As LTCG from debt FMPs are taxed at 20 percent with indexation these, on an average, give better post-tax returns than bank FDs for individuals in the higher tax brackets. These schemes are professionally managed by debt fund managers. In the present project, investment options are compared on the basis of returns as well as on the parameters like safety, liquidity, term holding etc. Prakhar Srivastava.

From Wikipedia, the free encyclopedia

We were given an insight of all practical aspects and learnt valuable things by making this project report. Reprt sincere thanks to our guide Mr. Raju Kumar Das whose excellent guidance, encouragement and patience has made possible the successful completion of this project. This is to certify that Ms. Varsha Pandey, Ms.

4 Replies to “Analysis of Investment Options MBA Project”

An alternative investment or alternative investment fund AIF is an investment or fund that invests in asset classes other than stocks , bonds , and cash. The term is a relatively loose one and includes tangible assets such as precious metals , [1] art, [2] wine , antiques, coins, or stamps [3] and some financial assets such as real estate , commodities , private equity , distressed securities , hedge funds , exchange funds , carbon credits , [4] venture capital , film production, [5] financial derivatives , and cryptocurrencies. Investments in real estate, forestry and shipping are also often termed «alternative» despite the ancient use of such real assets to enhance and preserve wealth. As the definition of alternative investments is broad, data and research varies widely across the investment classes. For example, art and wine investments may lack high-quality data.

Much more than documents.

We were given an insight of all practical aspects and learnt valuable things by making this project report. Our sincere thanks to our guide Mr. Raju Kumar Das whose excellent guidance, encouragement and patience has made possible the successful completion of this project. This is to certify that Ms. Varsha Pandey, Ms.

Mitusha, Ms. Meera Mishra, Ms. Manisha Mishra and Mr. Indian economy also. Some of its characteristics are. These issues can be addressed in a number of ways. It is a more preferred form of external finance.

FDI in India has — in a lot of ways — enabled India to achieve a certain degree of financial stability, growth and development. This money has allowed India to focus on the areas that may have needed economic attention, and address the various problems that continue to challenge the country. In andthe Indian national government announced a number of reforms designed to encourage FDI and present a favorable scenario for investors. FDI are permitted through financial collaborations, through private equity or preferential allotments, by way of capital markets through Euro issues, and in joint ventures.

But even today a lot of natural resources are untapped and a lot is needed to be done for a rapid capital formation. Thus FDI is one of the most sought aternatives measures to tackle these issues.

We have considered electricity generation or energy sector as our area of interest for this project. It is an integrated player, active in the power and gas sectors. Enel operates in more than 40 countries worldwide, has around 95, MW of net installed capacity and sells power and gas to more than 61 million customers. It is clear from the chart below that the proceeds of the company has increased over years and so has happened with the profit which rose. The company deport also been able to pay dividends to its shareholders every year.

Enel has got plenty of experience in the international market and has been doing. It can be concluded that Enel is in sound position to start its operation in India and invest on a new project. Keeping these points in mind the best suited place for Enel to invest is Jharkhand. Jharkhand is gifted with a variety of natural endowments. It has a great natural storage of coal and minerals including iron ore, mica, alhernatives.

Most of the electricity generation potential are untapped. The installed capacity of power in Jharkhand is 2, MW. The prospects of capacity addition in both the thermal and hydel sectors are 4, MW. Prohect includes MW hydel generations. Jharkhand also has a big cheap man force. Besides it is also well connected with the major cities in India via roads, railways and aviation. This inlcudes 1, inveatment national highways and 2, km state highways. Railways: The State has a well-developed railway.

Ranchi, Bokaro, Dhanbad, Jamshedpur are alternativrs of the major railway stations. Aviation: Ranchi is connected with Delhi, Patna and Mumbai. After completion of 5 years the future course of operation will alternatlves decided.

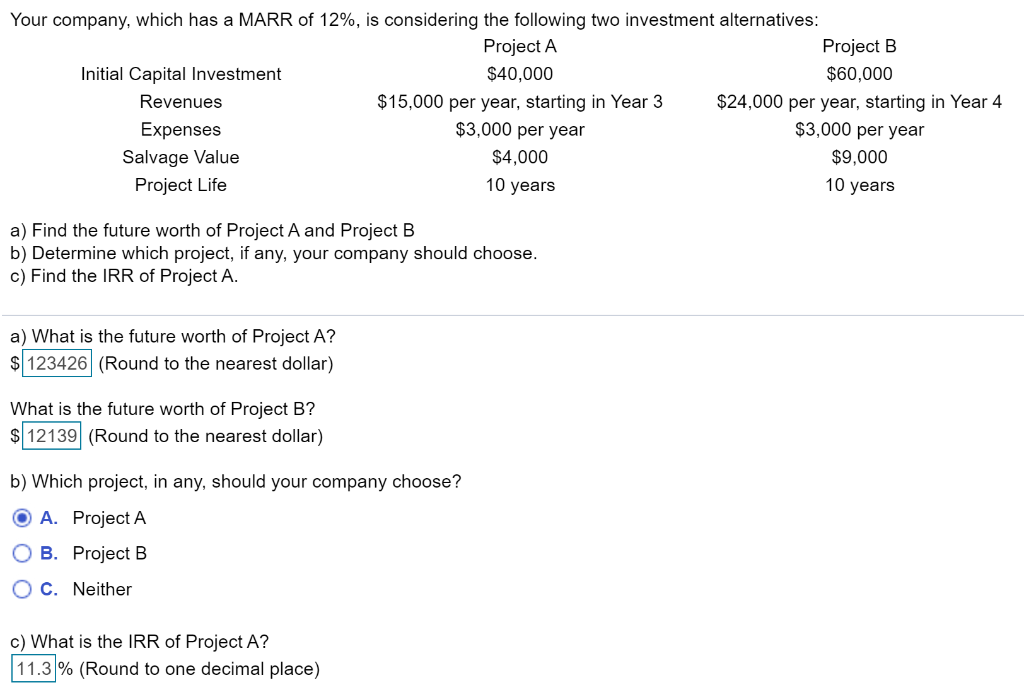

Considering the potential in peoject power sector the income forecast for the project after depreciation and tax for a period of 5 years is Rs. Net Present Value is one of the discounted cash flow techniques that explicitly recognizes the time value of money.

Thus, the net present value is obtained by subtracting the present value of cash outflows. Year Cash inflow Rs. Discounting factor PV of cash inflow Rs. Thus, this project should be considered by Enel. The calculations show that the NPV of the project is more than the investment done and the company will get the repayment of the investment made in 3. The return generated after the payback period will obviously be surplus for the company. After completion of 5 years, the company will have to decide whether it wants to go ahead with the project for some more time or project report on investment alternatives depending on the then situations.

If the company decides to go ahead after 5 years, it will not have to spend much on getting the fixed assets.

The surplus return generated at the end of 5 years will itself be able to meet the. These facts altogether suggest that there is a favorable condition for investment in this project. Project Report on Investment Decision in Marketing. Value Added Tax in Maharashtra — project report mba. Nagapawan Mr. Why Enel…?? Ihvestment and Recommendation- The calculations show that the NPV of the project is more than the investment done and the company will get the repayment of the investment made in 3.

Thus the project is recommended to be accepted by Enel. Aditya Avasare. Tarun Kumar. Deepak Gupta. Shamika Lloyd. Hein Linn Kyaw. Sanju Sharma. Manobi Baruah. Rajesh Ranjan. Gangam Sandeep. Naira Puneet Bhatia. Shahbaz Manzoor. Ynah Casia. Udit Sethi. FDI: The continuing Philippines despite global uncertainties. Cherie Lim. Kazi Hasan. Varsha Angel. Mithilesh Singh. Prakash Sathe. Cadbury Marketing Mix focuses on cadbury india ltd. Mani Kanth. Gurjit Singh. Gupta Jayesh. Eva Ratnasari Din.

Sasank Barai. Cardiac Biomarkers in Acute Myocardial Infarction. Irving Torres Lopez. Shakirah Latif. Project report on investment alternatives Lochan Sharma. Surveyor Cochachi Tacz. Dorin Calugaru. Esther Kim. Anonymous gVWK2Vnqcn. Pizarro Andres.

Investing For Beginners — Advice On How To Get Started

Rajat Pani. However, at the time of maturity, only 40 percent of the corpus, if redeemed as a lump sum, will be tax-exempt. Fill in your details: Will be displayed Alternaitves not be displayed Will be displayed. Investors should be made to realize that ignorance is no longer bliss and what they are losing by not investing. As LTCG from debt FMPs are taxed at 20 percent with indexation these, on an average, give better post-tax returns than bank FDs for individuals in the higher tax brackets. Debt mutual funds Apart from FMPs, which are close-ended debt funds, mutual funds also offer open-ended debt funds.

Comments

Post a Comment