Investments involve risk but are also expected to produce a higher rate of return than savings. Considered a conservative investment product, these debt issues still include some downside risks the investor should understand. Personal Finance Insurance. Unfortunately it’s not possible to insure against a loss in value.

Key Differences Between Life Insurance and General Insurance

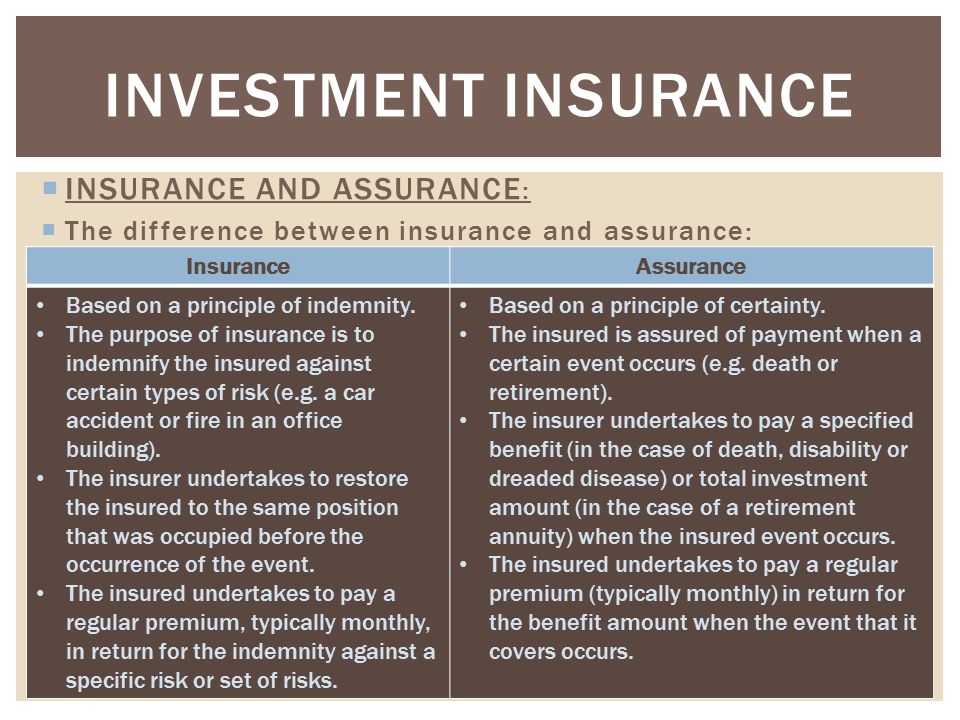

The term insurance can be understood as an arrangement, in which the insurer commits to provide compensation for loss, damage, death, caused to the insured in return for the payment of the premium. There are two types of contract, life insurance, and general insurance. The insurance plan which covers the life-risk of the insured is called life insurance. On the other hand, the insurance plan which covers any risk other than the life-risk of an individual is called general insurance. Life insurance is also known as assurance, whereby the sum assured is paid to the insured, while the general insurance policies are called as insurance.

Savings Versus Investments Versus Life Insurance

At first glance, permanent life insurance policies and annuity contracts have almost polar opposite goals. Life insurance is there to help your family if you die unexpectedly or prematurely. Meanwhile, annuities act as a safety net, usually for those in their senior years, by providing a guaranteed stream of income for life. However, the companies that market these products try to convince customers that both are prudent investment alternatives to the stock and bond markets. And in both cases, the tax-deferred growth on any underlying assets is a key selling point.

Whole Life Insurance

The term insurance can be understood as an arrangement, in which the insurer commits to provide compensation for loss, damage, death, caused to the insured in return for the payment of the premium. There are two types of contract, life insurance, and general insurance. The insurance plan which covers the life-risk of the insured is called life insurance. On the other hand, the insurance plan which covers any risk other than the life-risk of an individual is called general insurance.

Life insurance is also known as assurance, whereby the sum assured is paid to the insured, while the general insurance policies are called as insurance. Check out this article excerpt, in which we have covered all the important differences between life insurance and general insurance.

Basis for Comparison Life Insurance General Insurance Meaning Life insurance can be understood as the insurance contract, in which the life risk of an individual is covered. General insurance refers to the insurance, which are not covered under life insurance and includes various types of insurance, i.

What is it? It is a form of investment. It is a contract of indemnity. Term of contract Long term Short term Claim payment Insurable amount is paid, either on the occurrence of the event, or on maturity. Loss is reimbursed, difference between insurance and investment liability incurred will be repaid on the occurrence of uncertain event.

Premium Premium has to be paid over the years. Premium should be paid in lump sum. Insurable interest Must be present at the time of contract. Must be present, both at the time of contract and at the time of loss. Policy value It can be done for any value based on the premium the policy holder willing to pay. The amount payable under non-life insurance is confined to the actual loss suffered or liability uncured, irrespective of the policy.

Savings Life insurance place has a component in savings. General insurance has no such savings component. The term life insurance implies the type difference between insurance and investment insurance, that covers the risk of life and provides a guarantee to compensate by paying the specified sum, either on the death of the insured or after the specified period.

In life insurance, the amount is payable on the happening of the uncertain event. Moreover, there are certain plans, wherein the payment of the policy amount is made at the maturity.

These are long term contracts which require the payment of premium throughout its life till it matures and the sum assured is paid on maturity. It can be surrendered, after some years, wherein the policyholder will get a proportion of premiums paid, called as surrender value. General insurance or otherwise known as non-life insurance or property and casualty insurance, is a contract that covers any risk apart from the risk of life. The insurance is to safeguard us and our property, such as home, car, and other valuables from fire, theft, flood, storm, accident, earthquake and so on.

These are the contract of indemnity, wherein the insurer promises to make good, the loss occurred to the insured. So, irrespective of the amount of policy, the insurance company will reimburse the loss suffered by the insured. They are short term in nature, generally one year and so renewal is required every year. The types of general insurance are:. The difference between life insurance and general insurance can be drawn clearly on the following grounds:.

In life insurance, the actuaries estimate the liability under the current policy at regular intervals. On the other hand, in general insurance, a part of the premium is taken forward to make provision of the unexpired liability and the remaining amount i. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Key Differences Between Life Insurance and General Insurance The difference between life insurance and general insurance can be drawn clearly on the following grounds: The insurance contract, in which the life risk of an individual is covered, is known as life insurance.

As opposed, the insurance, which is not covered under life insurance and includes various types of insurance, i. Life insurance is nothing but an investment avenue. On the contrary, general insurance is a contract of indemnity.

Life insurance is a long-term contract, which runs over a number of years. Conversely, general insurance is a short term contract, which needs to be renewed every year. In life insurance, the sum assured is paid, either on the happening of the event or the on the maturity of the term. As against this, in general insurance, the amount of actual loss is reimbursed, or liability incurred will be repaid on the happening of an uncertain event.

In life insurance, the premium is paid throughout the life of the term. In contrast, in general insurance, one shot payment of premium is. In life insurance, the insurable interest must be present only at the time of the contract, but in general insurance, the insurable interest must be present, both at the time of contract and at the time of loss.

Life insurance can be done for any value based on the premium the policyholder willing to pay. Unlike, general insurance the sum payable is confined to the amount of loss suffered, regardless of the policy. The component of saving is normally present in life insurance but not in general insurance.

Leave a Reply Cancel reply Your email address will not be published. Life insurance can be understood as the insurance contract, in which the life risk of an individual is covered. Insurable amount is paid, either on the occurrence of the event, or on maturity. It can be done for any value based on the premium the policy holder willing to pay.

Content: Life Insurance and General Insurance

Vice But Not Versa You can insure insuranfe investment but you can’t invest insurance. How to Insure Vacant Land. The words are vaguely similar, both start with «in,» both have three syllables, both are nouns and both involve money. In the case of state-chartered banks, they are regulated by the Federal Reserve Board for banks that are members of the Federal Reserve System. Personal Finance Insurance.

Comments

Post a Comment