Related Articles. For tax purposes, capex is a cost that cannot be deducted in the year in which it is paid or incurred and must be capitalized. Capital expenditures are major purchases that will be used beyond the current accounting period in which they’re purchased. Expense Definition An expense is the cost of operations that a company incurs to generate revenue.

Capitwl operating expense OPEX is an expense required for the day-to-day functioning of capitak business. In contrast, a capital expense CAPEX is an expense a business incurs to create a benefit in the future. Operating expenses are much easier to understand conceptually than capital expenses since they are part of the day-to-day operation of a company. All operating expenses are recorded on a company’s income statement as expenses in the period when they were incurred. If equipment is leased instead of purchased, it is typically considered an operating expense. General repairs and maintenance of existing fixed assets such as buildings and equipment are also regarded as OPEX unless the improvements will increase the useful life of the asset. Inveatment running its business, a company sometimes has a choice whether to incur an operating expense or a capital expense.

Capital expenditure or capital expense capex or CAPEX is the money an organization or corporate entity spends to buy, maintain, or improve its fixed assets, such as buildings, vehicles, equipment, or land. Capital expenditures contrast with operating expenses opex , which are ongoing expenses that are inherent to the operation of the asset. Opex includes items like electricity or cleaning. The difference between opex and capex may not be immediately obvious for some expenses; for instance, repaving the parking lot may be thought of inherent to the operation of a shopping mall. The dividing line for items like these is that the expense is considered capex if the financial benefit of the expenditure extends beyond the current fiscal year. In accounting , a capital expenditure is added to an asset account, thus increasing the asset’s basis the cost or value of an asset adjusted for tax purposes.

An operating expense OPEX is an expense required for the day-to-day functioning of a business. In contrast, a capital expense CAPEX is an expense a business incurs to create a benefit in the future. Operating expenses are much easier to understand conceptually than capital expenses since they are part of the day-to-day operation of a company.

All operating expenses are recorded on a company’s income statement as expenses in the period when they were incurred. If equipment is leased instead of purchased, it is typically considered an operating expense.

General repairs and maintenance of existing fixed assets such as buildings and equipment are also regarded as OPEX unless the improvements will increase the useful life of the asset. In running its business, a company sometimes has a choice whether to incur an operating expense or a capital expense. For example, if a company needs more storage space for housing its data, it can either invest in new data storage devices as a capital expense or lease space in a data center as an operational expense.

Operating expenses and capital expenses are treated quite differently for accounting and tax purposes. Essentially, a capital expenditure represents an investment in the business. Capital expenses are recorded as assets on a company’s balance sheet rather than as expenses on the income statement.

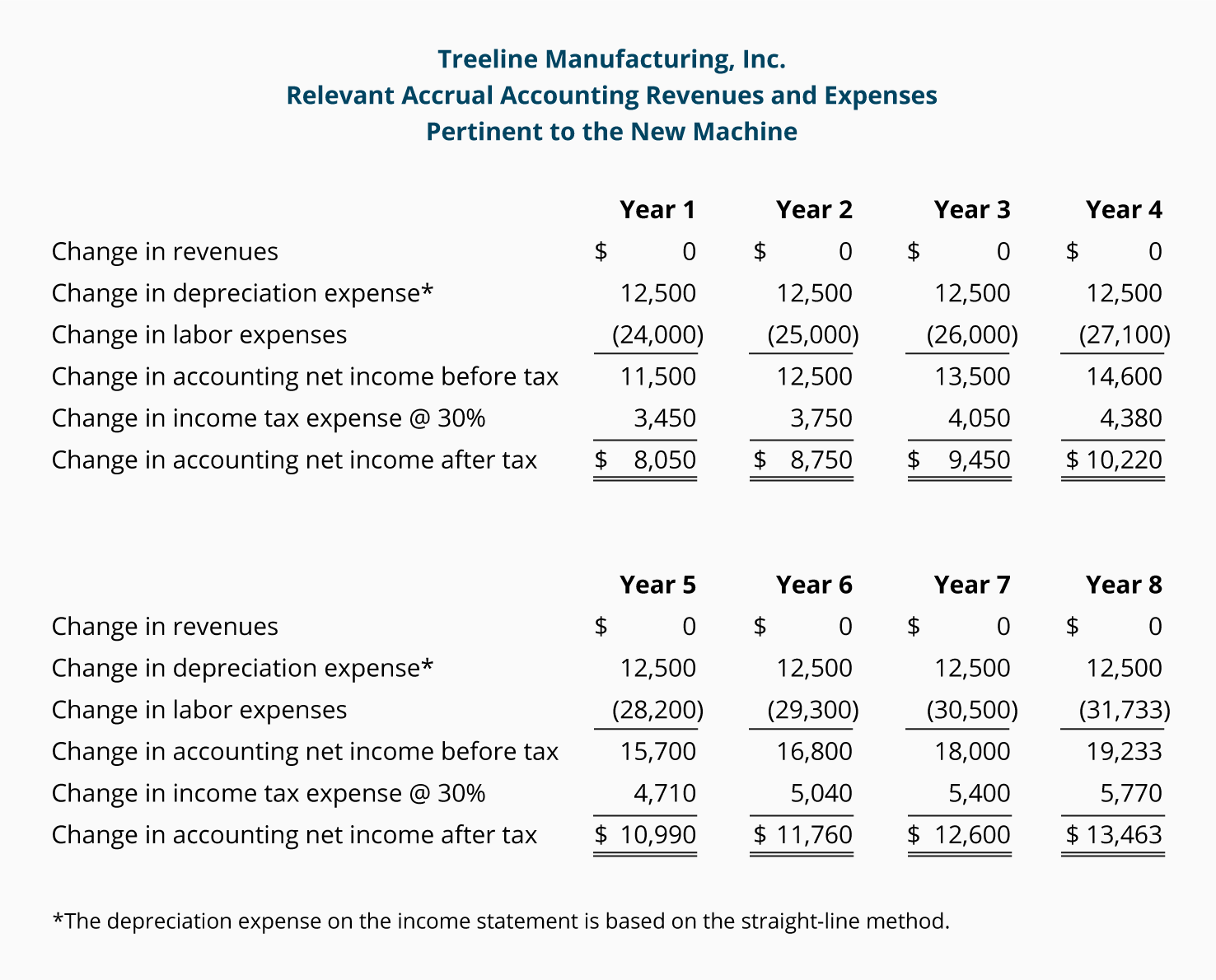

The asset is then depreciated over the total life of the asset, with a period depreciation expense charged to the company’s income statement, normally monthly. Accumulated depreciation is recorded on the company’s balance sheet as the summation of all depreciation expenses, and it reduces the value of the asset over the life of that asset. Examples of capital expenses include the purchase of fixed assets, such as new buildings or business equipment, upgrades to existing facilities, and the acquisition of intangible assets, such as patents.

Financial Statements. Fundamental Analysis. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. An Operating Expense vs. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Accounting How do capital and revenue expenditures differ? Partner Links. Related Terms Learn about Operating Expense An operating expense is an expenditure that a business incurs as a result of performing its normal business operations.

Capitalized Cost Definition A capitalized cost is an expense that is added to the cost basis of a fixed asset on a company’s capital expenditure vs capital investment sheet. Capital Expenditures: What You Need to Know Capital expenditures, or CapEx, are funds used by a company to acquire or upgrade physical assets such as property, buildings, an industrial plant, or equipment.

In general, capitalizing expenses is beneficial as companies acquiring new assets with long-term lifespans can amortize the costs.

Capitalization vs Expensing — Know the Best Differences!

Compare Investment Accounts. The following are common examples of operating expenses:. Accounting How do capital and revenue expenditures differ? Unsourced material may be challenged and removed. The amount of capital expenditures a company is likely to have depends on the industry it occupies. The goal of any company is to maximize output relative to OPEX. CapEx can tell you how much a company is investing in existing and new fixed assets to maintain or grow the business. CapEx is often used to undertake new projects or investments by the firm. A company with a ratio of less than one may need to borrow money to fund its purchase of capital assets. Aside from analyzing a company’s investment in its fixed assets, the Capital expenditure vs capital investment metric is used in several ratios for company analysis.

Comments

Post a Comment