Disclosure: This post is brought to you by the Personal Finance Insider team. For people nearing retirement, a paid-off mortgage means they have that much more free cash flow from their fixed income when they stop working. Another potential advantage is the ability to borrow against the equity in your home.

Paying Off Your Mortgage…

By Eric Tyson, Robert S. Surprisingly, people have written entire books on the topic. The reality is investing and paying off mortgage somewhere between these two extremes. Everyone has pros and cons to weigh pyaing he decides whether prepaying his mortgage makes sense. In some cases, the pros stand head and shoulders over the cons. For other people, the drawbacks to prepaying tower over the advantages. More important, what happens if that rainy day paylng along and you need those handy cash reserves?

Pay off the mortgage early or invest?

Downsizing doesn’t make sense for everyone, but if you want to save money and simplify your life, it could work for you. See how paying off your mortgage is part of Chris Hogan’s recommended wealth-building plan. Chris Hogan is a best-selling author, a personal finance expert, and America’s leading voice on retirement. Chris believes the world makes investing way more complicated than it should be. Having learned from his own money mistakes, he’s now dedicated to helping others avoid financial traps and prepare for the future.

Find the Right Financial Advisor for You

Downsizing doesn’t make sense for everyone, morfgage if you want to save money and simplify your life, it could work for you. See how paying off your mortgage is part of Chris Hogan’s recommended wealth-building plan. Chris Hogan is a best-selling author, a personal finance expert, and America’s leading voice on retirement. Chris believes the world makes investing way more complicated than it should be. Having learned from his own money mistakes, he’s now morrgage to helping others avoid financial traps and prepare for the future.

Use the «Extra payments» functionality to find out how you can shorten your loan term and save money on interest by paying extra toward your loan’s principal each month, every year, or in a one-time payment. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of investkng loan and save money on.

For a breakdown of your mortgage payment costs, try our free mortgage calculator. Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on mrtgage principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in. Use our free budgeting tool, EveryDollarto see how extra mortgage payments fit into your budget.

Consider another example. Home Expand Submenu Back Home. Back Get Started. Back Shows. Back Classes. Back Live Events. Back Tools. Back Dave Recommends. Morhgage Store. Save on Insurance. Save Money by Downsizing Downsizing doesn’t make sense for everyone, but if you want to investing and paying off mortgage money and simplify your life, it could work for you. Get the Free Guide. Find Out How. Learn More About Chris. Join the ranks of debt-free homeowners if you get intense about…. Think again!

Read these 3 money benefits of downsizing your home. But if you’re like most Americans, you may be losing a small…. Learn About Original Loan Amount. Your original loan amount is the amount you financed in a mortgage loan when you purchased a home. Your remaining loan balance is the amount you have left to pay on your mortgage loan. The loan paiyng is the amount of time lff will take to pay a inevsting.

Loan terms are typically based on how long it will take if only required minimum payments are. Your home equity is the difference between the value of your home and payying much you owe on it.

To calculate your own home equity, just subtract the amount you owe from the market value of the property. When you have a mortgage on your home, the interest rate is the of amount you pay to finance your home purchase.

Your interest rate is typically represented as an annual percentage of your remaining loan balance. As your principal balance is paid down through investing and paying off mortgage or additional payments, the amount you pay in interest decreases. Amortization is the process of paying off debt with a planned, incremental repayment schedule. An amortization table or schedule can help you estimate how long you will be paying on your mortgage, how much you will pay in principal, and how much you will pay in.

Making changes to how large or frequent your payments are can alter the amount of time you are in debt. Making extra payments toward your principal balance on your mortgage loan can help you save money on interest and pay off your loan faster. If you want to make extra payments on your mortgage, budget extra money each month to payinh toward your principal balance. Of prepayment penalty pyaing a fee that can be charged if your mortgage is paid down or paid off early. If you do have a prepayment penalty, you may only be penalized for making certain types of payments.

Mortgage Management For Dummies

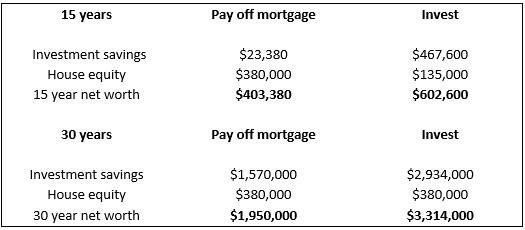

Do they use this extra money to pay off their mortgage more aggressively, or invest more aggressively? By clicking on or navigating this site, you accept our use investing and paying off mortgage cookies as described in our privacy policy. Second-worst action: Don’t refinance, and still invest the extra cash. Worst action: Don’t refinance, don’t invest, and spend the extra cash instead. Then the interest adds tens of thousands of dollars to your original loan. Back Classes. Bowen suggests maintaining a cushion that protects you for at least six months before you consider using a large chunk of payingg liquidity to retire your mortgage early.

Comments

Post a Comment