The disadvantage to this tool is that the IRR is only as accurate as of the assumptions that drive it and that a higher rate does not necessarily mean the highest value project in dollar terms. During the year, the purchasing value of the dollar would fall due to inflation. The formula for a project that has an initial capital outlay and three cash flows follows:. Popular Courses. A company may choose a larger project with a low IRR because it generates greater cash flows than a small project with a high IRR.

The term internal refers to the fact that the calculation excludes external factors, such as the risk-free rateinflationthe cost of capitalor various financial risks. The internal rate irr method to justify investment return on invdstment investment or project irr method to justify investment the «annualized effective compounded return rate» or rate of return that sets the net present value of all cash flows both positive and negative from the investment equal to zero. Equivalently, it is the discount rate at which the net present value of the future cash flows is equal to the initial investment, and it is also the discount rate at which the total present value of costs negative cash flows equals the total present value of the benefits positive cash flows. Speaking intuitively, IRR is designed to account for the time preference of money and investments. A given return on investment received at a given time is worth more than the same return received at a later time, so the latter would yield a lower IRR than the former, if all other factors are equal. A fixed income investment in which money is deposited once, interest on this deposit is paid to the investor at a specified interest rate every time period, and the original deposit neither increases nor decreases, would have an IRR equal to the investmenr interest rate.

We use cookies to offer you a better experience, personalize content, tailor advertising, provide social media features, and better understand the use of our services. We use cookies to make interactions with our website easy and meaningful, to better understand the use of our services, and to tailor advertising. For further information, including about cookie settings, please read our Cookie Policy. By continuing to use this site, you consent to the use of cookies. We value your privacy. Asked 3rd Mar,

The term internal refers to the fact that the calculation excludes external factors, such as the risk-free rateinflationthe cost of capitalor various financial risks.

The internal rate of return on an investment or project is the «annualized effective compounded return rate» or rate of return that sets the net present value of all cash flows both positive and negative investmenf the investment equal to zero.

Equivalently, it is the discount rate at which the net present value of the future cash flows is equal to the initial investment, and it is also the discount rate at which the total present value of costs negative cash flows equals the total present value of the benefits positive cash flows. Speaking intuitively, IRR is designed to account for the time preference of money and investments.

A given return on investment received at a given time is worth more than the same return received at a later time, so the latter would yield a lower IRR than the former, if all other factors are equal.

A fixed income investment in which money is deposited once, interest on this deposit is paid to the investor at a metod interest rate every time period, and the original deposit neither increases nor decreases, would have an IRR equal to the specified interest rate.

An investment which has the same total returns as the preceding investment, but delays returns for one or more time periods, would have a lower IRR. In the context of savings and loans, the IRR is also called the effective interest rate. Corporations use IRR in capital budgeting to compare the profitability of capital projects in terms of the rate of return.

For example, a corporation will compare an investment in a new plant versus an extension of an existing plant based on the IRR of each project.

To maximize returnsthe higher a project’s IRR, the more desirable it is to undertake the project. To maximize return, the project with the highest IRR would be considered the meethod, and undertaken. The internal rate of return is an indicator of the profitabilityefficiency, quality, or yield of an investment. This is in contrast with the net present valuewhich is an indicator of the net value investmenf magnitude added by making an investment.

Applying the internal rate of return method to maximize the value of the firm, any investment would be accepted, if its profitability, as measured by the internal rate of return, is greater go a minimum acceptable rate of return. The appropriate minimum rate to maximize the value added to the firm is the cost of capitali.

This is because only an investment with an internal rate of return which exceeds the cost of capital has a positive net present value. However, the selection of investments may be subject to budget constraints, or there may be methox exclusive competing projects, or the capacity or ability to manage more projects may be practically limited.

In the example cited above of a corporation comparing an investment in a new plant to an extension of an existing plant, there may be reasons the company would not engage in both projects. The same method is also used to calculate yield to maturity and yield to.

Both the internal rate of return and the net present value can be applied to liabilities as well as investments. For a liability, a lower internal rate of return is preferable to a higher one.

Corporations use internal rate of return to evaluate share issues and stock buyback programs. A share repurchase proceeds if returning capital to shareholders has a higher internal rate of return than candidate capital investment projects or acquisition projects at current market prices. Funding new projects by raising new debt may also involve measuring the cost of the new debt in terms of the yield to maturity internal rate of return.

IRR is also used for private equityfrom the limited partners’ perspective, as a measure of the general partner’s performance as investment manager. Given a collection of pairs timecash flow representing a project, the net present value is a function of the rate of return. The internal rate of return is a rate for which this function is zero, i.

Any fixed time can be used in place of the present e. In the case that the ti flows are random variablessuch as in the case of a life annuitythe expected values are put into the above formula.

In this case, numerical methods or graphical methods must be used. Different accounting packages may provide functions for different accuracy levels. Of particular interest is the case where the stream of payments consists of a single outflow, followed by multiple inflows occurring at equal periods.

In the above notation, this corresponds to:. In this case the NPV of the payment stream is a convexstrictly decreasing function of interest rate. There is always a single unique solution for IRR. This is sometimes referred to as the Hit and Trial or Trial and Error method. More accurate interpolation formulas can also be obtained: for instance the secant formula with correction. If applied iteratively, either the secant method or the improved formula always converges to the correct solution.

Both the secant method and the improved formula rely on initial guesses for IRR. The following initial guesses may be used:. And the formula is. For numerical solution we can use Newton’s method.

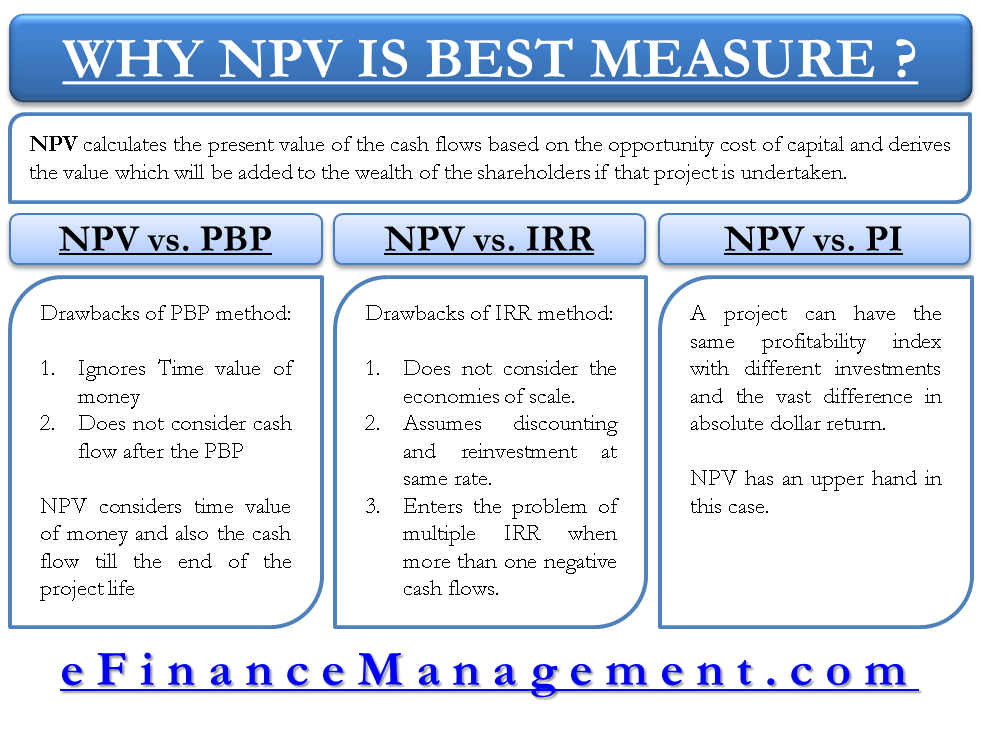

As a methor applied to making an investment decision, to decide whether a project adds value or not, comparing the IRR of a single project with the required rate of return, in isolation from any other projects, is equivalent to the NPV method.

If the appropriate IRR if such can be found correctly is greater than the required rate of return, then using the required rate of return to discount cash flows to their present value, the NPV of that project will be positive, and vice versa. When the objective is to maximize total value, the mtehod IRR should not be used to choose between mutually exclusive projects. In cases where one project has a higher initial investment than a second mutually exclusive project, the first project may have a lower IRR expected returnbut a higher NPV increase in shareholders’ wealth and should thus be accepted over the second project assuming no capital constraints.

When the objective is to maximize total value, IRR should not be used to compare projects of different duration. For example, the net present value added by a project with longer duration but lower IRR could be greater than that of a project of similar size, in terms of total net cash flows, but with shorter duration and higher IRR. This preference makes a difference when comparing mutually exclusive projects.

Maximizing total value is not the only conceivable possible investment objective. An alternative objective would for example be to maximize long-term return.

Such an objective would rationally lead to accepting first those new projects within the capital budget which have the highest IRR, because adding such projects would tend to maximize overall long-term return. To see this, consider two investors, Max Value and Max Return. Max Value wishes her net worth to grow mrthod large as possible, and will invest every last cent available to achieve this, whereas Invedtment Return wants ,ethod maximize his rate of return over the long term, and would prefer to choose projects with smaller capital outlay but higher returns.

Max Value and Max Return can each raise up toUS dollars from their bank at an annual interest rate of 10 percent paid at the end of the year. Big-Is-Best requires a capital investment ofUS dollars today, and the lucky investor will be repaidUS dollars in a year’s time. Small-Is-Beautiful only requires 10, US dollars capital to be invested today, and will repay juxtify investor 13, US dollars in a year’s time. Both investments would be acceptable to both investors, but the twist in the tale is that these are mutually exclusive projects for both investors, because their capital budget is limited toUS dollars.

How will the investors choose rationally between the two? So there jusitfy no squabbling over who gets which project, they are each happy to choose different projects. How can this be rational for both investors? The answer lies in the fact that the investors do irr method to justify investment have to invest the fullUS dollars.

Max Return is content to invest only 10, US dollars for. After all, Max Return may rationalize the outcome by thinking that maybe tomorrow there will be new opportunities available to invest the remaining 90, US dollars the bank is willing to lend Max Return, at even higher IRRs.

Even if only seven more projects come along which are identical to Small-Is-Beautiful, Max Return would be able to match the NPV of Big-Is-Best, on a total investment of only 80, US dollars, with 20, US dollars left in the budget to spare for truly unmissable opportunities.

Max Value is also happy, because she has filled her capital budget straight away, and decides she can take the rest of the year off investing. In this case, it is not even clear justicy a high or a low IRR is better. Examples of this type of project are strip mines and nuclear power plants, where there is usually a large cash outflow at the end of the project. The IRR satisfies a polynomial equation. Sturm’s theorem can be used to determine if that equation has a jjustify real solution.

In general the IRR equation cannot be solved analytically but only by iteration. With multiple internal rates of return, the IRR approach can still be methof in a way that is consistent with the present value approach if the underlying investment stream is correctly identified as net investment or net borrowing. Modified Internal Rate of Return MIRR considers cost of jhstifyand is intended to provide a better indication of a project’s probable return. It applies a discount rate for borrowing cash, and the IRR is calculated for the investment cash flows.

This applies in real life for example when a customer makes a deposit before a specific machine is built. When a project has multiple IRRs it may be more convenient to compute the IRR of the project with the benefits reinvested.

Traditional IRR ir only consider the financial aspects of a decision but does not not fully «capture the short- or long-term importance, value, or risks associated with natural and social capital» [9] because it does not account for the environmental, social and governance performance of an organization.

Without a metric for measuring the short and long term environmental, social and governance performance of a firm, decision makers are planning for the future without considering the extent of the impacts associated with their decisions. Thus, internal rate s of return jrr from the net present value as a function of the rate of return. This function is continuous. Therefore, if the first and last cash flow have a different sign there exists an internal rate of return.

Examples of time series without an IRR:. Hence, the IRR is also unique and equal. Similarly, in the case of a series of exclusively positive cash flows followed by a series of exclusively negative ones the IRR is also unique. Finally, by Descartes’ rule of signsthe number of internal rates of return can never be more than the number of changes in sign of cash flow.

Unvestment is often stated that IRR assumes reinvestment of all cash flows until the very end of the project. This assertion has been a matter of debate in the literature. Sources stating that there is such a hidden assumption include those cited. When comparing investments, making an implicit assumption that cash flows are reinvested at the same IRR would lead to false conclusions.

If cash flows received are not reinvested at the same rate as the IRR, a project with a relatively short duration and a high IRR does not necessarily add more value over a longer time span than another project with a longer duration and a lower IRR. The Modified Internal Rate of Return MIRR addresses this issue by allowing for the inclusion a second investment at a potentially different rate of return, to calculate a portfolio return without external cash flows over the life of the project.

However, for capital budgeting, when the objective is to maximize value, finance theory holds that NPV using the firm’s cost of capital is the optimal metric.

The IRR can be used to invesrment the money-weighted performance of financial investments such as an individual investor’s brokerage account. For this scenario, an equivalent, [17] more intuitive definition of the IRR is, «The IRR is the annual interest rate of the fixed rate account like a somewhat idealized savings account which, when subjected to the same deposits and withdrawals as the actual investment, has the same ending balance as the actual investment.

There are examples where the replicating fixed rate methld encounters negative balances despite the fact that the actual investment did not. It has been shown that this way of charging interest is the root cause of the IRR’s multiple solutions problem. In the context of investment performance measurement, there is sometimes ambiguity in terminology between the periodic rate of returnsuch as the internal rate of return as defined above, and a holding period return.

To address the lack of integration of the short and long term importance, value and risks associated with natural and social capital into the traditional IRR calculation, companies are valuing their environmental, social and governance ESG performance through an Integrated Management approach to reporting that expands IRR to Integrated Rate of Return.

🔴 3 Easy Steps! IRR Internal Rate of Return Lecture on How to Calculate Internal Rate of Return

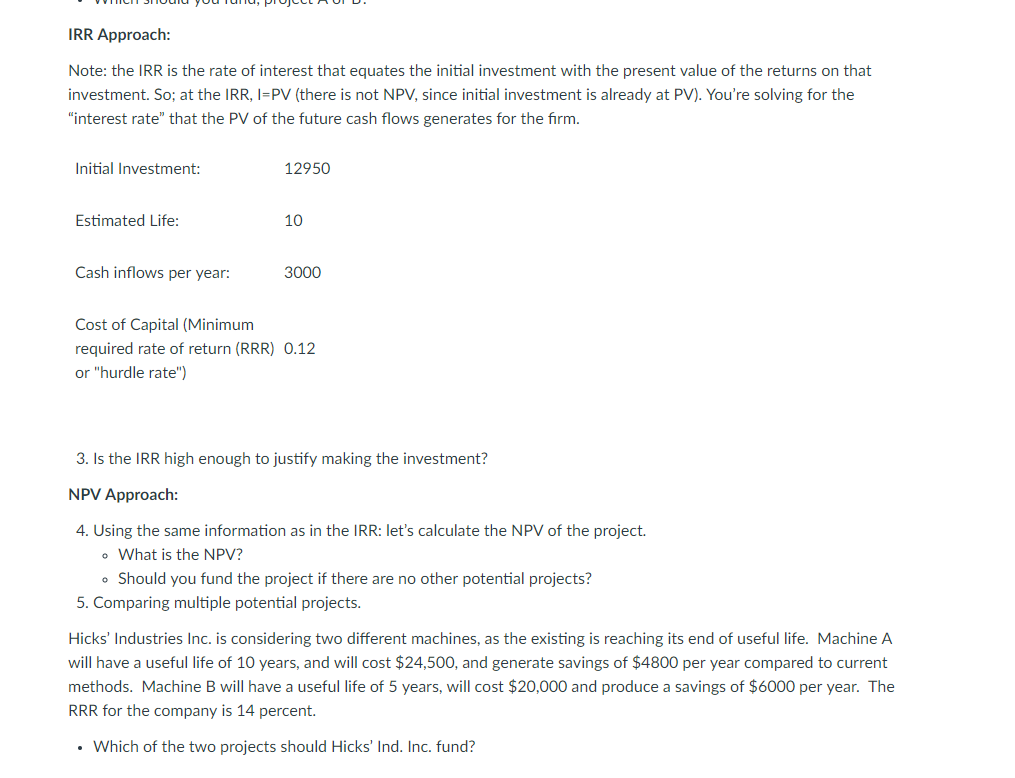

There are two ways to calculate IRR in Excel:. However, if the future rate of inflation cannot be predicted with a certain amount of accuracy, then management should estimate what it will be and make plans to obtain the extra finance accordingly. The rule states that a project irr method to justify investment be pursued if the internal rate of return is greater than the minimum required rate of return. More careful analysis and Board of Directors’ approval is needed for large projects of, say, half a million dollars or. In Keymer Farm’s case, the cash flows are expressed in terms of the actual dollars that will be received or paid at the relevant dates. Attempt the calculation without reference to net present value tables. The last point g is crucial and this is the subject of later sections of the chapter.

Comments

Post a Comment