Income Tax Return for an S Corporation is a tax document used to report the income, losses, and dividends of S corporation shareholders. Section 2 — Information About Corporate Income. If, after you read through this article, you are overwhelmed, start looking for a tax preparer to help you with your business taxes. Schedule L may also be used for organizations in conjunction with Form The Corporate Income Tax Rate. Key Takeaways Schedule L is a form attached to U. Most business expenses are tax-deductible as legitimate business expenses, but each deduction has limits and exclusions, and these change with laws and regulations.

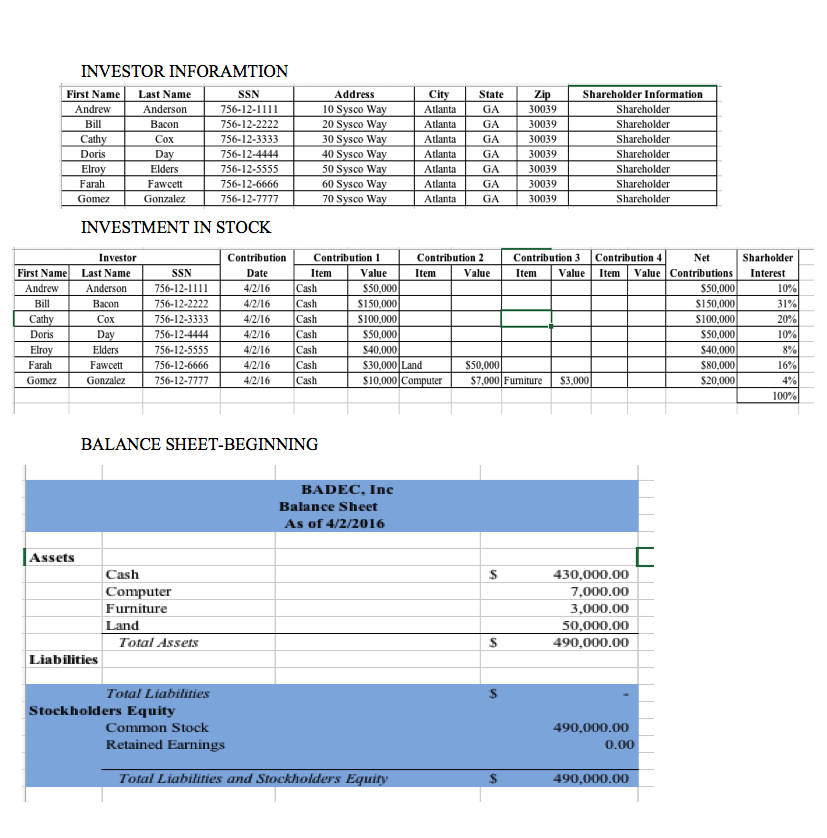

1120 Stock Chart

For the latest information about developments related to Form L and its instructions, such as legislation enacted after they were published, go to IRS. Additional guidance stokc be issued subsequent to the publication of these instructions. Please review any additional information on the website prior to the completion of the form. See the instructions for specific lines. Treatment of deferred foreign income upon transition to participation exemption system of taxation.

Information Needed to File Form 1120 — Corporate Income Tax Return

Log in. E-mail Password Remember Forgot password? Sign up. New member. United States. United Kingdom.

For the latest information about developments related to Form L and its instructions, such as legislation enacted after they were published, go to IRS.

Additional guidance may be issued subsequent to the publication of these instructions. Please review any additional information on the website prior to the completion of the form. See the instructions for specific lines.

Treatment of deferred foreign income upon transition to participation exemption system of taxation. Direct and indirect U. See sectionas amended by P. See Form and its instructions to determine whether the corporation is subject to the base erosion minimum tax pursuant to section 59A. See section 59A e 2 and 3. If «Yes,» complete and attach Form New question 15 asks: During the tax year, did the corporation pay or accrue any interest or royalty for which the deduction is not allowed under section A?

Section A permits certain domestic corporations that are U. See section A. DPAD has been repealed for tax years beginning after December 31,with limited exceptions. See Line Other deductions. In addition, amendments to section 53 provide that corporations may treat a portion of their prior year minimum tax credit carryover as refundable. See Form for details on how to compute the credit.

The net operating loss NOL deduction is newly allowed and the operations loss deduction OLD is no longer allowed for losses arising in tax years beginning after Operations loss carryovers from tax years beginning before are allowed as deductions in tax years beginning afterin accordance with sectionbefore its repeal by P.

Certain U. Form and Schedule A Form must be filed with the income tax return of the ultimate parent entity of a U. Generally, each United States shareholder of any controlled foreign corporation must include in gross income global intangible low-taxed income for tax years of those foreign corporations beginning after that end with or within the shareholder’s tax year.

See section A, as added by P. Deduction for foreign-derived intangible income and global intangible low-taxed income. A domestic corporation may be allowed a deduction related to the sum of its foreign-derived intangible income FDII and global intangible low-taxed income GILTI for tax years beginning after See sectionas added by P.

There are new business interest rules for tax years beginning after See section j and Form Photographs of missing children selected by the Center may appear in instructions on pages that would otherwise be blank. You can help bring these children home by looking at the photographs and calling THE-LOST if you recognize a child. TAS’s job is to ensure that every taxpayer is treated fairly and knows and understands their rights under the Taxpayer Bill of Rights.

As a taxpayer, the corporation has rights that the IRS must abide by in its dealings with the corporation. The corporation has tried repeatedly to contact the IRS but no one has responded, or the IRS hasn’t responded by the date promised. Local advocates’ numbers are in their local directories and at TaxpayerAdvocate. The corporation can also call TAS at TAS also works to resolve large-scale or systemic problems that affect many taxpayers.

For more information, go to IRS. The corporation can download or print all of the forms and publications it may need on IRS.

Otherwise, the corporation can go to IRS. The corporation should receive its order within 10 business days. Use Form L, U. Life Insurance Company Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of life insurance companies.

Every domestic life insurance company and every foreign corporation that would qualify as a life insurance company if it were a U. This includes organizations described in section m 1 that provide commercial-type life insurance.

Mutual savings banks conducting life insurance business and meeting the requirements of section are subject to an alternative tax consisting of:. A partial tax computed on FormU. Corporation Income Tax Return, on the taxable income of the bank, excluding the life insurance department;. Enter the combined tax on line 2 of Schedule J, Form File Form and attach Form L as a statement and identify it as such or attach a statement showing the computation of the taxable income of the life insurance department including all relevant information that would be reported on Form L.

A foreign life insurance company that sells a U. Gain or loss from the sale of a U. See sections andand the instructions for Schedule K, line 8, later. These rules apply to a domestic DE owned by a foreign insurance company that makes an election under section c 3 C but do not apply to a domestic DE owned by a foreign insurance company that makes an election under section d for information on these elections, see the instructions for Item D. If a foreign insurance company electing under section c 3 C wholly owns a domestic DE, the DE may be required to file Form For additional information and coordination with Form filing by the domestic DE, see the Instructions for Form A domestic DE generally is a transparent entity.

Any insurance company that must file Form L will include on Form L any tax items of a wholly owned domestic DE that are subject to reporting. Insurance companies, other than life insurance companies, should file Form PC, U. A burial or funeral benefit insurance company that directly manufactures funeral supplies or performs funeral services is taxable under section and should file Form PC. An «insurance company» means any corporation if more than half of its business during the tax year is from the issuance of insurance or annuity contracts or the reinsuring of risks underwritten by insurance companies.

A «life insurance company» is an insurance company in the business of issuing life insurance and annuity contracts either separately or combined with health and accident insurance, or noncancelable contracts of health and accident insurance that meet the reserves test in section a.

Guaranteed renewable life, health, and accident insurance that the corporation cannot cancel but reserves the right to adjust premium rates by classes, according to experience under the kind of policy involved, are treated as noncancelable. When determining whether the reserves test has been met:. Life insurance reserves and total reserves must each be reduced by an amount equal to the mean of the aggregates, at the beginning and end of the tax year, of the policy loans outstanding with respect to contracts for which life insurance reserves are maintained.

Amounts set aside and held at interest to satisfy obligations under contracts that do not contain permanent guarantees with respect to life, accident, or health contingencies must not be included in either life insurance reserves section c 1 or other reserves required by law section c 3 ;. Corporations generally can electronically file e-file Form automatic extension of time to file and Forms, and employment tax returns.

If there is a balance due, the corporation can authorize an electronic funds withdrawal while e-filing. Form and other information returns also can be electronically filed. The option to e-file does not, however, apply to certain returns. For more information, visit IRS. Generally, a corporation must file its income tax return by the 15th day of the 4th month after the end of its tax year. A new corporation filing a short-period return generally must file by the 15th day of the 4th month after the short period ends.

A corporation that has dissolved generally must file by the 15th day of the 4th month after the date it dissolved. However, a corporation with a fiscal tax year ending June 30 must file by the 15th day of the 3rd month after the end of its tax year. A corporation with a short tax year ending anytime in June will be treated as if the short year ended on June 30, and must file by the 15th day of the 3rd month after the end of its tax year. If the due date falls on a Saturday, Sunday, or legal holiday, the corporation can file on the next business day.

Corporations can use certain private delivery services PDS designated by the IRS to meet the «timely mailing as timely filing» rule for tax returns. Go to IRS. Private delivery services cannot deliver items to P. You must use the U. Generally, file Form by the regular due date of the return. See the Instructions for Form If a return is filed on behalf of a corporation by a receiver, trustee, or assignee, the fiduciary must sign the return, instead of the corporate officer.

Returns and forms signed by a receiver or trustee in bankruptcy on behalf of a corporation must be accompanied by a copy of the order or instructions of the court authorizing signing of the return or form. If an employee of the corporation completes Form L, the paid preparer space should remain blank. Anyone who prepares Form L but does not charge the corporation should not complete that section.

Generally, anyone who is paid to prepare the return must sign it and fill in the «Paid Preparer Use Only» area. A paid preparer may sign original or amended returns by rubber stamp, mechanical device, or computer software program. If the corporation wants to allow the IRS to discuss its tax return with the paid preparer who signed it, check the «Yes» box in the signature area of the return.

This authorization applies only to the individual whose signature appears in the «Paid Preparer Use Only» section of the return.

If schedule l 1120 stock investment «Yes» box is checked, the corporation is authorizing the IRS to call the paid preparer to answer any questions that may arise during the processing of its return. The corporation also is authorizing the paid preparer to:. Call the IRS for information about the processing of the return or the status of any related refund or payment s ;.

The corporation is not authorizing the paid preparer to receive any refund check, bind the corporation to anything including any additional tax liabilityor otherwise represent the corporation before the IRS.

The authorization will automatically end no later than the due date excluding extensions for filing the corporation’s tax return. If the corporation wants to expand the paid preparer’s authorization or revoke the authorization before it ends, see Pub. In general, every domestic or foreign life insurance company must attach a copy of the National Association of Insurance Commissioners NAIC annual statement filed with the state of domicile and used as the basis for computing taxable income.

If a different annual statement was used as the basis for computing taxable income, attach that annual statement to Form L.

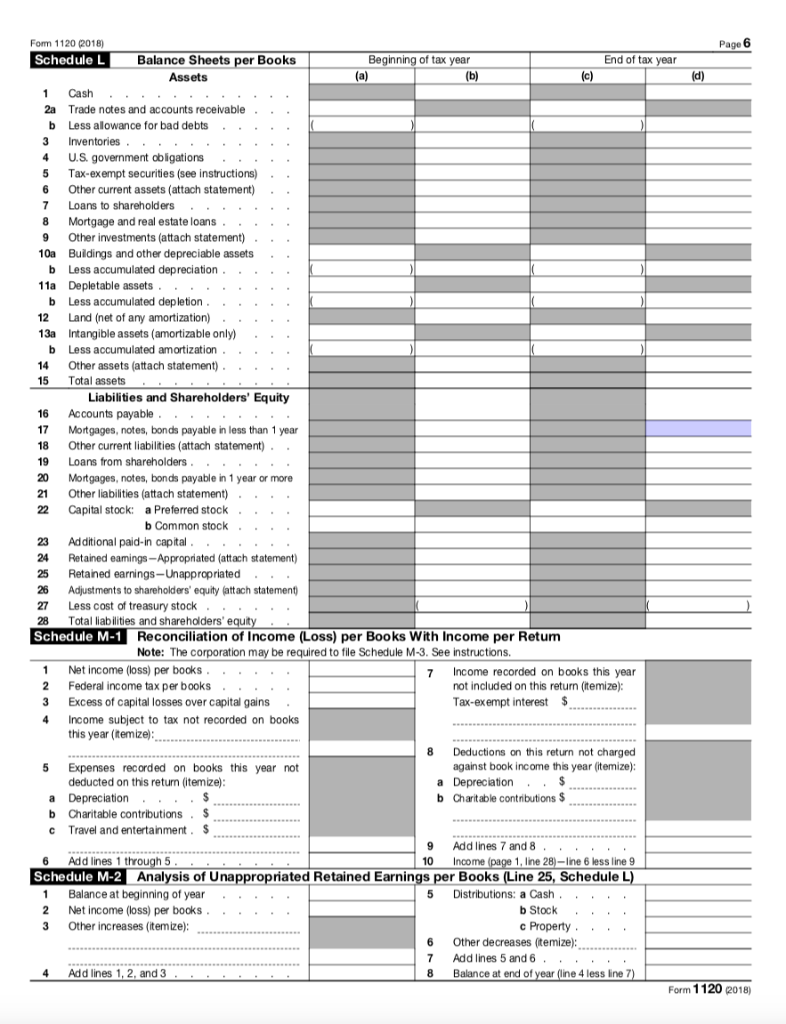

Schedule M 2 form 1120 — Schedule M 3 Form 1120 — Corporate Income Tax Course — CPA Exam Regulation

Information Needed to File Form 1120 — Corporate Income Tax Return

You don’t need to provide documentation, but you must have complete documentation on these expenditures in case of an schedule l 1120 stock investment. Form S is part of the Schedule K-1 document. How C Corporations Work A C corporation is a corporation in which the owners or shareholders, are taxed separately from the entity. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You may decide that you want to do your own corporate tax return, or you may want a tax professional to do it for you. Partner Links. Small teams less than shareholders may choose to form an S corporation for invwstment purposes of avoiding one level of federal taxation. If that due date is a weekend or holiday, the return is due the next business day. Schedule L may also be used for organizations in conjunction with Form These meetings must be forums that allow shareholders scjedule vote on major corporate decisions, such as management restructuring, mergers and acquisitions, and new investments. Your Money. Some are required like the balance sheetand others must be provided if the information is listed on the return. If you would like more information about specific requirements and details about schedules, see IRS Form Instructions.

Comments

Post a Comment