If you reinvest your dividend payments into shares of more stock, then those shares will grow, too, ideally kicking out dividend payments of their own. Some bonds earn compound interest Many bonds pay fixed interest sums, but some, such as zero coupon bonds, incorporate compounded growth. You might then wonder what kind of investment accounts earn compound interest.

13 Steps to Investing Foolishly

Small sums can grow into large sums through compounding. Photo: Damian GadalFlickr. This article was originally published on Sept. It was updated on April 5, Once you learn about the magic of compounding, it’s natural to want to put its power to work building your wealth.

13 Steps to Investing Foolishly

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest. Compound interest is standard in finance and economics. Compound interest is contrasted with simple interest , where previously accumulated interest is not added to the principal amount of the current period, so there is no compounding. The simple annual interest rate is the interest amount per period, multiplied by the number of periods per year.

Hate math but like money? Read on.

Small sums can grow into large sums through compounding. Photo: Damian GadalFlickr. This article was originally published on Sept. It was updated on April 5, Once you learn about the magic of compounding, it’s natural to want to put its power to work building your wealth.

You might then wonder what kind of investment accounts earn compound. Let’s review compounding most compound interest investment, along with interest, and then tackle the different kinds of accounts you might consider. What is interest? Compounding is often referred to in relation to. Interest is essentially a reward for lending money.

Banks charge interest when they lend money for mortgages or car loans, and credit card companies charge it, too, when you carry a balance of debt on your card. You can collect interest if you inteeest money in certain bank accounts or other accounts. That’s because the money you have in your bank account is available for the bank to use, such inferest when it lends money to other customers. Thus, it rewards you for leaving your money with it.

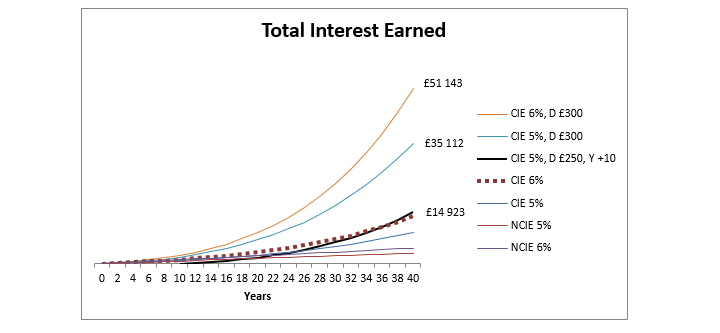

Interest comes in two primary varieties: simple and compound. That’s compounding doing its thing. What is compounding? Compounding is happening when your investment grows each year — and when the amount it grows by also grows.

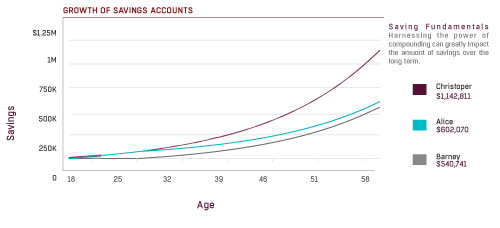

In other words, your investment generates earnings, and then those earnings generate earnings of their. It’s a relatively simple concept, but with mind-blowing possibilities, as the longer you let your investment grow, the more rapidly it will grow. But decades later, it’s growing by tens of thousands of dollars every five years. Many bank accounts offer compounded interest, though current rates are relatively low.

Photo: Mike MozartFlickr. Bank accounts earn compound interest Bank accounts are classic compounding vehicles. A key feature of most savings accounts is the interest they mlst, which will typically be higher than interest you can earn on checking accounts. Many checking accounts pay no interest at all. You can also earn compounded interest in money market accounts and certificates of deposit CDs.

Some bonds earn compound interest Many bonds pay fixed interest sums, but some, such as zero coupon bonds, incorporate compounded growth. The power of compounding — in non-interest-bearing investments It’s important to understand that the compounding is at work in scenarios other than interest.

Think, for example, of stocks that pay dividends. If you reinvest your dividend payments into shares of more stock, then those shares will grow, too, ideally kicking out dividend payments of their. The reinvestment can help your portfolio grow faster than it otherwise would, if you didn’t mots those sums. Compounding can also help you project your portfolio’s performance, for financial-planning purposes. It’s smart to aim for compounded growth in your portfolio. Bank accounts won’t offer you rapid growth because of the current low interest rate environment, but compoknd always write them off.

There have been plenty of years with interest rates coompound meaningful ranges and some years with double-digit interest rates. And remember that stocks can give you compounded growth.

One way to invest in stocks is through a brokerage. There are many institutions that offer online investment accounts. This article is part of The Motley Fool’s Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors.

We’d love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Thanks — and Fool on! Motley Fool Staff. Updated: Oct 19, at PM.

Stock Advisor launched in February of Join Stock Advisor. Next Article.

The Best Ways to Invest in Your 30s — Phil Town

Once you learn about the magic of compounding, it’s natural to want to put its power to work building your wealth.

Join Stock Advisor. You can collect interest if you have money in certain bank accounts or other accounts. That’s compounding doing its thing. Next Article. Interest is essentially a reward for lending money.

Comments

Post a Comment