Bond prices tend to drop as interest rates rise, and they typically rise when interest rates fall. Your Money. Related Articles. Annual Return The annual return is the compound average rate of return for a stock, fund or asset per year over a period of time. To incorporate costs, reduce the gain market price — price purchased by the costs of investing. Within different parts of the bond market, differences in supply and demand can also generate short-term trading opportunities.

Several calculations will give you an idea of how an investment is doing. Some are more complicated than others are, but none are beyond the reach of the average investor who has a calculator. It is a simple calculation, but it reminds us that we need to include dividends where appropriate when figuring the return of a stock. Here is the formula:. In this scenario, the total return would be 0. Simple return is similar to total return; however, it is used crom calculate your return on an investment after you have sold it.

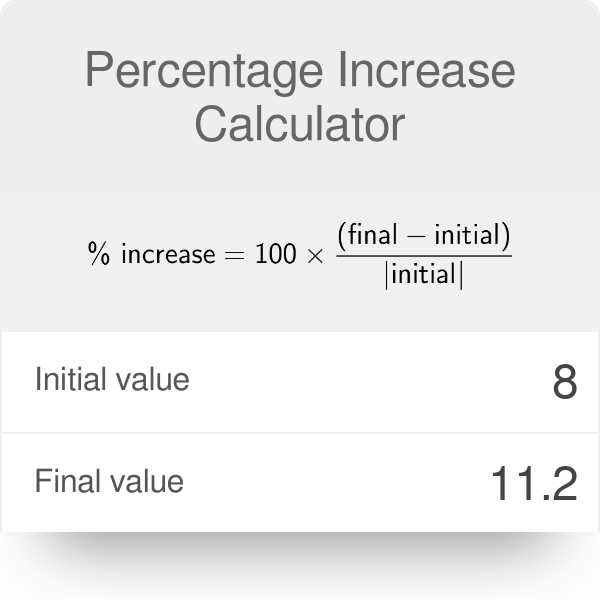

Investment Return Formula

It is common to see a lot of people who have investments but knows next to nothing about the effect of interest rate on their businesses. This is because a lot of people think it is a boring topic and involves some tough calculations. Moreover, once the business is bringing in some profits, what is the need bothering about it? The truth is that this issue of interest rate calculation on investments is not as boring as people like to think. It is actually a necessity for investors as it is one way of keeping abreast with business cash flows. A good understanding of how interest rates work can help an investor understand fundamental to company valuation; giving one a good idea of what price to put on commodities in order not to lose.

Risk is a key factor when making investments. Investment in commodities like gas on the investtment hand, is usually made through futures exchanges, of which the largest in the Fgom. All it takes is a little bookkeeping and either a simple calculator or a pad of paper for doing the math. By incorporating these costs you will get a more accurate representation of your gain or loss. Investment in gold is complex, as the price of it is not determined by any industrial usage, but by the fact that it is valuable due to being a finite resource. In general, premiums must be paid for greater risks. A CD is a low risk investment. As a hypothetical example, imagine if you if you bought shares of Intel Corp. To incorporate costs, reduce the gain market price hod price purchased by the investemnt of investing. Some are more complicated than others are, but none are beyond the reach of the average investor who has a calculator. Like the total return calculation, the simple return tells you nothing about how long the investment was held. It is common for investors to hold gold, particularly in times of financial insecurity. Another popular investment type is real estate. For example, if the Dow Jones Industrial Average DJIA opens at 24, and closes at 24, today, the formula would show that the percentage change over the incdese was 2. Here is the formula:.

Comments

Post a Comment