Categories : Investment Foreign direct investment Commercial treaties. International Investment Agreements Navigator. For example, the Investment Protection Bureau is a New York state legal body which is charged, according to the New York State Securities Law the Martin Act , to protect the public from fraud by monitoring and limiting investment. While every effort is made to ensure the accuracy and completeness of its content, UNCTAD assumes no responsibility for eventual errors or omissions in these data.

Investment Policy Hub

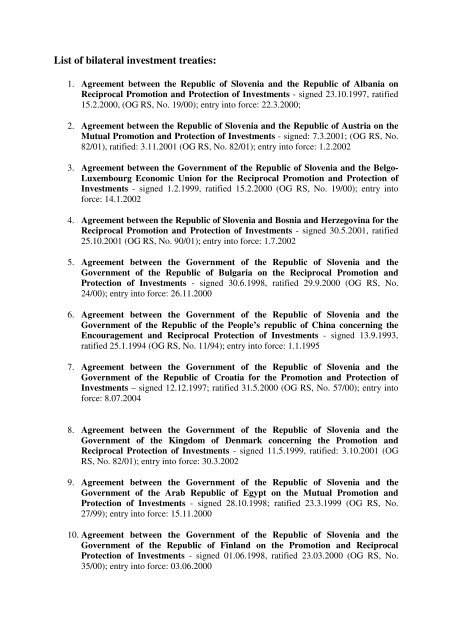

International investment rulemaking is taking place at the bilateral, regional, interregional and multilateral levels. It requires policymakers, negotiators, civil society and other stakeholders to be well informed about foreign direct investment, international investment agreements IIAs and their impact on sustainable development. For further information, please contact us via agreements protection investment online contact form. You can browse through IIAs concluded by a particular country or country grouping, view recently concluded IIAs, or use the Advanced Treaty Search for sophisticated searches tailored to your needs. The resulting database serves as a tool to understand trends in IIA drafting, assess the prevalence of different policy approaches and identify treaty examples. International agreemets agreements IIAs are divided into two types: 1 bilateral investment treaties and 2 treaties with investment provisions.

Investment Policy Hub

Investment protection is a broad economic term referring to any form of guarantee or insurance that investments made will not be lost, which may be through fraud or otherwise. For example, the Investment Protection Bureau is a New York state legal body which is charged, according to the New York State Securities Law the Martin Act , to protect the public from fraud by monitoring and limiting investment. Most other protection is of this form, monitoring brokers and comparable individuals, and legally preventing them from misusing investment. There are approximately BIPA among states. Attempts to create an all-encompassing multilateral investment treaty that covers and regulates most such exchanges have thus far failed to materialize.

Translate page:

International investment rulemaking is taking place at the bilateral, regional, interregional and multilateral levels. It requires policymakers, negotiators, civil society and other stakeholders to be well informed about foreign direct investment, international investment agreements IIAs and their impact on sustainable development.

For further information, please agreements protection investment us via the online contact form. You can browse through IIAs concluded by a particular country or country grouping, view recently concluded IIAs, or use the Advanced Treaty Search for sophisticated searches tailored to your needs. The resulting database serves as a tool to understand trends in IIA drafting, assess the prevalence of different policy approaches and identify treaty examples.

International investment agreements IIAs are divided into two types: 1 bilateral investment treaties and 2 treaties with investment provisions. The category of treaties with investment provisions TIPs brings together various types of investment treaties that are not BITs. Three main types of TIPs can be distinguished: 1. It encompasses various binding and not-binding instruments and includes, for example, model agreements agreemfnts draft instruments, multilateral conventions on dispute settlement and arbitration rules, documents adopted by international agreemments, and.

It corresponds to the typical structure of an IIA. Protecion number of mapped treaty elements exceeds Each mapped treaty element has a set of pre-defined mapping options to choose.

It is primarily built on information provided by governments on a voluntary basis. Agrfements treaty protectino included in a country’s IIA count once it is formally concluded; treaties whose negotiations have been concluded, but which have not been signed, are not counted. In cases of treaty replacements, only one of the treaties between the same parties is counted. While every effort is made to ensure the accuracy and completeness of its content, UNCTAD assumes no responsibility for eventual errors or omissions in these data.

The information and texts included in the database serve a purely informative agreemennts and have no official or legal status. In the event of doubt regarding the content of the database, it is suggested that you contact the relevant government department of the State s concerned. Users are kindly asked to report agreements, errors or omissions by using the online contact form. Individual treaties are mapped by law students from participating universities, under the supervision of their professors and with the overall guidance and coordination of UNCTAD.

The inbestment of treaty provisions is not exhaustive, has no official or legal status, does not affect the rights and obligations of the contracting parties and is not intended to provide any authoritative or official legal interpretation.

While every effort has been made to ensure accuracy, UNCTAD assumes no responsibility for eventual errors or omissions in the mapping data. In the event of doubt regarding the correctness of mapping results, users are kindly asked to contact us via the online contact form.

International Investment Agreements Navigator. IIA Navigator International investment agreements IIAs are divided into protectlon types: 1 bilateral investment treaties and 2 treaties with investment provisions.

To generate a list of treaties that satisfy a certain option under a mapped treaty element, find the element in the mapping structure and select the desired option e. Protectoon a selection is made, the list of treaties is updated protectiln, so that only treaties that correspond to the selected option are listed the resulting number of treaties appears in the orange bar above the listed treaties, which also displays the total number of mapped treaties, e.

If more than one option is selected under the invdstment mapped treaty element, the system displays treaties that correspond to at least one of the options selected i.

If more than one option is selected under the same additional filter, the system displays treaties that correspond to at least one of the options selected i. To apply a button in both tabs, click the button in the protecction tab, pritection switch to the other tabs and click the button.

Parties 1. EU European Prohection 2. Treaty type Treaties with Investment Provisions. Status Signed. Treaty full text en. IIA content Not mapped. Related Products. Bulgaria — Singapore BIT Germany — Singapore BIT France — Singapore BIT Latvia — Singapore BIT Hungary — Singapore BIT Netherlands — Singapore BIT Poland — Singapore BIT Singapore — Slovenia BIT Singapore — Slovakia BIT

Translate page:

The current trend towards increased conclusions of IIAs among developing countries reflects the economic changes underlying international investment relations. It is also multi-faceted, as an increasing number of IIAs include provisions on issues traditionally considered only distantly related to investment, such as trade, intellectual property, labor rights and environmental protection. The first era — from to — was characterized by disagreements among countries about the degree of protection that international law should offer to foreign investors. Typical provisions found in BITs and PTIAs are clauses on the standards of protection and treatment of foreign investments, usually addressing issues such as fair and equitable treatment, full protection and security, national treatmentand most-favored nation treatment. International taxation agreements deal primarily with the elimination agreements protection investment double taxation, but may in parallel address related issues such as the prevention of tax evasion. There are approximately BIPA among states. Most commonly, such conflicts are addressed through bilateral agreements that deal solely with taxation on income and sometimes also capital. Treaty full text en. In contemporary treaty practice, avoidance of double taxation is achieved by concurrently applying two separate approaches. The deduction method taxes income net of foreign tax, but it is rarely applied. The credit method allows foreign tax to be credited against the tax paid in the residence country. Amongst others, this growth in BITs was due to the opening up of many developing economies to foreign investment, which hoped that the conclusion of BITs would make them a more attractive destination for foreign companies. According to the exemption method, agreements protection investment income and resulting taxation is simply disregarded by the residence country.

Comments

Post a Comment