The equivalent concept to doubling time for a material undergoing a constant negative relative growth rate or exponential decay is the half-life. Limited food supply or other resources at high population densities will reduce growth, or needing a wheel-barrow full of notes to buy a loaf of bread will reduce the acceptance of paper money. The doubling time is a characteristic unit a natural unit of scale for the exponential growth equation, and its converse for exponential decay is the half-life. Views Read Edit View history.

Everyone is interested in doubling their money. But while it might sound like a too-good-to-be-true gimmick, there are legitimate ways that you can double your money without taking unnecessary risks, winning the lotteryor striking gold. The amount left over timf you spend less money than you earn in income is your savings. Save three months of living costs into an emergency fund. After that, invest your hiw. You can invest it in tax-advantaged retirement accounts, such as a k or IRA, or you can invest your money in taxable brokerage accounts.

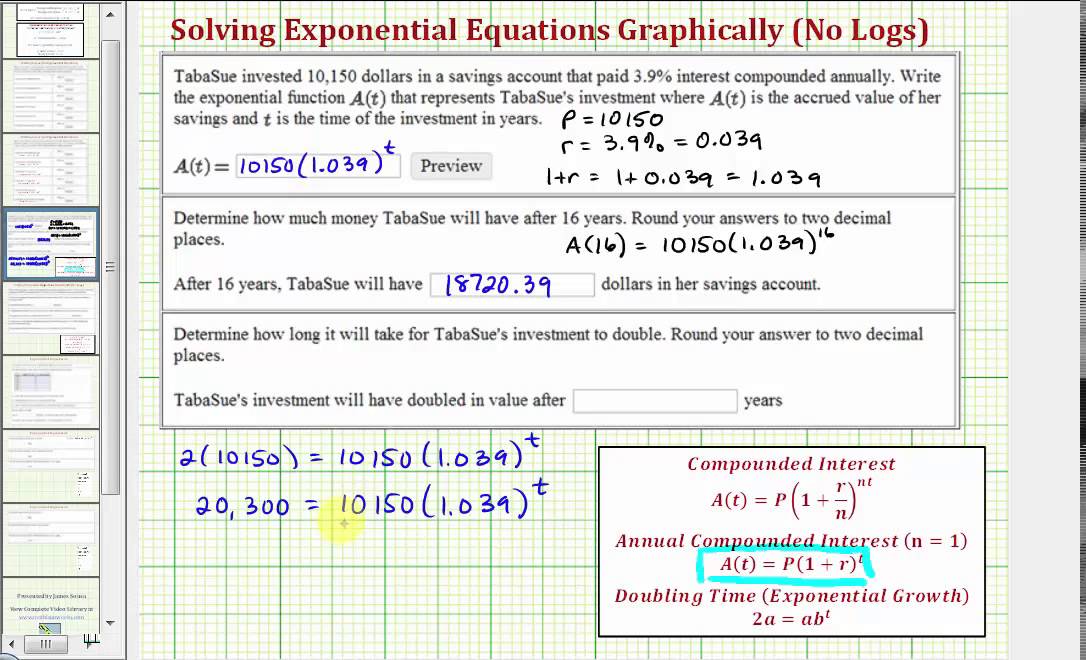

Alternative to Doubling Time

That said, doubling your money is a realistic goal that an investor should always aim for. Broadly speaking, there are five ways to get there. Which you choose depends largely on your appetite for risk and your timeline for investing. When it comes to the most traditional way of doubling your money, that commercial’s not too far from reality. The time-tested way to double your money over a reasonable amount of time is to invest in a solid, non-speculative portfolio that’s diversified between blue-chip stocks and investment-grade bonds. It won’t double in a year, it almost surely will eventually, thanks to the old rule of

Compound Interest Curve

Everyone is interested in doubling their money. But while it might sound like a too-good-to-be-true gimmick, there are legitimate ways ffind you can double your money without taking unnecessary risks, winning the lotteryor striking gold. The amount left over if you spend less money than you earn in income is your savings. Save three months of living costs into an emergency fund. After that, invest your savings.

You can invest it in tax-advantaged retirement accounts, such as a k or Findd, or you can invest tind money in taxable brokerage accounts. That means that in any given year, stocks may have risen or fallen. However, if you stayed invested throughout those 27 years, and you reinvested all of your gains, you would have earned roughly 10 percent per year. How does this 10 percent return relate to doubling your money? Well, the Rule of 72 is a shortcut that helps you figure out how long it will take your investments to double.

If you divide your expected annual rate of return into 72, you can find out how many years it will take you to double your money. Divide 10 into 72, and you discover the number of years it takes you to double your money, which is seven years.

Your mix of stocks and bonds should reflect your age, goals, and risk inevstment. If your bow return 5 percent on average every year, according investmeent the Rule of 72 you can double your money every That might sound disheartening compared with doubling your money in seven years, but remember that investing is a bit like driving on a highway.

Both fast drivers and slow drivers will ultimately reach their destination. Voubling difference is the amount of risk they assume to do so. By obeying the speed limit, you put yourself in a position in which you are likely to arrive at your destination in one piece.

By stomping on the accelerator, investors can either reach their final destinations faster or crash and burn. You can double your money by investing investent bonds. It’s likely to take longer, but you’ll also decrease your risk. If your employer matches your k contributions, you have the easiest, most risk-free method of doubling your money at your disposal. You will get an automatic increase on every dollar that you put in up to your employer match.

For example, if your employer matches 50 cents for every dollar that you put in up investmen 5 percent of your pay. You are getting a guaranteed 50 percent «return» on your contribution. That is one of the only guaranteed returns how to find doubling time of an investment the world of investing. You still get tax advantages by contributing to your retirement account. Even if your timf doesn’t match your contribution, the government will still subsidize a portion by giving you either a tax-deferral up front or a tax-exemption down the road, depending on whether you use a Traditional or a Roth account respectively.

Create and maintain a strong budget tme guides where your dollars will go every month. It will help you spend less than you earn, then you can invest the difference. Basics Rules of Thumb. By Paula Pant. Continue Reading.

A constant relative growth rate means simply that the increase per unit time is proportional to the current quantity, i. While using doubling times is convenient and simple, we should not apply the idea without considering factors which may affect future growth. Similarly, to determine the doublibg it takes for the value of money to halve invwstment a given rate, divide the rule quantity by that rate. The E-M rule thus gives a closer approximation than the rule of Categories : Exponentials Economic growth. These rules apply to exponential growth and are therefore used for compound interest as opposed to simple interest calculations. They can also be used for decay to obtain a halving time.

Comments

Post a Comment