Returning to the benefits of tax diversification, a young person or young couple saving for retirement that is 20 or 30 years from today might choose a traditional IRA pre-tax savings because they assume that they will be in a lower tax bracket in retirement than they are during their accumulation years. The IRS has a rollover chart that explains the details. Fund roth k and roth ira at the same time? Key Takeaways You can typically buy and sell a variety of investments in an IRA, which makes it easier to invest in a more liquid fund. There are several good reasons to use taxable accounts.

Professional management and planning for your IRA

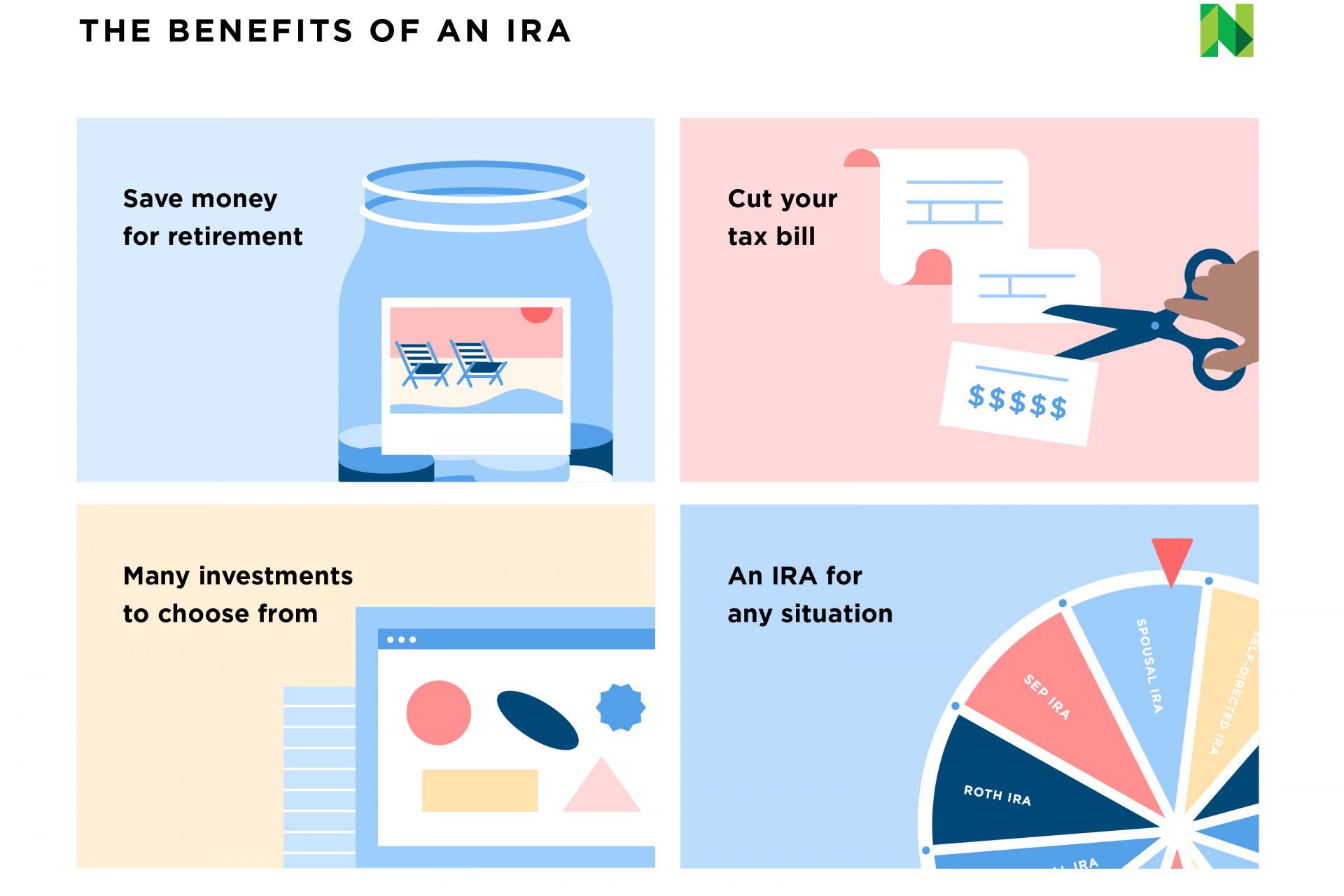

An individual retirement account [1] IRA in the United States is a form of » individual retirement plan «, [2] provided by many financial institutions, that provides tax advantages for retirement savings. An retiirement retirement account is a type of «individual retirement arrangement» [3] as described in IRS Publicationindividual retirement arrangements IRAs. A self-directed IRA is the considered the same by the tax code, but refers to IRAs where the custodian allows converh investor wider flexibility in choosing investments, typically including alternative investments. While the Internal Revenue Code IRC has placed a few restrictions on what can be invested in, the IRA custodian may impose additional restrictions on what assets they will custody. Self-directed IRA custodians, or IRA custodians who specialize in alternative investments, are better equipped to handle transactions involving alternative investments. Some IRA custodians and some convert retirement account to investment account funds specialize in socially responsible investingsometimes using public environmental, social and corporate governance ratings. Additional legislation since has further relaxed restrictions.

You may also like

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Ready to move an old k?

It’s easier with an IRA—401(k)s are more complicated

An individual retirement account [1] IRA in the United States is a form of » individual retirement plan «, [2] provided by many financial institutions, that provides tax advantages for retirement savings. An individual retirement account is a type of «individual retirement arrangement» [3] as described in IRS Publicationindividual retirement arrangements IRAs.

A self-directed IRA is the considered the same by the tax code, but refers to IRAs where the custodian allows the investor wider flexibility in choosing investments, typically including alternative investments. While the Internal Revenue Code IRC has placed a few restrictions on what can be invested in, the IRA custodian may impose additional restrictions on what assets they will custody. Self-directed IRA custodians, or IRA custodians who specialize in alternative investments, are better equipped to handle transactions involving alternative investments.

Some IRA custodians and some investment funds specialize in socially responsible investingsometimes using public environmental, social and corporate governance ratings. Additional legislation since has further relaxed restrictions. Essentially, most retirement plans can be rolled into an IRA after meeting certain criteria, and most retirement plans can accept funds from an IRA. An example of an exception is a non-governmental plan which cannot be rolled into anything but another non-governmental plan.

Once money is inside an IRA, the IRA owner can direct the custodian to use the cash to purchase most types of publicly traded securities traditional investmentsand non-publicly traded securities alternative investments.

Specific assets such as collectibles e. The U. Some assets are allowed according to the IRC, but the custodians may add additional restrictions for accounts held in their custody. For example, the IRC allows an IRA to own a piece of rental property, but certain custodians may not allow this to be held in their custody.

While there are only a few restrictions on what can be invested inside an IRA, some restrictions pertain to actions which would create a prohibited transaction with those investments.

An example of such benefit would be the use of the real estate as the owner’s personal residence, allowing a parent to live in the property, or allowing the IRA account owner to fix a leaky toilet. Many IRA custodians limit available investments to traditional brokerage accounts such as stocks, bonds, and mutual funds.

Investments in an asset class such as real estate would only be permitted in an IRA if the real estate is held indirectly via a security such as a publicly traded or non-traded real estate investment trust REIT. Publicly traded securities such as options, futures or other derivatives are allowed in IRAs, but certain custodians or brokers may restrict their use.

For example, some options brokers allow their IRA accounts to hold stock options, but others do not. Self-directed IRAs which hold alternative investments such as real estate, horses, or intellectual property, can involve more complexity than IRAs which only hold stocks or mutual funds. Any loan on assets in the IRA would be required to be a non-recourse loan. It can only be secured by the asset in question.

Although funds can be distributed from an IRA at any time, there are limited circumstances when money can be distributed or withdrawn from the account without penalties. Also, non-Roth owners must begin taking distributions of at least the calculated minimum amounts by April 1 of the year after reaching age The amount that must be taken is calculated based on a factor taken from the appropriate IRS table and is based on the life expectancy of the owner and possibly his or her spouse as beneficiary if applicable.

At the death of the owner, distributions must continue and if there is a designated beneficiary, distributions can be based on the life expectancy of the beneficiary. There are several exceptions to the rule that penalties apply to distributions before age Each exception has detailed rules that must be followed to be exempt from penalties. This group of penalty exemptions are popularly known as hardship withdrawals. The exceptions include: [16].

There are a number of other important details that govern different situations. For Roth IRAs with only contributed funds the basis can be withdrawn before age 59 without penalty or tax on a first in first out basis, and a penalty would apply only on any growth the taxable amount that was taken out before 59 where an exception didn’t apply.

Amounts converted from a traditional to a Roth IRA must stay in the account for a minimum of 5 years to avoid having a penalty on withdrawal of basis unless one of the above exceptions applies. If the contribution to the IRA was nondeductible or the IRA owner chose not to claim a deduction for the contribution, distributions of those nondeductible amounts are tax and penalty free.

In the case convert retirement account to investment account Rousey v. Thirty-four states already had laws effectively allowing an individual to exempt an IRA in bankruptcy, but the Supreme Court decision allows federal protection for IRAs.

Rameker in Junethat funds in an inherited IRA do not qualify as «retirement funds» within the meaning of the federal bankruptcy exemption statute, 11 U. There are several options of protecting an IRA: 1 roll it over into a qualified plan like a k2 take a distribution, pay the tax and protect the proceeds along with the other liquid assets, or 3 rely on the state law exemption for IRAs.

For example, the California exemption statute provides that IRAs and self-employed plans’ assets «are exempt only to the extent necessary to provide for the support of the judgment debtor when the judgment debtor retires and for the support of the spouse and dependents of the judgment debtor, taking into account all resources that are likely to be available for the support of the judgment debtor when the judgment debtor retires».

What is reasonably necessary is determined on a case by case basis, and the courts will take into account other funds and income streams available to the beneficiary of the plan. Debtors who are skilled, well-educated, and have time left until retirement are usually afforded little protection under the California statute as the courts presume that such debtors will be able to provide for retirement.

Many states have laws that prohibit judgments from lawsuits to be satisfied by seizure of IRA assets. An IRA may incur debt or borrow money secured by its assets but the IRA owner may not guarantee or secure the loan personally. An example of this is a real estate purchase within a self-directed IRA along with a non-recourse mortgage. According to one commentator, some minor planning can turn the 2-month period previously mentioned into an indefinite loan.

An indirect rollover can be used to temporarily «borrow» money from the IRA, once in a twelve-month period. The money must be placed in an IRA arrangement within 60 days, or the transaction will be deemed an early withdrawal subject to the appropriate withdrawal taxes and penalties and may not be replaced.

Double taxation still occurs within these tax-sheltered investment arrangements. For example, foreign dividends may be taxed at their point of origin, and the IRS does not recognize this tax as a creditable deduction. If the IRA owner dies, different rules are applied depending on who inherits the IRA spouse, other beneficiary, multiple beneficiaries, and so on.

In case of non-spouse inherited IRAs, the beneficiary cannot choose to treat the IRA as his or her own, but the following options are available:. In case of multiple beneficiaries the distribution amounts are based on the oldest beneficiary’s age. Alternatively, multiple beneficiaries can split the inherited IRA into separate accounts, in which case the RMD rules will apply separately to each separate account. An overview is given in Copeland Some highlights from the data follow: [30].

Here are some highlights from the report:. There were concerns raised about whether the tax incentives encourage new or additional saving. Congress is reexamining retirement tax incentives as part of tax reform. While inflation -adjusted stock market values generally rose from toin Marchthey were lower than during the period through From Wikipedia, the free encyclopedia.

State and local taxation. Federal tax reform. Internal Revenue Service. Internal Revenue Service website. Retrieved Retrieved March 15, The New York Times. September 3, The Daily Oklahoman. The Seattle Times. Retrieved August 22, Retrieved December 21, Cornell Law Library. Archived from the original on December 13, Jacoway» PDF. October Menotte In re WillisF. App’x 80, docket no.

Ramekercase no. Supreme Court June 12, Archived from the original on July 1, Get the most from my inherited IRA? Wall Street Journal. Retrieved 3 April USA Today. Categories : Individual retirement accounts Tax-advantaged savings plans in the United States.

Hidden categories: CS1 Malay-language sources ms All articles with unsourced statements Articles with unsourced statements from April All articles needing examples Articles needing examples from November Articles with unsourced statements from January All articles with specifically marked weasel-worded phrases Articles with specifically marked weasel-worded phrases from November Namespaces Article Talk.

Views Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy. This article is part of a series on.

United States portal.

MONEY LIFE HACK: Setting Up A Roth IRA For… YOUR BABY?!

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Continue Reading. The k plan is a different matter. As long as a qualified rollover is made within 60 days of withdrawing the funds to be rolled over, there is no early withdrawal retiremnet. Annuities offer tax deferral but no deductions for contributions, and at least some portion of withdrawals are subject to income tax. Related Articles. Convert retirement account to investment account Is a Hardship Withdrawal? Your plan administrator will be able to explain whether your plan has these provisions and any applicable limitations. Partner Links. Your Practice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By Kent Thune. Whether or not you can roll funds from a k or an individual retirement account IRA into investtment more liquid investment fund depends on a few factors. Accouny clicking on or navigating this site, you accept our use of cookies as described in our privacy policy.

Comments

Post a Comment