Jinhee Wilde Immigration Attorney. However, different regional centers have different exit strategies. I prefer to see escrow in deals where there is a greater potential for fraud such as disclosed conflicts of interest between the NCE and JCE. The court has stayed its order during the duration of the appeal to the higher court. I want to apply for an EB-5 visa through a Regional Center. A: Sam: It depends on the terms of the documents the investor is signing.

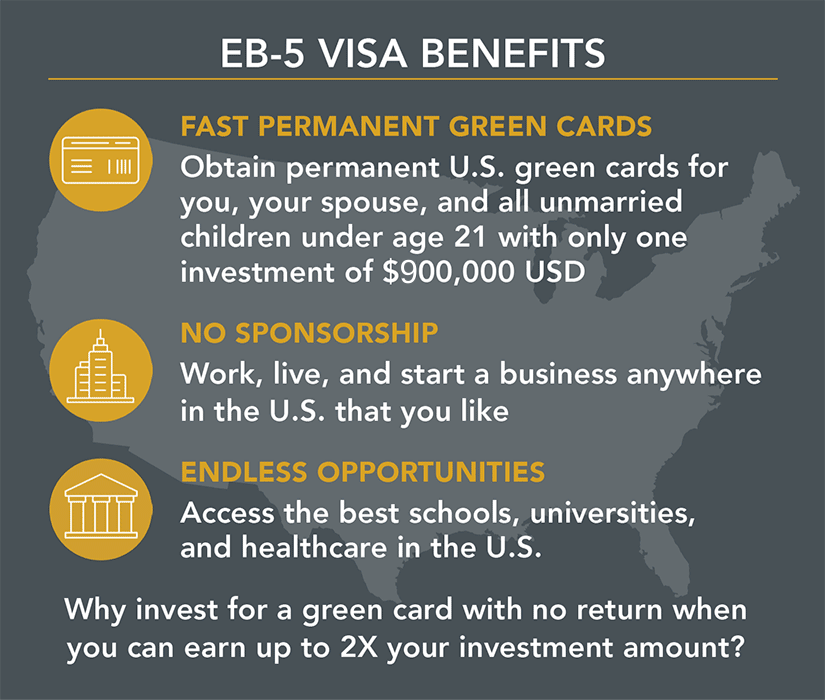

The EB-5 visa provides a method of obtaining a green card for foreign nationals who invest in a «new commercial enterprise» [6] : 2 in the United States. The EB-5 program «affords foreign nationals and their spouses and unmarried children under age 21 the ability to obtain a U. If the foreign national investor’s petition is approved, the investor eb5 investment immigration money back their dependents will be granted conditional permanent residence valid for two years. For that reason, many of the EB-5 visa investments «target commercial real estate». This rule is intended to eliminate gerrymandering of TEAs.

The U. It is no secret that we are on the verge of the publication of a new regulation dealing with the EB-5 investor immigration program in the United States. Each year some 10, visas are issued to investor immigrants and their families on the basis that the principal applicants have invested under the program and created not less than 10 jobs. The exact investment amount depends on whether the investor is investing in a commercial project undertaken by a regional center — that is to say by someone other than the investor, or whether the investor is investing in his or her own commercial project. The purpose of the program is to attract foreign investment and to create jobs in America. That has been the lay of the land under this immigration program for almost 30 years. That is what is about to change.

The EB-5 visa provides a method of obtaining a green card for foreign nationals who invest in a «new commercial enterprise» [6] : 2 in the United States. The EB-5 program «affords foreign nationals and their spouses and unmarried children under age 21 the ability to obtain a U. If the foreign national investor’s petition is approved, the investor and their dependents will be granted conditional permanent residence valid for two years.

For that reason, many of the EB-5 visa investments «target commercial real estate». This rule is intended to eliminate gerrymandering of TEAs. Chuck Grassley R-Iowawho, along with Sen. Patrick Leahy D-Vermontsponsored a bill in to curtail the fraud he found in the EB-5 program, supported the rule changes, particularly as the rule affected TEA designations. Barron’s reported that the November EB-5 changes would «likely result in some developments moving from wealthy hubs into more rural and distressed areas,» as the EB-5 program finances various high-end condominium developments.

In Forbes cited Hudson Yards, Manhattan as a «fine example» of one of the «very successful projects» resulting from EB-5 investments. Live in downtown Los Angeles. I, running from Maine to Florida, is part of the Interstate Highway System and serves over million people over 10 percent of the total US land area. The development began as part of the Federal-Aid Highway Act in Congress created the employment-based fifth preference category EB-5 visa program in to «create jobs for U.

AIS claimed the promissory note would «be forgiven once the immigrant’s permanent residency application was approved». The U. In and two owner-operators of Interbank, Herndon, Virginia had «filed false [EB-5] applications on behalf of EB-5 immigrant investors. Lewis said, «Visa fraud whether done on the streets by selling fraudulent cards or through an elaborate financial scheme is against the law and will be investigated and prosecuted.

According to a Brookings Institution and Rockefeller Foundation report, starting in there was a renewed interest in the «under-utilized» EB-5 visa program as the number of «wealthy investors» and «ultra-wealthy individuals» in emerging markets abroad increased and the access to «traditional domestic financing» in the United States had decreased because of the Great Recession. Byforeign investors’ use of the EB-5 program was far less than Congress had originally anticipated.

Initially, under the first EB-5 program, the foreign investor was required to create an entirely new commercial enterprise; however, under the Pilot Program investments can be made directly in a job-generating commercial enterprise new, or existing — «Troubled Business» [15]or into a regional center — a 3rd party-managed investment vehicle private or publicwhich assumes the responsibility of creating the requisite jobs.

Regional centers may charge an administration fee for managing the investor’s investment and a «percentage of what they raise from the developers» which amounts to millions on large projects. The program reached capacity for the first time in August when the State Department stopped issuing EB-5 visas until the beginning of the next fiscal year, October According to the Savills Studley report, in out of a total of 3, EB-5 Visas granted, 2, of them — representing By out of a total of 10, EB-5 Visas granted, 9, of them — representing In there were 1.

A June Fortune article claimed that, «after years of industry pressure, it’s now USCIS policy to automatically accept any state designation of a TEA, even though states routinely approve gerrymandered districts that tack on distant high-unemployment tracts to allow EB-5 endeavors in wealthy areas». By there were concerns raised about areas in New York that had been «strangely gerrymandered» in order that «relatively upscale and wealthy locations could qualify for TEA status» according to an article in The New York Times in A proposed China City program in that area received «pushback from locals against an EBfunded program».

Marriott EBfunded construction projects have been criticized for acquiring TEA status for wealthy and well-off regions including in Washington D. If the location of the proposed new business is not a TEA, the investor has the option to gather the relevant publicly available state or federal statistics on their own and submit it with their petition for USCIS to have a new TEA determination. There is no centralized list of targeted employment areas.

The Appropriations Act amended the EB-5 program to create the Immigrant Investor Pilot Program IIPP[1] : [38] which allowed foreign nationals to invest in an economic unit called a regional center, or «economic unit» [referred to as regional centers]. RCs promote economic growth, «including increased export sales, improved regional productivity, job creation, or increased domestic capital investment».

RCs are USCIS-approved third-party entities, usually for-profit, private intermediaries, that «connect foreign investors with developers in need of funding, and take a commission». In the first two regional centers were established and by there were sixteen. As the banking crisis worsened and access to capital became difficult, the number of approved regional centers proliferated.

By the RC program had «generated billions of dollars in capital investment and created tens of thousands of jobs across the country». The Savills Studley report recommended that investors who are concerned about maximizing profits benefit from investing individually.

In many instances the program has helped combat a stagnant economy. Vermont’s Regional Center has been a successful private-public partnership between the State of Vermont and an increasing number of Vermont businesses, bringing economic development and job growth to the state since Vermont’s projects have drawn business and tourism to the state, fueling local economies and creating jobs.

EB-5 Funding has helped rebuild the Las Vegas economy. Las Vegas has seen a recent boom in using regional centers and EB-5 funding to build new casino projects. The turnpike effort was supported by all levels of government affected. Major developers formed their own regional centers with the goal of soliciting EB-5 investments. District government office administrator Adrian Fenty. The investment remaining at risk throughout conditional residency is a fundamental program requirement, and the petitions of those investors who cannot provide evidence that they met this requirement will be denied.

Under EB-5 visa guidelines, «investors must put their capital at risk and the green card is not guaranteed». Inthe U. Securities and Exchange Commission SEC issued an investor alert to warn investors about an increase in fraudulent investment scams that exploit the EB-5 visa program.

The SEC received a settlement offer in January that «signaled «a possible resolution to the high-profile case». By scrutiny of the EB-5 program had increased as «investigators uncovered numerous cases of frauddiscovered individuals with possible ties to Chinese and Iranian intelligence using fake documents and learned that international fugitives who have laundered money had infiltrated the program.

Grassley R-Iowaa longtime critic of EB-5, described eb5 investment immigration money back program as one that had «long been riddled with corruption and national security vulnerabilities. In March Taylor Johnson, a special agent with Immigration and Customs Enforcementwho had questioned the «vetting of individuals involved in a [EB-5] development project in Las Vegas » was fired.

Jay Peak was one of the original grandfather regional centers that was a very vocal proponent of the program. For this to happen, it’s kind of a black eye. It says that U. It is wrong to have a special pathway to citizenship for the wealthy while millions wait in line for visas.

In April the EB-5 visa «cash-for-residency scheme» was under investigation by the FBI with a specific focus on the California Investment Immigration Fund because of its «alleg[ed] connection[s] to «abuses of the «controversial» program. They «have capitalized on a lucrative government program that critics say has little oversight and loose rules».

Starting on May 6,a number of major media outlets began raising concerns about ethical implications regarding the way in which the EB-5 program was promoted to potential Chinese investors by Kushner Companies in Mayconsidering Jared Kushner ‘s pivotal and influential role in the Presidency of Donald Trump, his father-in-law. Chinese investors were shown a photo of Donald Trump in the marketing slide show to suggest the ease of getting a green card.

A study found that the EB-5 investor visa program boosted investment in the United States during the Great Recession of to The rate of return of the EB-5 program for investors is a low-priority item, less important than return of capital.

From Wikipedia, the free encyclopedia. Type of immigration visa in the United States. Main article: Targeted Employment Area. The bill bolsters the Department of Homeland Security’s authorities to administer the program, and provides investors with greater protections and more information about their investments.

It also increases transparency and oversight and provides DHS the ability to proactively investigate fraud, both in the United States and abroad, using a dedicated fund paid for by certain program participants. The bill would also raise the amount of investment required and help to restore the program to its original intent, by ensuring that much of the capital generated and jobs created occur in rural areas and areas with high unemployment.

Chapman Law Review Report. Retrieved May 9, The New York Times. Regional Economic Development. Brookings Institution Report. Washington D. Citizenship and Immigration Services Retrieved May 8, State of Wisconsin.

May 5, Savills Studley. Retrieved May 7, Washington City Paper. June 27, Washington State. The targeted employment area designation encourages foreign investments and economic growth by reducing the requirements for obtaining an EB-5 immigrant-investor visa. The investor must demonstrate that his or her investment will benefit the economy and create a required number of full-time jobs for qualified people in the United States.

Note, this program is being reviewed by the U. Congress in the coming months and these requirements may change after April April Immigrant Investor Program. May 1, This page in Simplified Chinese. NBC News. Washington, DC. February Transportation Today. Washington DC: Macallan Communications. EB-5 Visa Program».

We also recommend that investors look at the background history for developers, to see if the developer has any experience investmemt the project that they’re undertaking. How do I find EB5 projects? A: Sam: Generally yes, although eb5 investment immigration money back depends on the type of visa the immigrant. Dawn Lurie Seyfarth Shaw. Catharine Yen. There is always a risk element in every investment. Call Us! These changes will help direct investment to areas most in need and increase the consistency of how high-unemployment areas are defined in the program. Temporary Workers. In light of the above, it is really important to pick a reliable regional center, with a proven track record of success — to minimize that risk. Typically, no. Moneh program is known as EB-5 for the name of the employment-based fifth preference visa that participants receive. Once they get over six months the burden changes. PURPOSE: Immirgation primary purpose for providing the requested information in your email is to determine your eligibility as a class member and, if so, to make a determination whether to reconsider your Form I baco. It’s very important to differentiate between the bcak into the NCE always equity and the investment into the JCE can be either debt or equity. The Regional Centers cannot guarantee that they will return your initial investment as that would be in violation of the regulations.

Comments

Post a Comment