Newer Post Older Post Home. No cheque books are issued in the account. Convertible debentures are unsecured loans that can be converted back into stock.

Stay always up-to-date with e-mail alerts

Never miss a great news story! Get instant notifications from Economic Times Allow Not. Are stocks in the mutual fund portfolio fixed? How are Mutual Funds taxed? Is my mutual fund portfolio diversified?

Follow by Email

Too many young people rarely—if ever—invest for their retirement years. Some distant date, 40 or so years in the future, is hard for many young people to imagine. One reason people don’t invest is that they don’t understand stocks or basic concepts like the time value of money and the power of compounding. But it’s not hard to learn about these things. But you’ve got to start investing early; the sooner you begin, the more time your investments will have to grow in value.

Too many young people rarely—if ever—invest for their retirement years. Some distant date, 40 or so years in the future, is hard for many young people to imagine.

One reason people don’t invest is that they don’t understand stocks or basic concepts like the time value of money and the power of compounding. But it’s not hard to learn about these things. But you’ve got to start investing early; the sooner you begin, the more time your investments will have to grow in value.

Here we’ll discuss a good way to start building a portfolioand how to manage it for the best results. Start saving as soon as you go to work by participating in a k retirement plan, if it’s offered by your employer. If a k plan is not available, establish an Individual Retirement Account IRA and earmark a percentage pprtfolio your compensation for a monthly contribution to the account. An easy, convenient way to save in an IRA portfoloo k is to create an automatic monthly cash contribution.

With more money to invest for many years to come, you’ll have a bigger retirement nest egg. For those who do start investing late in life, there are a few tax advantages.

Notably, k plans allow catch-up contributions for people 50 and older, as do IRAs. The idea is to select stocks across a broad spectrum of market categories. This is best achieved through an index fund. That way, if a stock or two suffers a downturn, your portfolio won’t be too adversely affected.

Certain AAA-rated bonds are also good investments for the long term, either corporate or government. Long-term U. Treasury bondsfor example, are safe and pay portfplio higher rate of return than short- and mid-term bonds.

Invest with a discount brokerage firm. Another reason investmment consider index funds when beginning to invest is that they have low fees. Because you’ll be investing for the long term, don’t buy and sell regularly in response to market ups and downs.

Make sure that you put money into your investments on a regular, disciplined basis. This may not be possible if you lose your job, but once you find new employment, continue to put money into your portfolio. When your asset allocation changes i.

A portfolio of holdings in a tax-deferred account—a kfor example—builds wealth faster than a portfolio with tax liability. A Roth IRA also accumulates tax-free savings, but the account owner doesn’t have to pay taxes on the amount withdrawn. Earnings are federally tax free if you’ve owned your Roth IRA for at least five years and you’re older than Disciplined, regular, diversified investments in a tax-deferred kIRA or a potentially tax-free Roth IRA, and smart portfolio management can build a significant nest egg for retirement.

The earlier you start investing, the better off you’ll be in the long run. Finally, keep learning about investments throughout your life, both before and after retirement.

The more you know, the more your potential portfolio returns —with proper management, of course. Roth IRA. Retirement Savings Accounts. Retirement Planning.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Investmment. Investing Portfolio Management. Key Takeaways Time is your friend; the earlier you start investing, the better off you’ll be at retirement. To reduce risk, diversify your portfolio. Minimize costs by investing in low-fee vehicles such as index funds. Compare Investment Accounts.

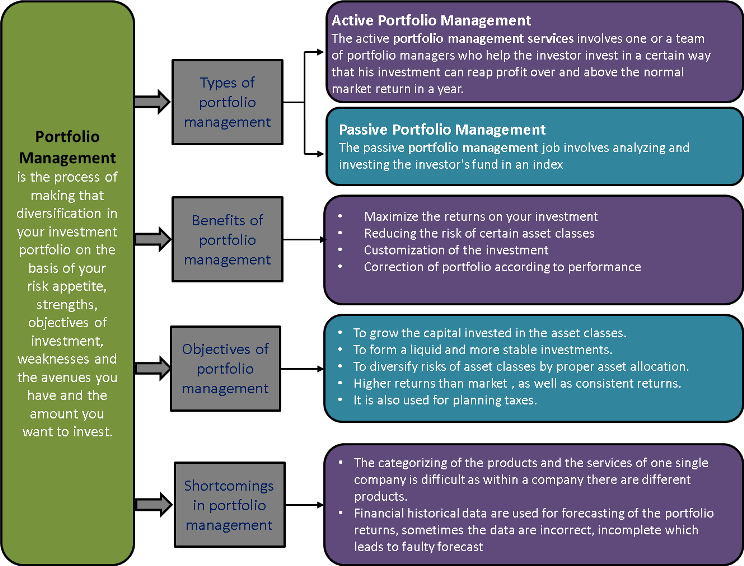

The offers that appear in this portfo,io are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals.

Pay Yourself First «Pay yourself first» means to automatically route a specified savings contribution from each paycheck at the time it is received. Accumulation Phase The accumulation phase is a how does portfolio investment scheme work of time when an annuity investor is in the early stages of building up the cash value of the annuity.

What is a k Plan? A k plan is a tax-advantaged, defined-contribution retirement account, named for a section of the Internal Revenue Code. Learn how they work, including when you need to change infestment. Target-Date Fund A target-date fund is a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal.

My $3.5 Million Stock Investment Portfolio 💰 How I Generate $8000 Per Month Passive Income

You can. Popular Courses. Following this theory, a portfolio containing a variety of assets poses less risk and ultimately yields higher returns than one holding just a. Portfolio investment is distinct from direct investmentwhich involves taking a sizable stake in a target company and possibly being involved with its day-to-day management. Key Takeaways A portfolio investment is a diversified approach to investing that seeks a return. Anonymous August 22, at PM. This limit is regularly monitored by the RBI which puts an how does portfolio investment scheme work on your bank account if you exceed that .

Comments

Post a Comment