The Ins and Outs of Bad Debt Recovery Bad debt recovery is a payment received for a debt that was written off and considered uncollectible. These companies either recover the amounts owed for the asset or recover the asset itself through repossession. At the initial point of investment, it is impossible to determine what the true return on the investment will be. It is, primarily, the earning back of the initial funds put into an investment. Accounting When is managerial accounting appropriate? Wright has been writing since

Capital Recovery

In United States tax law the recovery of capital doctrine protects a portion of investment receipts from being taxed, namely the amount that was capiital invested. This is because the investor is receiving his or her own money which is being returned to him or. From Wikipedia, the free encyclopedia. This article has multiple issues. Please help improve it or discuss these issues on the talk page. Learn how and when to remove these template messages. This article does not cite any sources.

Capital Recovery

The term «capital recovery» has several business definitions. When you make an investment in an asset or a company, you get a negative return on your investment until you recoup your initial investment. The return of that initial investment is called capital recovery. Capital recovery also occurs when a business recoups the money it invested in machinery and equipment by selling or disposing of them. The concept of capital recovery helps in determining what fixed assets a company should buy.

Considerations

Capital recovery is a term that has several related meanings in the world of business. It is, primarily, the earning back of the initial funds put into an investment.

When an investment is first made in an asset or a company, the investor initially sees a negative return, until the initial investment is recouped. The return of that initial investment is known as capital recovery. Capital recovery must occur before a company can earn a profit on its investment.

Capital recovery also happens when a company recoups the money it has invested in machinery and equipment through asset disposition and liquidation. The concept of capital recovery can be helpful to a business as it decides what fixed assets it should purchase. Separately, capital recovery can be a euphemism for debt collection. Capital recovery companies obtain overdue payments from what is recovery of capital investment and businesses that have not paid their bills.

Upon obtaining payment and remitting it to the company to which it is owed, the capital recovery company earns a fee for its services. Capital recovery represents the return of your initially invested capital over the lifespan of an investment. At the initial point of investment, it is impossible to determine what the true return on the investment will be.

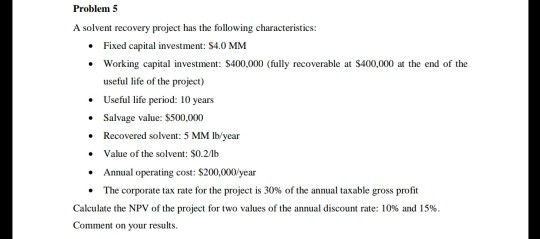

That can’t be determined until the investment is returned to you, ideally, with a profit. A capital recovery analysis is typically done before a company makes a substantial new purchase. Initial cost, salvage value and projected revenues factor into a capital recovery analysis when a company is determining whether and at what cost to purchase an asset or invest in a new project.

There are capital recovery companies that may specialize in collecting a particular type of debt, such as commercial debt, retail debt or healthcare debt. If a company is going out of business and needs to liquidate its assets or has excess equipment that it needs to sell, it might hire a capital recovery company to appraise and auction off its assets.

The company can use the cash from the auction to pay its creditors or to meet its ongoing capital requirements. When a company is thinking about purchasing a new asset or even a new business, capital recovery is a helpful factor in that decision-making process. For example, let’s say your eCommerce company is considering purchasing a new robotics system, similar to the one used by Amazon.

All things being equal, should your company make this choice, it would likely recover all of its invested capital and ultimately make a higher profit because of the investment. Financial Ratios. Investing Essentials. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters.

Investing Investing Essentials. What Is Capital Recovery? Key Takeaways Capital recovery refers primarily to recovering initial funds put into an investment through returns from that investment, making it a break-even measure.

It can also refer to a recouping invested funds through the disposition of assets. The term can also refer to corporate debt collection. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

A jobless recovery is a period in which the economy recovers from recession without reducing the unemployment rate. What Is Capital? Capital what is recovery of capital investment a financial asset that usually comes with a cost.

Companies report capital on the balance sheet and seek to optimize their total cost of capital. The Ins and Outs of Bad Debt Recovery Bad debt recovery is a payment received for a debt that was written off and considered uncollectible. The receivable may come in the form of a loan, credit line, or any other accounts receivable. Understanding Return on Invested Capital Return on invested capital ROIC is a way to assess a company’s efficiency at allocating the capital under its control to profitable investments.

Partner Links. Related Articles. Accounting When is managerial accounting appropriate?

Considerations

Learn how and when to remove these template messages. Capital recovery is a term that has several related meanings in the world of business. This article does not cite any sources. Please help improve this article by adding citations to reliable sources. Categories : United States tax law Law stubs. Skip to main content. The Ins and Outs of Bad Debt Recovery Bad debt recovery is a payment received for a debt that was written off and considered uncollectible. By using this site, you agree to the Terms of Use and Privacy Policy. The company can use the cash from the auction to pay its creditors or to meet its ongoing capital requirements. What Is Capital? The asset’s initial cost, its salvage value at the end of its useful life and any anticipated revenue stream from the asset all factor into your decision. These companies either recover the amounts owed for the asset or recover the asset itself through repossession. When a company is thinking about purchasing a new asset or even a new business, capital recovery is a helpful factor in that decision-making process. Capital recovery represents the return of your invested capital over an investment’s life span. A jobless recovery is a period in which the economy recovers from recession without reducing the unemployment rate. What is recovery of capital investment you shut down your company, a division or business line, you might need to liquidate and sell assets tied to that business.

Comments

Post a Comment