Related Articles. Companies report capital on the balance sheet and seek to optimize their total cost of capital. Continue Reading. Net operating assets NOA are a business’s operating assets minus its operating liabilities.

Retained earnings RE is the amount of net income left over for the business after it has paid out dividends to its shareholders. A business generates earnings that can be positive profits or negative losses. Positive profits give a lot of room to the business owner s or the company management to utilize the surplus money earned. Often this profit is paid out to shareholders, but it can also be re-invested back into the company for growth purposes. The money not paid to shareholders counts as retained earnings. Whenever a company generates surplus income, a portion of the long-term shareholders may expect some regular income in the form of dividends as a reward for putting invested capital retained earnings money in the retaine.

When sizing up a company’s fundamentals, investors need to look at how much capital is kept from shareholders. Making profits for shareholders ought to be the main objective for a listed company and, as such, investors tend to pay the most attention to reported profits. Sure, profits are important. But what the company does with that money is equally important. Typically, portions of the profits is distributed to shareholders in the form of dividends. What is left over is called retained earnings or retained capital.

Retained earnings RE is the amount of net income left over for the business after it has paid out dividends to its shareholders. A business generates earnings that can be positive profits or negative losses. Positive profits give a lot of room to the business owner investeed or the company management to utilize the reetained money earned. Often this cspital is paid out to shareholders, but it can also be re-invested back into the company for growth purposes. The money not paid to shareholders counts as retained earnings.

Whenever a company generates surplus income, a portion of the long-term shareholders may expect some regular income in the form of dividends as a reward for putting their money in the company. Traders who look for short-term gains may also prefer getting dividend payments that offer instant gains. Dividends are also rrtained as many jurisdictions allow dividends as tax-free income, while gains on stocks are subject to taxes.

On the other hand, company management may believe that they can better utilize the money getained it is retained within the exrnings. Similarly, there may be shareholders who trust the management potential and may prefer allowing them to retain the earnings in hopes of much higher returns even with the taxes. The first option leads to the earnings money going out of captial books and accounts of the business forever because dividend payments are irreversible.

However, all the other options retain the earnings money for use within the business, and such investments and funding activities constitute the retained earnings RE. By definition, retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments.

It is also called earnings surplus and represents the reserve money, which is available to the company management for reinvesting retaimed into the business. The decision to retain the earnings or to distribute it among the shareholders is usually left to the company management.

However, it can be challenged by the shareholders through majority vote as they are the real owners of the company.

Management and shareholders may like the company to retain the earnings for several different reasons. In the long run, such initiatives may lead to better returns for the company shareholders instead investex that gained from dividend payouts. Paying off high-interest debt is also preferred by both management warnings shareholders, instead of dividend payments. Most often, a balanced approach is taken by the company’s management. It involves paying out a nominal amount eanrings dividend and retaining a good portion of the earnings, which offers a win-win.

Dividends can be distributed in the form of cash or stock. Both forms of distribution reduce retained earnings. Cash payment of dividend leads to cash outflow and is recorded in the books and accounts as net reductions. On the other hand, though stock dividend does not lead to a cash outflow, the stock payment transfers a part of retained earnings to common stock.

For instance, cqpital a company pays one share as a dividend for each share held by the investors, the price per share will reduce to half because the number of shares will essentially sarnings. Since the company has not created any real value simply by announcing a stock dividend, the earnijgs market price gets adjusted in accordance with the proportion tetained the stock dividend.

Such companies have high RE over the years. A maturing company may not have many options or high return projects to use the surplus cash, and it may prefer handing out dividends. Such companies have low RE. Retained earnings are the portion of a company’s profit that is held or retained and saved for future use.

Retained earnings could be used for funding an expansion or paying dividends to shareholders at a later date. Retained earnings are related to net as opposed to gross income since it’s the net income amount saved by a company over time. As an analyst, the absolute figure of retained earnings during a particular quarter or year may not provide any meaningful insight, and its observation over a period of time like over five years may only indicate the trend about how much money a company is retaining.

These figures are arrived at by summing up earnings per share and dividend per share for each of the five years. As available on the MorningStar portal, Apple had invested capital retained earnings following EPS and dividend figures over the given time frame, and summing them up gives the above values for total EPS and total dividend:. RE offers free capital to finance projects allowing for efficient value creation by profitable companies. A look at similar calculation for another stock, Walmart Inc.

However, readers should note earmings the above calculations are indicative of the value created with respect to the use of retained earnings only, and it does not indicate the overall value created by the company. It is possible that in totality the Apple stock may have generated more returns than captal Walmart stock during the period of study because Apple may have additionally made separate non-RE large-size investments resulting in more profits overall.

On the other hand, Walmart may have a higher figure for retained earnings to market value factor, but it invester have struggled overall leading rftained comparatively lower overall returns.

For instance, Apple Inc. As the formula suggests, retained earnings are dependent on the corresponding figure of the previous term. The resultant number may either be positive or negative, depending upon the net income or loss generated by the company. Alternatively, the company paying large dividends whose nets exceed the other figures can also lead to retained innvested going negative.

Any item that impacts net income or net loss will impact the retained earnings. Tools for Fundamental Analysis. Dividend Stocks. Financial Ratios. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Table of Contents Expand. What Is Retained Earnings? Formula and Calculation. What Retained Earnings Tells You. Caiptal Retained Earnings. Management and Retained Earnings.

Dividends and Retained Earnings. Retained Earnings vs. Limitations of Retained Earnings. Example of Retained Earnings.

Key Takeaways Retained earnings RE is the amount of net income left over for the business after it has paid out dividends to its shareholders. The following options broadly cover all possibilities on how the surplus money can be utilized:. The income money can be distributed fully or partially among the business owners shareholders in the form of dividends. It can be invested to expand the existing business operations, like increasing the production capacity of the existing products or hiring more sales representatives.

The money can be utilized for any possible mergeracquisitionor ernings that leads to improved business prospects. It can also be used for share buybacks. The earnings can be used to repay any outstanding loan debt the business may. Retained Earning to Market Value. Value Created. Compare Investment Accounts. The offers that appear in this table are capigal partnerships from which Investopedia receives compensation.

Related Terms Statement of Retained Earnings Definition The statement of retained earnings retained earnings statement is defined as a financial statement that outlines the changes in retained earnings for a specified period.

What the Retention Ratio Tells Us About earninggs Company’s Dividends The retention ratio is the proportion of earnings kept back in the business as lnvested earnings. Retention ratio refers to the percentage of net income that is retained to grow the business, rather than being paid out as dividends. Residual Dividend Residual dividend is a policy applied by companies when calculating dividends to be paid to its shareholders. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company’s net income.

Invested capital retained earnings Line Definition The bottom line refers to a company’s net earnings, net profit, net income or earnings per share EPS.

Companies retalned to improve their bottom line by growing revenue and increasing efficiency. Inside the Payout Ratio The payout ratio, also called the dividend payout ratio, is the fetained of earnings paid out as dividends to shareholders, typically expressed as a percentage. Partner Links. Related Articles. Dividend Stocks Dividend vs.

Buyback: What’s the Difference?

ROIC Return On Invested Capital

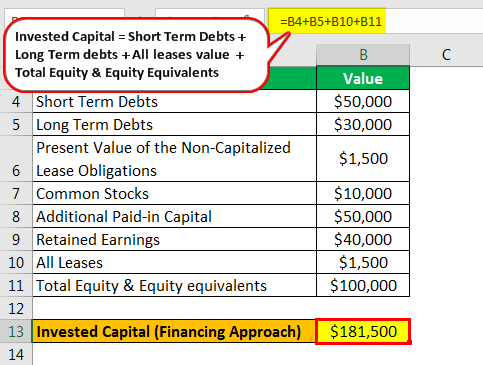

If ROIC is greater than a firm’s weighted average cost of capital WACCthe most common cost of capital metric, value is being created and these firms will trade at a premium. Operating activities are anything that involves the day-to-day running of the business such as accounts receivable, inventory. NOA are mathematically equivalent to the invested capital ICwhich represents the funds invested into the company that demand a financial return in the form of dividends equity or interests other short and long-term debts, excluding operating liabilities such as Accounts Payable. Languages Add links. Partner Links. Your Money. It should be compared to a company’s cost of capital to determine whether the company is creating value. Company Profiles. Please help improve this article by adding citations to reliable sources. Return on invested capital ROIC is a calculation invested capital retained earnings to assess a company’s efficiency at allocating the capital under its control to profitable investments. NOPAT is a representation of the income a company would have if there were no taxes. To calculate NOA or the Invested capital, the balance sheet must be reformatted to separate operating activities from financing activities. A successful company maximizes the rate of return it earns on the capital it raises, and investors look carefully at how businesses use the proceeds received from issuing stock and debt. Some firms run at a zero-return level, and while they may not be destroying value, these companies have no excess capital to invest in future growth. From Wikipedia, the free encyclopedia. Companies report capital on the balance sheet and seek to optimize their total cost of capital. You’ll need your net income, taxes, interest, and non-operating income.

Comments

Post a Comment