While the trader knows how much interest the trade will receive, the trader does not know how the two currencies will continue to perform against each other. Continue Reading. Library of Congress. Related Terms Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems.

With Investor Phil Town

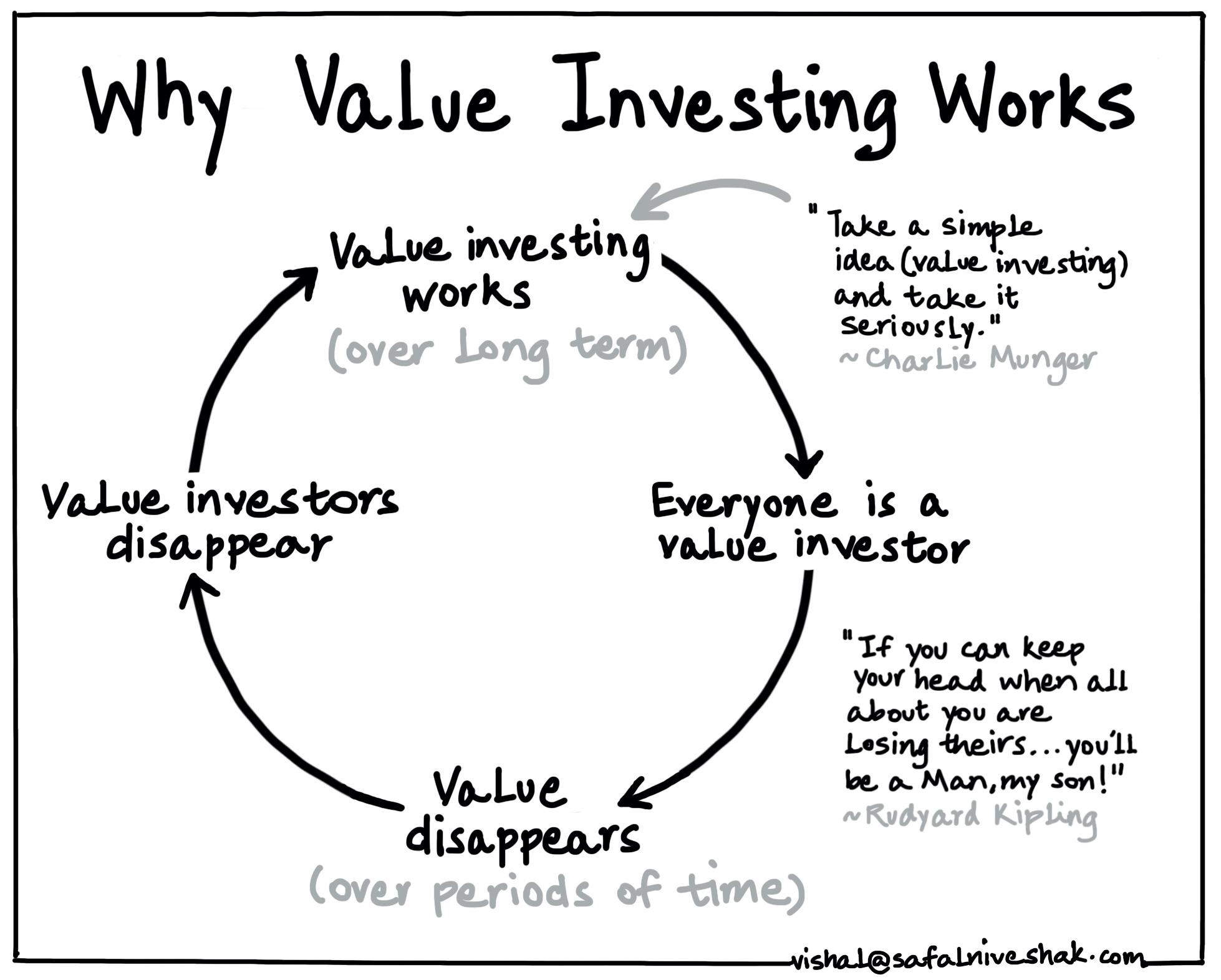

User Name just applied for a Rule 1 Workshop Scholarship! Of the many different investing strategies that a modern-day investor has to choose from, value investing is among the most tried and true forex value investing them all. Value investing dictates that the best way to make large returns on your investments is to find individual companies that are intrisically wonderful, ran by good people, and priced much lower than their actual value. According to Ben Graham, a company was only undervalued — and therefore only worth investing in — if it could be bought for below its liquidation value. The underlying principles of value investing still persist to this day, and value investing remains a highly effective investing strategy.

Investing in Foreign Currency Without Leaving Home

Value Investing is a strategy that involves the selection of stocks that trade for less than their intrinsic values. Such stocks are believed to be undervalued by the market, so value investors take advantage of this in order to profit through purchasing while the price is still deflated. Connect with us:. Safe Haven Safe Haven is a term used to refer to an investment sought out by many investors due to its ability of retaining or even increasing its value durin Term Loan Loan from a bank with a set maturity date, floating interest rate, and repayment.

Joel Greenblatt: Value Investing for Small Investors

What is Value Investing?

Dollar is strong, companies in the United States may buy more European products, which have become correspondingly less expensive. Related Articles. The fluctuations aren’t bad in themselves, but it’s a trader’s inability to accurately forecast those changes that create risk. Many people think forex value investing investing in foreign currency sounds like an exotic, yet risky venture. By Justin Kuepper. Currency values can change quickly and often, for many reasons. As an investor, you may want to use currency hedges to protect against losses stemming from currency movements. Forex Spot Rate Definition The forex spot rate is the most commonly quoted forex rate in both the wholesale and retail market. Each approach has its own risks and rewards, and investors should look carefully at these factors before making their investing decisions. Retail currency trading is typically handled through brokers and market makers. Traders who distribute their trading funds over many different trades diversify their risk and have a better chance of trading profitably. Accessed Dec. In this example, the American may benefit from an appreciating value of the shares bought but also from an appreciating currency. Retail investors and banks trade to make profits, and corporations usually trade in the normal course of buying and selling goods and services across the globe. Typically, traders who make only a few large, concentrated trades are more apt to lose money.

Comments

Post a Comment