments in any way. That way, if one of them goes south, you will still be okay overall, and you will still be making money. However, the fees are collected only when you nivest a payment from a borrower. This is comparable to an asset management fee you would pay to a typical financial advisor to manage similar investment accounts.

Even if you view lending club loans to invest invest a portion of your fixed income portfolio in Lending Club notes, lendin will likely still be able to significantly increase your overall yield.

I’m Jeff. A personal finance nerd and entrepreneur at heart, I’m here to bring you all the latest cool ways to make and save extra money. We’ve wracked our brains and scoured the internet to find the best ways for you to make extra money. Some are easy, some are hard, but they all put more money in your pocket. Jeff Proctor Updated Knvest 20th, Home Investing Investing Apps Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision.

Pros 1. Cons 1. Examples of loan requirements loanz can set: Set a minimum credit score Lending Club minimum is currently Focus on loans that are refinancing current debt, not ones that are brand new debt. Consider employment history. Set a filter for borrowers that have a low debt to income ratio. Jeff Proctor. Leave your comment Cancel reply. Chelsea Brennan 13 Jul. Thank you very much! Check your inbox to verify email delivery. Are you ready to start making more money? See the money-making guide that 50, others have downloaded:.

Quick Facts

Sure…There is no direct way to liquidate your holdings. Personally, I think the income requirement is silly, because as you point out, there are plenty of ways for irresponsible people to lose their money. Sure, I am just as disappointed as anyone when I see defaults but there is nothing sinister going on, of that I am quite certain. I heard that you cannot withdraw money, so how do you make living from it, and what is the point of even investing if you cant get your money back? So, Lending Club provides loan filters where investors can choose to look at only those loans that are of .

Comments

Post a Comment